Last Month's Trading Volume Down 30%

Buyer Burden Due to Soaring Apartment Prices

Loan Regulations Likely to Further Reduce This Month

Interest Rate Cut Possibility a Variable... Transactions May Recover

The volume of apartment sales in Seoul, which had been steadily increasing since the beginning of this year, is now slowing down. The rapid rise in housing prices combined with the government's loan regulations has led to more people wondering whether they should buy a house or not.

If the number of such people increases, a trend of declining transactions could begin, potentially leading to a transaction cliff similar to last year. However, experts diagnose that this will likely end as a short-term wait-and-see trend rather than a long-term inflection point. Due to the recent 'big cut' (a 0.5 percentage point reduction in the base interest rate) in the United States, there is a high possibility that loan interest rates in Korea will also fall again, and transaction volumes will recover.

Seoul Apartment Transaction Volume 'Slows'

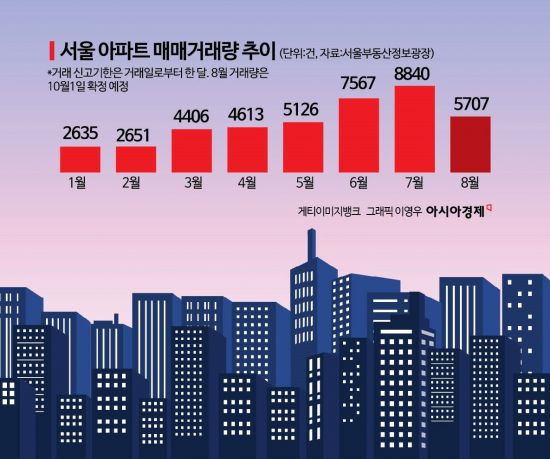

According to the Seoul Real Estate Information Plaza on the 23rd, the number of apartment sales transactions in Seoul last month was 5,574, about 30% less than the previous month (8,838). The final figure for last month's transactions will be determined by adding transactions reported over the next week. Although this number will increase from the current volume, it is unlikely to surpass the transaction volume of July. So far in September, 673 transactions have been reported, suggesting that the volume may decrease further compared to August.

The volume of apartment transactions in Seoul hit a low point of around 1,800 at the end of last year and then showed an increasing trend this year. The government eased loan regulations based on the judgment that housing prices had bottomed out, leading to a surge in people wanting to buy homes. As a result, transaction volume increased from about 2,600 in January to 8,838 in July, driving the rise in housing prices.

However, as housing prices soared and the government tightened loan regulations, buyers facing increased burdens have gradually shifted to a wait-and-see stance. According to the Korea Real Estate Board, as of the 16th, the Seoul apartment sale price rose by 0.16% compared to the previous week, marking 26 consecutive weeks of increase. A representative from a real estate agency in Seongdong-gu said, "With the summer heatwave, fewer people are coming to view houses compared to earlier this year," adding, "While homeowners are not lowering their asking prices, the number of listings is increasing." According to the real estate big data company 'Asil,' the number of apartment listings in Seoul has increased to about 80,000, up from a month ago.

Song Seung-hyun, CEO of Urban and Economy, analyzed, "The government has made mortgage loans more stringent, and with the implementation of the stress Debt Service Ratio (DSR) from this month, transaction volumes may decrease further for the time being." Financial authorities recently raised barriers to mortgage loans as apartment prices and transaction volumes continued to rise. Commercial banks have shortened loan maturities and blocked mortgage insurance for new mortgage loans. With the implementation of the stress DSR, mortgage loan interest rates will rise and loan limits will decrease.

The Key is 'Interest Rate Cuts'

The continuation of this decline in transactions is expected to depend on the direction of interest rates in the financial sector. With the U.S. lowering interest rates this month, there is a greater possibility that Korea will also reduce rates. Experts analyze that this will increase liquidity in the market and prevent a transaction cliff like last year.

Yoon Ji-hae, chief researcher at Real Estate R114, said, "A base interest rate cut is expected in the second half of this year, which could offset the government's loan regulations," adding, "There are still many buyers waiting, so if the environment improves, buying demand will recover."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)