"US Private Equity Firm Apollo Proposes $5 Billion Investment"

Intel, once reigning as the king of the semiconductor industry, is losing its stature as it has become a takeover target for competitors. To overcome this crisis, Intel has spun off its foundry (semiconductor contract manufacturing) business and embarked on a major overhaul. Amid investors on Wall Street willing to bet billions of dollars on Intel's future, attention is focused on whether Intel can turn the tide.

Earlier, the Wall Street Journal (WSJ) and others reported last week that U.S. semiconductor giant Qualcomm was exploring the possibility of acquiring Intel. While mergers and acquisitions (M&A) themselves are not unusual, the fact that a company that once built a semiconductor empire has become a target for acquisition by a competitor starkly illustrates Intel's current standing. In 2020, Intel's market capitalization was $290 billion, but it has now fallen to about half of Qualcomm's (approximately $188 billion), standing at $93 billion.

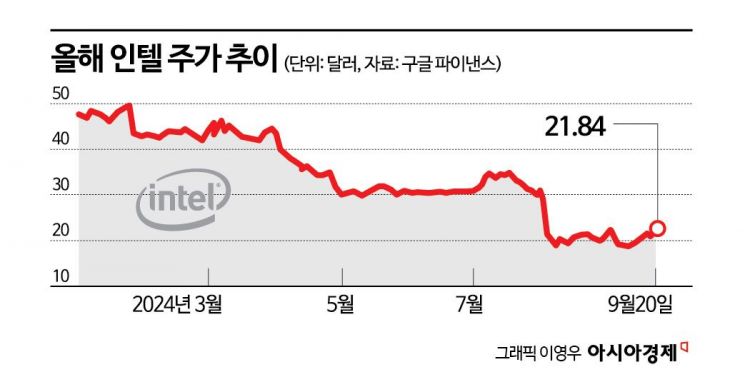

Intel is considered to be facing its greatest crisis since its founding in 1968. From the late 1970s, Intel dominated the semiconductor industry for nearly 50 years through central processing unit (CPU) design, but it has fallen behind in entering new businesses such as artificial intelligence (AI), putting it at risk of obsolescence. In the second quarter, Intel posted a net loss of $1.61 billion compared to the previous year, causing its market capitalization to drop below $100 billion. This contrasts sharply with Nvidia, whose revenue was only one-third of Intel's in 2021 but surpassed a market cap of $3 trillion.

However, there was good news for Intel at the brink. On the 22nd (local time), Bloomberg reported that Apollo Global Management, considered one of the world's top four private equity firms, proposed a $5 billion (approximately 6.6 trillion KRW) investment in Intel. A source said, "Intel is reviewing Apollo's proposal," adding, "However, nothing has been finalized yet, and the investment size may change or be canceled."

The form of investment Apollo proposed to Intel is said to be an ‘equity-like investment.’ It is presumed to be a structure where profits or losses are shared according to the company's performance. Apollo, which started in the 1990s in the U.S. as a company specializing in distressed investments, is now known for its reputation in insurance and corporate acquisition investments.

Bloomberg pointed out that Apollo's investment proposal to Intel reflects trust and support for Intel's new management strategy. Recently, Intel CEO Pat Gelsinger initiated a major management overhaul by spinning off the foundry division as a subsidiary and temporarily halting factory construction projects underway in Europe and Asia. Following the Q2 earnings shock, Intel also announced plans to cut 15% of its workforce and reduce annual capital expenditures by 17% to save $10 billion.

Experts say the likelihood of positive changes in Intel's future is not high, but there remains a foothold for a turnaround. One such factor is the 1.8nm (18A; 1nm = one billionth of a meter) process expected to enter production by the end of this year or early next year. If the plan proceeds as scheduled, it would put Intel ahead of the world's largest foundry companies, Taiwan's TSMC and Samsung Electronics, which are set to start 2nm processes next year. Stacy Rasgon, an analyst at Bernstein, said, "Intel's future depends on the success of next-generation chip manufacturing technology scheduled for production next year," adding, "If it regains technological leadership, it can improve profitability and restore customer trust."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)