Bank of Korea's 'September Consumer Sentiment Survey Results'

Expected Inflation 2.8%... Perceived Prices Still High

Housing Price Rise Expectations Highest in 2 Years 11 Months

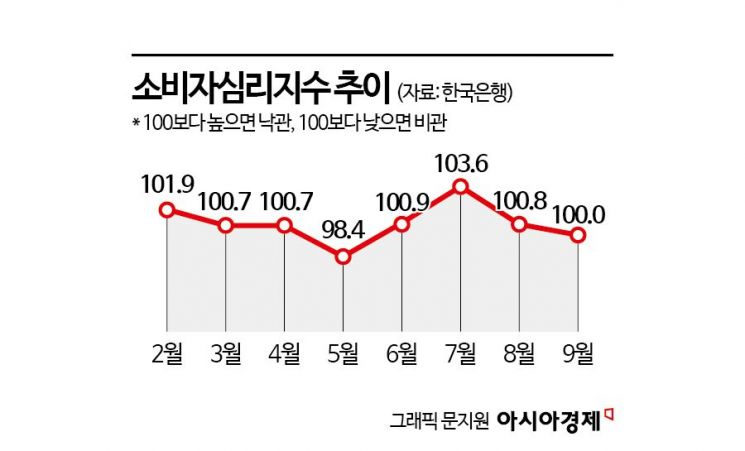

Despite the slowdown in inflation, concerns over delayed domestic demand recovery persisted, causing the Consumer Sentiment Index to decline for the second consecutive month.

The expected inflation rate, which indicates the anticipated consumer price inflation over the next year, stood at 2.8%, higher than the actual consumer price inflation rate of 2%. Expectations for housing price increases reached the highest level in 2 years and 11 months. However, the rate of increase somewhat slowed due to the government's strengthened household loan management measures this month.

According to the 'September Consumer Survey Results' released by the Bank of Korea on the 25th, the Consumer Sentiment Index (CCSI) for this month was 100.0, down 0.8 points from the previous month. The Consumer Sentiment Index had reached its highest level in 2 years and 3 months in July (103.6), but has been declining for two consecutive months since August. Although the recent consumer price inflation rate slowed to 2%, concerns over delayed domestic demand recovery have persisted.

The CCSI is a sentiment indicator calculated using six major indices that make up the Consumer Sentiment Index (CSI). A value above the long-term average (2003?2023) of 100 indicates optimistic consumer sentiment, while a value below 100 indicates pessimism.

Hwang Hee-jin, head of the Statistics Survey Team at the Economic Statistics Bureau of the Bank of Korea, said, "Consumer sentiment is expected to recover in the second half of the year as inflation stabilizes and export growth is broadly reflected."

The expected inflation rate for the next year decreased by 0.1 percentage points from the previous month to 2.8%. However, it still remained higher than the August consumer price inflation rate (2.0%). The expected inflation rate has stayed in the high 2% range for three consecutive months since July.

Hwang explained, "The stabilization of agricultural product prices and the slowdown in the sharp rise of petroleum prices have contributed to the lower consumer prices," but added, "However, factors such as increases in electricity bills, transportation costs, and city gas charges remain in the second half of the year, and with the prolonged heat, prices of some vegetables and other agricultural products rose ahead of the September holidays, so the perceived inflation has not significantly decreased."

Housing Price Increase Expectations Reach Highest in 2 Years and 11 Months... Rate of Increase Slows

Expectations for housing price increases reached the highest level in 2 years and 11 months. This month, the Housing Price Outlook CSI was 119, up 1 point from the previous month. This is the highest since October 2021 (125). This is due to increased apartment sales transactions recently and the continued rise in sales prices mainly in the Seoul metropolitan area. However, the rate of increase slowed compared to the previous month (3 points).

Hwang said, "Housing price expectations have been rising for four consecutive months," but added, "However, with the government's strengthened household loan management policies starting this month, the upward trend is showing signs of slowing down."

On the 24th, customers visiting the Hanaro Mart Yangjae branch in Seocho-gu, Seoul, were purchasing food and goods. According to a survey conducted by Korea Price Information, a professional price research organization, on the cost of Charyesang (ancestral ritual table) at traditional markets and large supermarkets three weeks before Seollal (Lunar New Year), the cost for a family of four this year was 281,500 won at traditional markets and 380,580 won at large supermarkets. This is the highest level ever recorded. In particular, prices of fruits and vegetables rose by more than 25%, driving up grocery prices. Photo by Kang Jin-hyung aymsdream@

On the 24th, customers visiting the Hanaro Mart Yangjae branch in Seocho-gu, Seoul, were purchasing food and goods. According to a survey conducted by Korea Price Information, a professional price research organization, on the cost of Charyesang (ancestral ritual table) at traditional markets and large supermarkets three weeks before Seollal (Lunar New Year), the cost for a family of four this year was 281,500 won at traditional markets and 380,580 won at large supermarkets. This is the highest level ever recorded. In particular, prices of fruits and vegetables rose by more than 25%, driving up grocery prices. Photo by Kang Jin-hyung aymsdream@

While some expected domestic demand to recover, the Consumption Expenditure Outlook CSI fell by 1 point to 108 compared to the previous month. This is because, despite the slowing inflation trend, agricultural products and public utility charges remain high, making it difficult for consumers to actually feel a decrease in prices, thus limiting their spending capacity.

Hwang explained, "In categories such as travel and durable goods, which usually improve when consumption activates, negative figures appeared," adding, "The consumption expenditure outlook remains at the long-term average level (108)."

The Price Level Outlook CSI was 144, down 1 point from the previous month, due to the slowdown in the rise of agricultural product and petroleum prices despite concerns over increases in public utility charges.

The Interest Rate Level Outlook CSI remained unchanged at 93 from the previous month. This is because, despite expectations of a U.S. base rate cut leading to lower market interest rates, concerns over the government's strengthened household loan management and rising mortgage rates at some commercial banks have kept the interest rates perceived by general consumers at a high level.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.