Main Department Store Division Performance Slumps

Food and Beverage Sales Reach 21.5 Billion Won in First Half of This Year

More Than Double Last Year's Sales

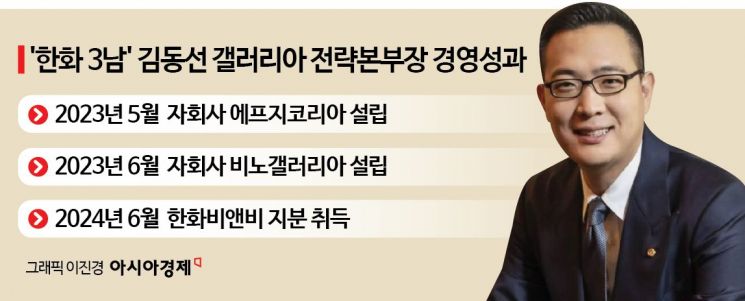

Kim Dong-seon, Vice President and Head of Future Vision at Hanwha Galleria, responsible for Hanwha Group's distribution and hotel businesses, is making aggressive moves to pioneer new food and beverage (F&B) ventures. As the performance of the department store sector, the group's core business, plummets due to sluggish domestic demand, the company is expanding its footprint into the F&B market. Kim, the third son of Hanwha Group Chairman Kim Seung-yeon, appears to be actively diversifying the business following the successful domestic launch of his first new venture under his own name, the American hamburger brand Five Guys, last year. However, the continued downturn in the core department store and hotel businesses, along with the lack of clear early results from new ventures other than hamburgers, remains a concern.

According to the distribution industry on the 1st, Hanwha Galleria acquired Pureplus, a beverage manufacturing specialist, last month. The acquisition was reportedly led by Vice President Kim. Pureplus is a manufacturing company specializing in non-alcoholic beverages for over 30 years, producing a variety of products including health drinks, organic juices, and children's beverages. Kim plans to aggressively target the 'premium health beverage' market following the acquisition of Pureplus.

Department Stores and Hotels Suffer Consecutive Losses... Focus on K-Food

Earlier this year, Hanwha Galleria renamed The Tastable, a food service subsidiary of Hanwha Hotels & Resorts, to Hanwha Food Tech and has been collaborating with Hanwha Robotics, a robot-specialized affiliate. In February, under Vice President Kim's leadership, the company acquired the American robot pizza brand 'Stella Pizza' and opened a pasta specialty restaurant 'PastaX' in Hannam-dong, Seoul, in April. Hanwha Food Tech recently filed a trademark application for 'Chinese Dining TaoTao' with the Korean Intellectual Property Office. Accordingly, it is expected that following 'PastaX,' a Chinese restaurant utilizing food tech technologies such as robotics will be launched.

Last month, Vice President Kim also formed a new organization to outline the distribution division's blueprint within the group. Through organizational restructuring, the Future Vision TFT (Task Force Team) was established. Kim's title was changed from Head of Strategy Headquarters to Head of Future Vision. The company stated, "The Future Vision TFT is an organization that supports Vice President Kim's duties as Head of Future Vision and will assist in drawing up the company's future blueprint for the time being."

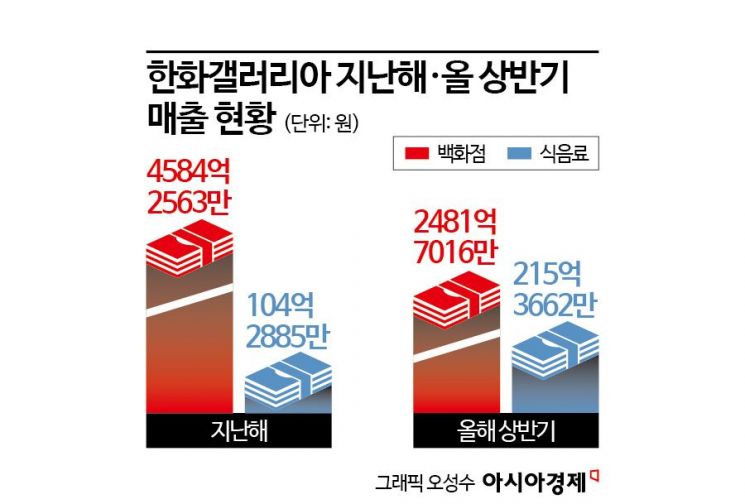

The reason Vice President Kim is focusing on new F&B ventures is due to the continued poor performance of the distribution division he is set to inherit. Hanwha Galleria's core department store segment recorded an operating profit of 600 million KRW in the first half of this year, down 82.9% from 3.5 billion KRW in the same period last year. It posted an operating loss of 5.3 billion KRW in Q2, marking its first loss since listing. While the department store industry is generally struggling due to weakened domestic consumption, Hanwha Galleria's decline has been particularly pronounced. Its market share dropped from 7.8% in 2022 to 6.8% last year and further to 6.5% in the first half of this year.

The hotel business is in a similar situation. Hanwha Hotels & Resorts recorded an operating loss of 3 billion KRW in Q2, increasing the deficit by over 1 billion KRW compared to the same period last year. Net loss for the period also expanded by 46% to 19.1 billion KRW.

Kim Dong-seon's Hamburger Brand 'Five Guys' Posts 20 Billion KRW Sales in First Half

On the other hand, some results are emerging from the new ventures led by Vice President Kim. According to Hanwha Galleria's semi-annual report, the F&B division recorded sales of 21.53662 billion KRW in the first half of this year. Compared to last year's F&B sales of 10.42885 billion KRW, this means sales in just half a year have more than doubled the entire previous year's revenue.

Exterior photos of Five Guys stores (clockwise from top left: Gangnam, Yeouido, Gangnam Express Bus Terminal, Seoul Station). [Photo by FG Korea]

Exterior photos of Five Guys stores (clockwise from top left: Gangnam, Yeouido, Gangnam Express Bus Terminal, Seoul Station). [Photo by FG Korea]

Most of Hanwha Galleria's F&B sales were generated by its subsidiary FG Korea, which operates Five Guys. FG Korea earned 20.38625 billion KRW in the first half, accounting for 95% of the F&B division's sales. FG Korea recorded sales of 9.98235 billion KRW from two stores last year but has expanded to five stores this year. Among them, the Pangyo store in Gyeonggi Province opened on the 9th and its sales were not reflected in this semi-annual report.

The American hamburger brand Five Guys started in Virginia, USA, in 1986 and is considered one of the top three American burger brands alongside Shake Shack and In-N-Out. It operates in 23 countries including the UK, France, and Germany. Vice President Kim led the effort to bring the brand to Korea, opening the first store in Gangnam last year. Five Guys plans to open additional stores in the second half of this year, aiming to expand to 15 stores within the next four years.

Meanwhile, the wine sales subsidiary Vino Galleria's sales remain modest compared to FG Korea. It recorded sales of 1.15037 billion KRW in the first half of this year. Considering last year's sales of 437.4 million KRW, this also represents more than double growth. However, industry insiders point out that these new ventures are still small compared to department store sales, and since ventures other than Five Guys are still in the early stages, it is too soon to evaluate their business performance.

Meanwhile, from the 23rd of last month to the 11th of this month, Vice President Kim acquired approximately 28.16 million shares of Hanwha Galleria worth 45 billion KRW through a public tender offer. His shareholding increased to 16.85%, making him the second-largest shareholder after Hanwha, which holds 36.3%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.