Bank of Korea September Corporate Business Sentiment Index (CBSI) Declines

Falls for Three Consecutive Months Since July Amid Economic Slowdown Concerns

Due to concerns over a global economic slowdown, the business sentiment among Korean companies has worsened for three consecutive months.

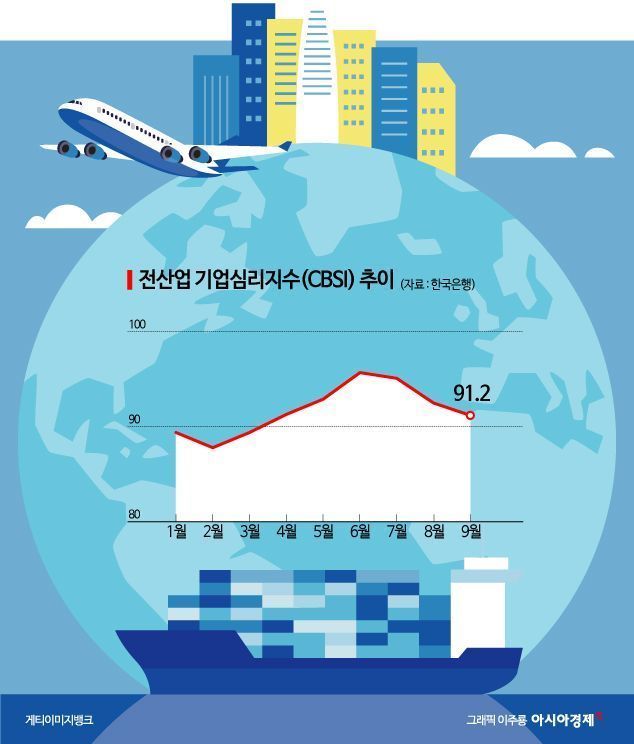

According to the 'September 2024 Business Survey' released by the Bank of Korea on the 27th, the Composite Business Survey Index (CBSI) for all industries this month stood at 91.2, down 1.3 points from the previous month.

The all-industry CBSI has been declining for three consecutive months following its peak of 95.7 in June, with 95.1 in July, 92.5 in August, and continuing this month. A CBSI below the long-term average of 100 (January 2003 to December 2023) indicates a pessimistic economic sentiment among companies.

The Bank of Korea explained that concerns over economic slowdown in major overseas countries such as the United States and China have led to deteriorating business sentiment in both manufacturing and non-manufacturing sectors. The manufacturing CBSI for September fell 1.9 points from the previous month to 90.9, while the non-manufacturing CBSI dropped 0.8 points to 91.4.

Looking at manufacturing by sector, business sentiment worsened in primary metals, petroleum refining, and chemical industries. In primary metals, weak demand from upstream industries such as construction and automobiles was a contributing factor.

In petroleum, concerns arose over profitability deterioration due to declining refining margins, and in chemicals, intensified competition with Chinese companies raised worries about export decreases.

Hwang Hee-jin, head of the Statistical Survey Team at the Bank of Korea’s Economic Statistics Bureau, explained, "Concerns over economic slowdown appearing simultaneously in the US and China have increased worries among domestic companies. The decline in international oil prices due to these concerns has also led to worries about shrinking refining margins and intensified competition."

Hwang added, "Among domestic demand companies, the sentiment of real estate-related firms worsened significantly due to sluggish housing construction, and industries such as light manufacturing and construction were affected by poor business conditions."

In the non-manufacturing sector, deterioration was centered around transportation and warehousing, and information and communication industries. The transportation and warehousing sector was affected by falling maritime freight rates and decreased overseas cargo transport volumes. The information and communication sector saw a significant impact from reduced sales in broadcasting program production and software development companies.

For non-manufacturing, the outlook CBSI for next month also declined by 0.5 points from the previous month to 91.5. Many companies expressed concerns about financial conditions and sales.

The Economic Sentiment Index (ESI), which incorporates the Consumer Sentiment Index (CSI) into the Business Survey Index (BSI), recorded 93.7, down 0.5 points from the previous month. The seasonally adjusted ESI cyclical component was 93.6, up 0.1 points from the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)