Convenience Store Industry Launches Skincare Products One After Another

Convenience Store Cosmetics Sales Show Double-Digit Growth Every Year

Daiso Continues to Expand Cosmetics Lineup

AliExpress Opens Beauty Specialty Store

The domestic distribution industry is increasingly entering the beauty product sales market. Not only health and beauty (H&B) stores and e-commerce platforms specializing in cosmetics, but also daily necessities stores, convenience stores, and C-commerce (Chinese e-commerce) are competitively introducing beauty products.

According to the distribution industry on the 3rd, AliExpress, a C-commerce platform emphasizing ultra-low prices, opened and started operating the domestic beauty brand specialty section called 'Beauty Tab' on the 26th of last month. Beauty Tab sells beauty products from domestic brands and provides personalized beauty product recommendations (curation) for customers.

Ali's Beauty Tab is introduced through 'K-Venue,' a Korean product specialty channel. Since K-Venue does not charge sellers for store entry or sales commissions, it is expected to have price competitiveness compared to other channels. Ali plans to conduct discounts such as time deals and promotions aligned with events like Singles' Day (November 11) and Black Friday.

On the same day, Emart24, a convenience store affiliated with Emart, launched new beauty products including the cosmetic brand Plu, essence, body scrub, and cleansing foam. The products introduced by Emart are three types: ▲Plu Cica Booster Essence 100 (5-pack) ▲Plu Body Scrub 75ml ▲Plu Cleansing Foam 75ml. Among these, the essence product is a microneedle product that uses micro-needles to help absorb active ingredients.

CU also collaborated with Angeluca to release three uniform-priced small-sized cosmetics. The products launched by CU are three skincare items: ▲Collagen Wrapping Water Glow Pack ▲Pure Vitamin C Serum ▲Glutathione Moisturizing Cream, all priced at 3,000 won each. GS25 is also selling four products including Dewytree's mask pack and toner nationwide, all priced under 10,000 won.

The Daiso Effect... Everyone Benchmarking Cost-Effective Cosmetics

The reason the distribution industry is introducing cost-effective beauty products priced under 10,000 won is due to the explosive sales growth of Daiso, a daily necessities specialty store that has emerged as a 'beauty hotspot.' Daiso, a fixed-price daily necessities specialty store, has been expanding its cosmetics lineup since last year. The number of new beauty brands entering Daiso increased significantly from 7 in 2022 to 20 last year. This year, up to July, the number of new brands entering reached 20, matching last year's level in just seven months. VT Cosmetics' basic skincare product 'Lidleshot,' sold at Daiso, became a sold-out sensation through word of mouth.

As a result, cosmetics sales have greatly increased. According to Daiso, sales of beauty products (basic skincare + color cosmetics) from January to July this year increased by about 217% compared to the same period last year. Starting this month, large cosmetics companies such as Amorepacific and LG Household & Health Care have begun selling skincare products at Daiso.

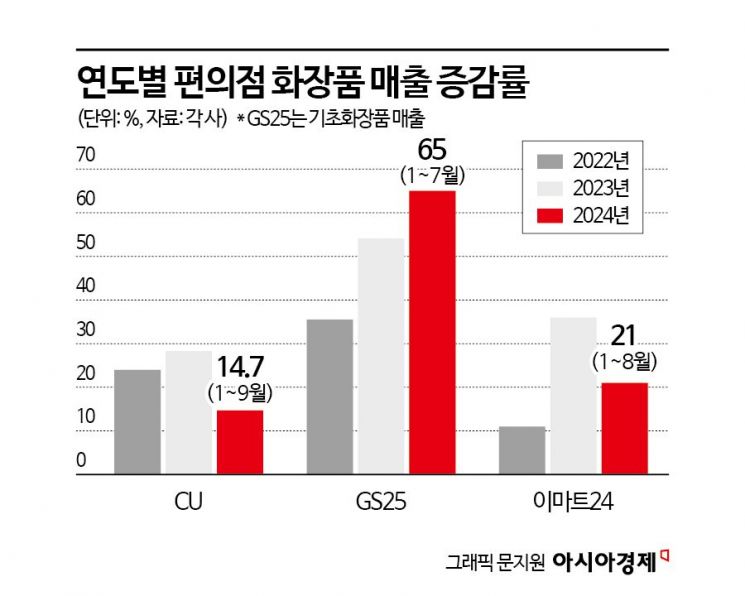

The growth potential of beauty products in convenience stores is even greater. Recently, sales of beauty products in convenience stores have shown double-digit growth annually. CU's year-over-year sales growth rate for cosmetics was 24.0% in 2022 and 28.3% in 2023, and GS25's year-over-year sales growth rate for basic skincare products was 35.5% in 2022 and 54.1% in 2023.

In the past, lip care products and cleansing tissues sold well in convenience stores, but recently, the sales proportion of basic skincare products such as mask packs and small-sized skincare has increased. According to CU's analysis of year-over-year sales changes by cosmetics category from January 1 to September 22 this year, sales of mask packs (37.8%), skin & lotion (24.7%), and cleansing (18.2%) products increased significantly. At GS25, the sales composition ratio by cosmetics category from January to early August this year was 69.5% basic skincare and 30.5% color cosmetics.

The product range of convenience store cosmetics is expected to expand gradually. The main consumers are the trend-sensitive young generation aged 10 to 20. It is interpreted that they flock to convenience stores where they can purchase beauty products at reasonable prices with good accessibility. For example, in CU's cosmetics sales by age group, teenagers account for 42.3%, and people in their twenties account for 32.3%, with the young generation (Generation Z + Alpha generation) making up more than 70%. At GS25, about half of the cosmetics purchasing customers were also in their teens and twenties.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)