Over the Past 1 Year and 8 Months, 5 Major GAs Averaged 700 Cases of Unfair Contract Transfers

Head Office Indifferent Despite Exceeding Recruitment and Settlement Support Fund Criteria for Agents

Financial Authorities Strengthen Internal Controls and Disclosures

It has been revealed that an average of 700 unfair replacement contracts occur per company among five major corporate insurance agencies (GAs) in South Korea. This practice, which involves improperly terminating existing insurance contracts to apply for new contracts, is prohibited under the Insurance Business Act.

On the 23rd, the Financial Supervisory Service (FSS) conducted inspections on five large GAs from 2023 until last month. As a result, 351 planners recruited 2,687 new contracts while unfairly terminating 3,502 existing contracts (an average of 700 cases per company). They induced unfair replacement contracts by not informing clients of important details when comparing the existing contracts terminated within six months and the new contracts. An FSS official stated, "We are currently proceeding with disciplinary measures," adding, "Since there is a high possibility of disruption to business order and consumer damage, we plan to strictly enforce sanctions."

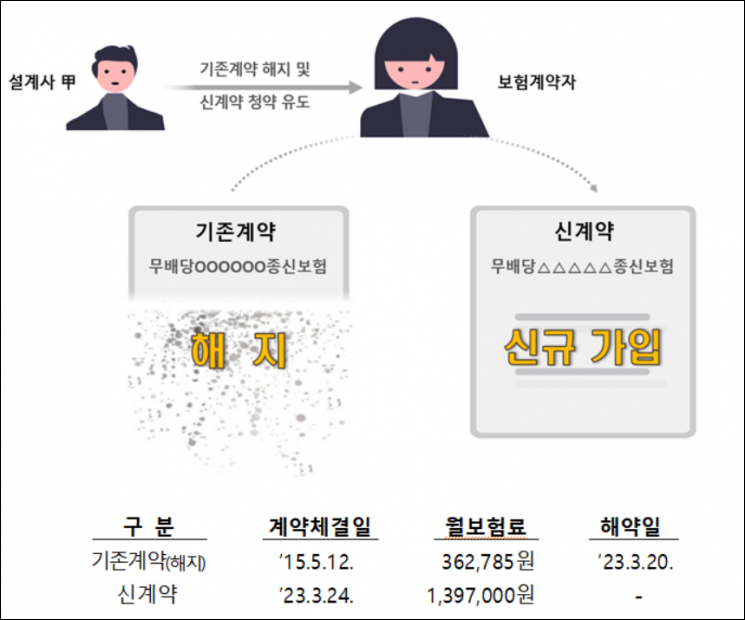

Planner Kim, affiliated with Company A, recruited 16 new contracts including the 'Non-dividend 00 Whole Life Insurance' from January 12, 2022, to March 8 of this year. During this process, he induced the cancellation of 18 existing contracts including the 'Non-dividend 00 Whole Life Insurance' and did not inform clients by comparing important details between the existing and new contracts. According to the FSS findings, although the coverage of the existing and new contracts was largely similar, the insurance premiums to be paid increased significantly. The surrender value from the existing contracts was also less than the premiums paid. Planners who receive large settlement support payments often face pressure and burden regarding performance, which increases their incentive to induce unfair replacement contracts.

Cases of unfair contract transfers by corporate insurance agencies (GA). The coverage is similar to the existing insurance, but the monthly premium has increased significantly. (Source: Financial Supervisory Service)

Cases of unfair contract transfers by corporate insurance agencies (GA). The coverage is similar to the existing insurance, but the monthly premium has increased significantly. (Source: Financial Supervisory Service)

Despite most of the five major GAs paying large settlement support payments, detailed standards and related control activities were insufficient. In the case of Company B, the regional headquarters chief paid settlement support payments exceeding the standards set by company regulations to recruited planners, but the GA took no particular action. Company C operates settlement support payments differently by headquarters and branches, and the head office neither monitors nor manages the payment status. The FSS plans to request 'management attention' or 'improvement' to ensure proper internal controls are established for GAs operating settlement support payments. GAs must submit a summary report on the requested measures within a certain period (6 months for management attention, 3 months for improvement). If the measures are insufficient, the FSS will set an appropriate period to request a reorganization.

The FSS will continue to strengthen ongoing monitoring, including internal control inspections related to settlement support payments and analysis of major disclosure indicators. For GAs where many suspicious unfair replacement contracts are found, on-site inspections will be promptly conducted and strict sanctions imposed.

The FSS also plans to encourage strengthening internal controls related to GA settlement support payments. According to the model code voluntarily established by the GA industry, settlement support payment operation details are to be disclosed quarterly. During the fourth quarter of this year, the FSS plans to check compliance with the model code in cooperation with the Insurance GA Association.

An FSS official said, "We will review improvements to commission regulations applied to GAs and their affiliated planners through discussions at the Insurance Reform Council," adding, "We will also actively promote improvements to the replacement comparison guidance system to strengthen insurance consumers' right to know and resolve information asymmetry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)