Inka Geumyung, First Rise to 2nd Place in H1 This Year

Aggressive Recruitment of Planners... Intensified Cutthroat Competition

Financial Authorities Indicate Strengthened GA Regulations

Intense competition for talent recruitment is unfolding over the second-place position in the corporate insurance agency (GA) industry. Due to concerns about consumer harm caused by excessive competition in scouting insurance planners, financial authorities have begun improving the system.

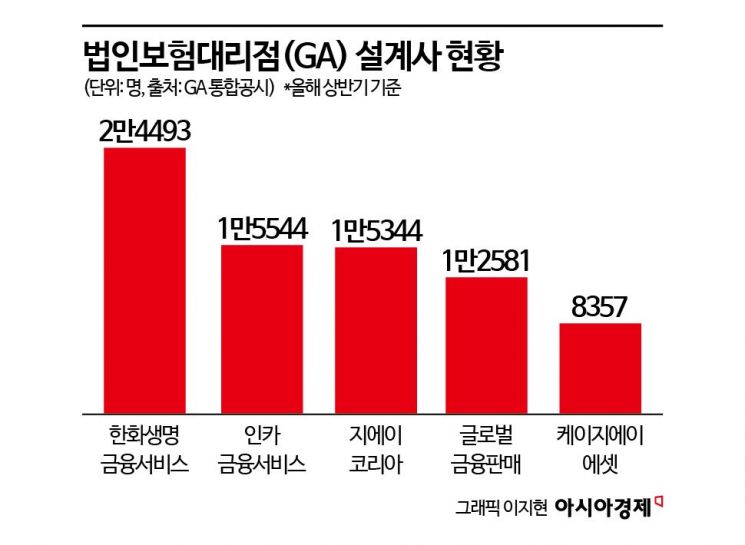

According to the integrated disclosure of corporate insurance agencies on the 23rd, in the first half of this year, Inka Financial Services' planners numbered 15,544, surpassing GA Korea (15,344) to leap to second place. This is the first time Inka Financial has jumped to second place based on the number of planners. The number of Inka Financial planners surged 51% over four and a half years, from 10,296 at the end of 2019. GA Korea, which had held the second place since 2021 following the undisputed first place Hanwha Life Financial Services (24,493 planners), fell to third place for the first time this time.

In terms of performance, Inka Financial's rapid progress is also remarkable. In the first half of this year, Inka Financial's new contract amount, combining life and non-life insurance, recorded 221.4 billion KRW, surpassing GA Korea's 210.8 billion KRW. Although GA Korea leads in the 13th installment retention rate (life insurance 95.08%, non-life insurance 88.6%), Inka Financial (life insurance 91.9%, non-life insurance 87.11%) is closely pursuing. The 13th installment retention rate refers to the percentage of insurance policies maintained without cancellation for more than one year after subscription.

Inka Financial has been rapidly growing since becoming the first in the industry to be listed on KOSDAQ on February 16, 2022. Its sales in the first half of this year reached 396.4 billion KRW, a 61.8% increase compared to the same period last year. Operating profit during the same period rose 99% to 39.4 billion KRW, and net profit surged 103.9% to 27.4 billion KRW. This is the highest half-year performance ever recorded. Inka Financial is leveraging the advantages of being a listed company, such as brand value and fundraising capability, to conduct aggressive sales activities. It is also actively recruiting planners with exceptional incentives. GA branch managers receive various incentives and commissions under different names, including corporate policies, win-win corporate policies, collection fees, renewal fees, and OA (office provision) fees. Besides the top three GAs, other leading GAs such as Global Financial Sales, KG Asset, and Prime Asset are also fiercely competing to recruit planners by offering exceptional conditions.

As competition among the top ranks of the GA industry intensifies, planner turnover is also frequent. Currently, in the insurance industry, there is active movement from insurance companies (original insurers) such as Samsung Life and Hyundai Marine & Fire Insurance to GAs. While original insurers can only sell their own insurance products, GAs can compare and sell multiple insurance products, which is advantageous for attracting customers. Last year, the retention rate of exclusive planners was 33% for life insurance companies and 52% for non-life insurance companies. The retention rate for 70 GAs was 47.9%. The planner retention rate refers to the survival rate of new insurance planners after one year. For non-life insurers and GAs, about five out of ten planners leave the company within a year. Frequent planner turnover results in a decline in service quality for customers who trust and rely on their insurance.

Incentives related to job changes, which can reach up to hundreds of millions of KRW, are a factor encouraging personnel movement. According to a full survey conducted by the Financial Supervisory Service on 39 GAs with more than 1,000 planners from 2022 to 2023, it was confirmed that 259 billion KRW (17.4 million KRW per person) in settlement support funds were paid to 14,901 experienced planners. A representative of a large life insurance company said, "Even though we invest a lot of time and money to train new planners, we are helpless as GAs offer high commissions and settlement support funds," adding, "Although the GA Association established a voluntary agreement last September to curb excessive scouting competition, it has now become almost ineffective."

Financial authorities are pushing for system reforms to increase supervisory intensity over GAs as the industry grows. They plan to introduce a specialized insurance sales company system to impose higher responsibilities on GAs. Unlike existing GAs that only act as agents for concluding insurance contracts, specialized insurance sales companies are financial firms that mediate insurance contract conclusions. Becoming a specialized insurance sales company entails consumer protection obligations, such as managing incomplete sales ratios at a certain level. A Financial Services Commission official said, "The influence of GAs in sales channels has changed significantly recently, so we are comprehensively reviewing sales channel improvements in line with this trend," adding, "We are also considering indirect regulation of GAs through insurance companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.