63% of Jeonse Fraud Victims Are Aged 20-30

Number of Guarantee Insurance Rejections Increasing Annually

Experts Say "Legal Protection Needed Now"

According to the KB Real Estate Weekly KB Apartment Market Trend report, last week Seoul apartment sale prices surged by 0.22% in just one week, with both sale and jeonse prices listed for apartments in Mapo-gu, Seoul on the 5th. Photo by Kang Jin-hyung aymsdream@

According to the KB Real Estate Weekly KB Apartment Market Trend report, last week Seoul apartment sale prices surged by 0.22% in just one week, with both sale and jeonse prices listed for apartments in Mapo-gu, Seoul on the 5th. Photo by Kang Jin-hyung aymsdream@

Lee (24), a young professional who succeeded in getting a job earlier this year, signed a contract for her first rented room two months ago. She said, "I thought things would have improved since the year before last, but it seems that jeonse fraud is still happening these days, so I was scared," adding, "I chose monthly rent reluctantly because it’s better than not getting any money back at all." She also said, "The terminology related to jeonse is difficult, and many people around me don’t know how to prepare for it," and added, "There needs to be policies for protecting young adults just entering society, whether it’s protective measures or monthly rent support."

Jeonse fraud crimes targeting university areas and the 2030 generation continue, leaving tenants anxious.

According to the police on the 26th, the Dongdaemun Police Station in Seoul recently arrested and sent Kim (57) to prosecution on charges of jeonse fraud amounting to 11 billion won near university areas. Kim is accused of signing lease contracts at prices higher than the sale price and not returning deposits after the contract period ended, defrauding 114 tenants of their deposits. In the Gwanak-gu area of Seoul, police have also launched an investigation after detecting signs that a landlord failed to return deposits worth tens of billions of won to about 20 tenants.

Because of this, young professionals prefer monthly rent, which has a lower risk, even if the financial burden is heavier. In fact, among the victims of jeonse fraud in the past two years, 6 out of 10 were young adults in their 20s and 30s.

According to the National Investigation Headquarters of the Korean National Police Agency, from July 2022 to July this year, among a total of 16,314 victims of jeonse fraud, those in their 30s accounted for 37.7%, and those aged 20 or younger accounted for 25.1%.

The only current measure to respond to jeonse fraud damage is the Jeonse Deposit Return Guarantee Insurance. This insurance guarantees the return of the jeonse deposit that the landlord must return to the tenant after the lease contract ends. In the metropolitan area, deposits up to 700 million won are guaranteed, and in other regions, up to 500 million won.

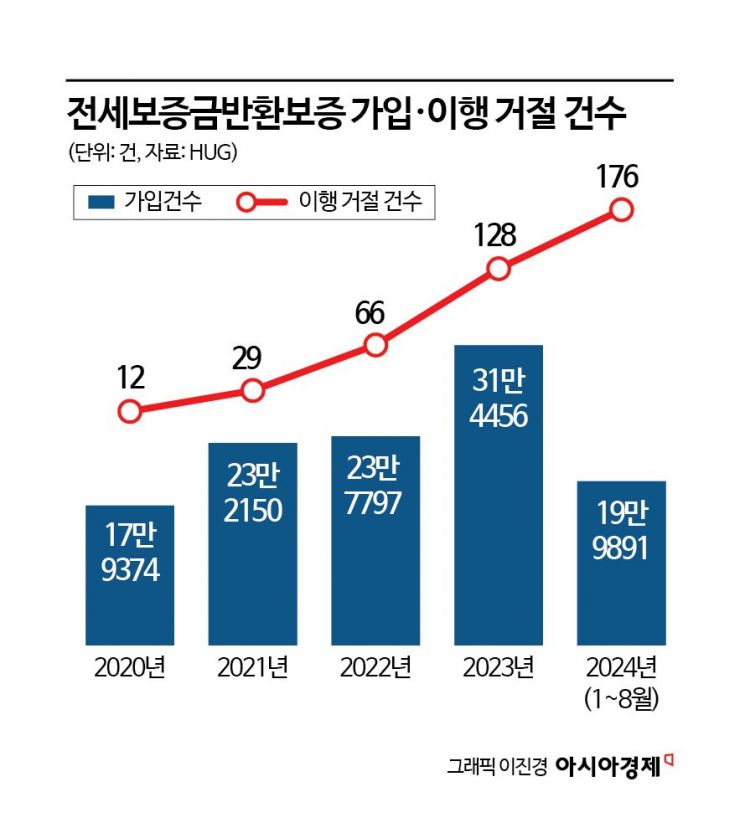

However, even this is increasingly failing to cover losses. According to the Housing and Urban Guarantee Corporation (HUG), there were 176 cases this year where insurance payment was denied after subscribing to jeonse deposit insurance. The amount of deposits denied payment totaled 30.6 billion won. The number of denials has increased every year since 2020, and by August this year, it had already surpassed last year's record.

The most common reason for denial was "non-occurrence of guarantee accident," with 176 cases. This year alone, there were 113 cases, more than double last year's 57 cases. Non-occurrence of guarantee accident means that the tenant did not express their intention to terminate the contract two months before the contract ended, resulting in an "implicit renewal" of the lease contract, making insurance payment impossible.

A HUG official explained, "Under the Lease Protection Act, if the tenant does not express their intention to terminate the contract, payment cannot be made, so we contact subscribers in advance to guide them, but some people seem to miss this," adding, "As the number of issued policies increases, the number of denials inevitably rises." The official also said, "We plan to strengthen explanations about reasons for non-payment when subscribing to guarantees in the future to prevent denial of guarantee execution."

There are also calls for improvement of the current institutional system, where the possibility of subscribing to guarantee insurance can only be known after the lease contract is signed. Kanghoon Lee, head of the Tenant 114 Center at the Housing Tenant Legal Support Center, said, "Because the market price itself is usually opaque, tenants find it difficult to accurately judge whether they can get their deposit back from the house, so they rely on the guarantee institution," adding, "From the guarantee institution’s perspective, it may be cumbersome, but they should determine in advance whether subscription is possible so that tenants can feel secure and fulfill the contract."

Experts emphasize that legal protection of jeonse deposits should be accompanied by tenants’ thorough verification at the time of contract. Professor Junhwan Kim of the Department of Real Estate at Seoul Digital University said, "Basic checks like verifying the registry or subscribing to guarantee insurance can sufficiently prevent jeonse fraud, so it is better to visit multiple brokerage offices rather than direct transactions before signing a contract," and urged, "Instead of trying to save money on the minimum necessary procedures, people should think of it as setting up safety measures to prevent fraud."

Hakwhan Kim, a researcher at the Real Estate Policy Institute, said, "Since the jeonse system can serve as a housing ladder, even if the terminology and clauses are difficult, if tenants carefully review various matters with experts such as licensed real estate agents when signing contracts, they can make good use of it," adding, "There is also a need for institutional improvements such as simplifying guarantee insurance procedures and subscriptions, and granting licensed real estate agents the authority to access lease information without the landlord’s consent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)