Reflecting Qualitative Indicators Such as Capital Efficiency and Shareholder Value Enhancement

"Will Contribute to the Reappraisal of the Korean Capital Market"

The Korea Exchange announced the 'Korea Value-Up Index' to promote market evaluation and investment attraction for companies with outstanding corporate value.

On the 24th, the Korea Exchange announced the constituent stocks and selection criteria of the 'Korea Value-Up Index' and stated that it plans to provide real-time index data to domestic and international investors starting from the 30th, after completing system testing.

The Exchange completed the development of the index by gathering diverse opinions from market participants such as pension funds and asset management companies, consulting experts from various fields, deriving the index concept, establishing detailed selection criteria, and conducting performance verification and analysis of the index.

The base date of the index is January 2, 2024, the first day of the corporate value-up program, with a base value of 1000 points. The index consists of 100 constituent stocks and will be revised once annually. It uses a free-float market capitalization weighting method, and the weight of each individual stock within the index is capped at 15%.

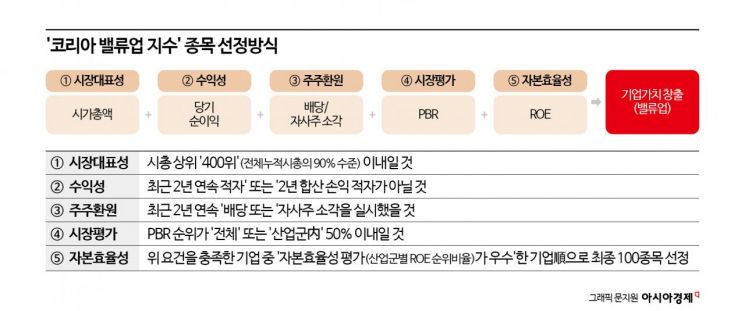

The Value-Up Index is composed of representative companies that meet various qualitative criteria objectively applicable and widely recognized, such as profitability, shareholder returns, market evaluation, and capital efficiency, in addition to external requirements like market capitalization and trading volume. Evaluation indicators that cannot be applied to certain industries or have limited evaluation targets and lack a reliable calculation method in the market were excluded from the selection criteria.

To ensure balanced inclusion without concentration or exclusion of specific industries when applying the selection criteria, a relative evaluation method was adopted. Additionally, to actively include not only companies with excellent corporate value but also those expected to grow in value in the future, special provisions for disclosed companies and relative evaluation of price-to-book ratio (PBR) by industry group were applied.

A Korea Exchange official said, "We differentiated this from indices like the KOSPI 200 to expand institutional participation such as pension funds, promote productization, and create new investment demand. Through investment activation and motivation for index inclusion, we will support companies' voluntary efforts to enhance corporate value." He added, "Index futures and exchange-traded funds (ETFs) are scheduled to be listed in November. Furthermore, we plan to develop follow-up indices by actively considering market demand identified during the index development process." He continued, "Through the development of the Value-Up Index reflecting qualitative indicators such as capital efficiency and shareholder value enhancement performance, we will actively support the establishment of a virtuous cycle structure that values corporate value in the Korean stock market."

Jung Eun-bo, Chairman of the Korea Exchange, stated, "Our stock market has long been criticized for not properly evaluating corporate value," and added, "We hope that the domestic stock market will be re-evaluated through the 'Korea Value-Up Index.'"

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.