Big Cut Surpasses $2600 per Ounce, Reaching All-Time High

Further Increase Possible Due to Additional Interest Rate Cuts and Geopolitical Conflicts

Gold prices have reached an all-time high as the United States lowered its benchmark interest rate. Experts predict that gold prices could rise further due to the rate cut combined with increasing geopolitical risks.

According to the New York Mercantile Exchange on the 23rd, gold futures traded in the U.S. have surpassed $2,645 per ounce, marking a record high. Gold prices have risen 27.7% so far this year, the largest increase in over 20 years on an annual basis.

The surge in gold prices is attributed to the U.S. Federal Reserve's big cut (a 0.5 percentage point reduction) in the benchmark interest rate on the 19th, which was larger than market expectations. When the U.S. lowers interest rates, the value of the dollar declines, increasing the value of gold, which is considered an alternative asset.

Geopolitical risks such as conflicts between the U.S. and China, the war between Russia and Ukraine, and Middle East conflicts also contribute to the rise in gold's value. There is also analysis that gold prices are rising further due to the increased possibility of a full-scale war between Israel and the Lebanese militant group Hezbollah.

Global investment bank UBS stated, "When interest rates fall, the dollar weakens and the appeal of alternative assets like gold increases," adding, "Further cuts in U.S. benchmark interest rates and geopolitical risks such as wars could push gold prices even higher." Pawad Rajakzada, an analyst at Forex.com, forecasted, "As geopolitical instability continues, demand for safe-haven assets like gold will be maintained."

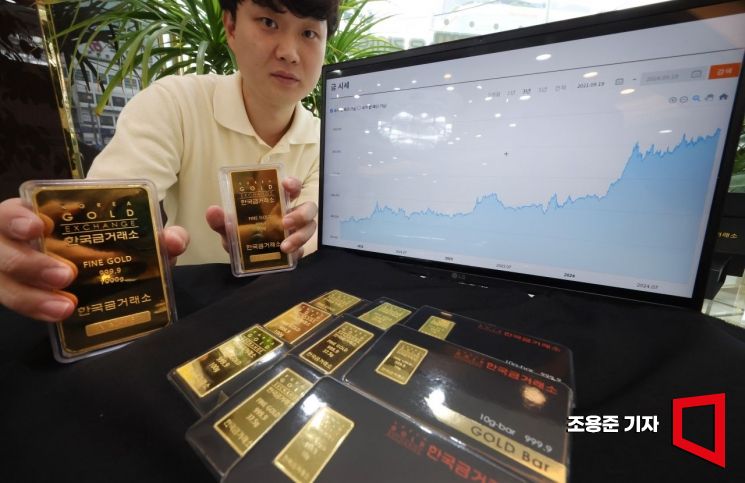

Gold prices are reaching record highs following the U.S. Federal Reserve's announcement of a 0.5 percentage point interest rate cut. On the 20th, an official at the Korea Gold Exchange in Jongno-gu, Seoul, is organizing gold bars. Photo by Jo Yongjun jun21@

Gold prices are reaching record highs following the U.S. Federal Reserve's announcement of a 0.5 percentage point interest rate cut. On the 20th, an official at the Korea Gold Exchange in Jongno-gu, Seoul, is organizing gold bars. Photo by Jo Yongjun jun21@

There are also forecasts that gold prices will continue to rise at least until next year. This is because the U.S. rate cuts are expected to continue through next year, and many anticipate that geopolitical risks will persist even after the U.S. presidential election at the end of the year.

Samsung Futures predicts that gold prices could rise to $2,750 per ounce this year and that the upward trend will continue next year. Jihee Ok, an analyst at Samsung Futures, stated, "As signs of cooling in the U.S. labor market become clearer, concerns about a recession may persist, making further rate cuts likely."

Analyst Ok explained, "The downward stabilization of interest rates and the dollar value, which have an inverse correlation with gold, act as momentum for gold price increases," adding, "Moreover, continued buying by central banks, led by the People's Bank of China, is also favorable for gold prices," and "Like other minerals, gold faces supply shortages, so there is potential for price increases next year."

Seongbong Park, an analyst at Hana Securities, also said, "Expectations of U.S. benchmark rate cuts and a weaker dollar have recently driven gold price increases," and predicted, "Gold prices will rise further until the end of the year due to the possibility of additional U.S. rate cuts and supply constraints."

However, some voices suggest that gold is approaching a short-term peak. Germany's Commerzbank forecasted, "The additional U.S. benchmark rate cuts are unlikely to be large, so the rise in gold prices will not continue indefinitely." Daniel Gali, an analyst at TD (Toronto-Dominion) Securities, analyzed, "Although gold buying demand remains due to U.S. rate cuts, considering the minimal inflows into gold exchange-traded funds (ETFs) and reduced buying in Asia, this could be a signal that gold prices have risen excessively."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)