Korea International Trade Association International Trade and Commerce Research Institute Report Published

Emerging Market Demand Recovery... Limited Impact of Won Strength on Exports

The U.S. Federal Reserve (Fed) recently cut the benchmark interest rate by 0.5 percentage points, and an analysis suggests that this rate cut will have a positive impact on South Korea's exports. It is expected that the increase in global import demand will lead to a recovery in South Korean exports.

The Korea International Trade Association (KITA) International Trade and Commerce Research Institute forecasted in its report titled "The Impact of U.S. Policy Rate Cuts on South Korea's Exports," published on the 22nd, that if the U.S. policy rate is lowered by 1 percentage point, South Korea's exports to the world would increase by 0.6%. The export growth effect is expected to appear from two months after the rate cut and last up to six months.

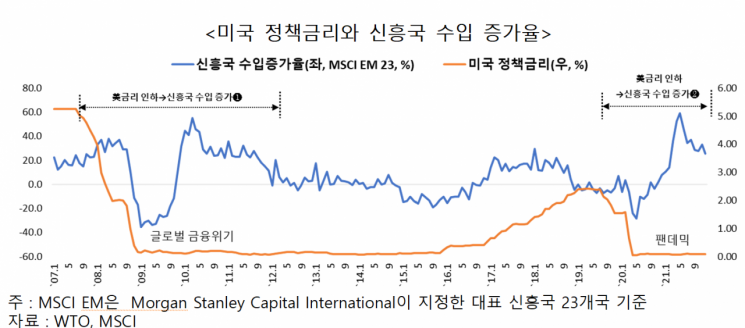

US Policy Interest Rate and Emerging Markets' Import Growth Rate

US Policy Interest Rate and Emerging Markets' Import Growth Rate [Image Source=Korea International Trade Association]

The report projected that the U.S. rate cut would accelerate the economic recovery of emerging markets, revitalizing South Korea's exports to these countries. An analysis of the correlation between U.S. policy rate changes and emerging market import demand over the past 15 years showed a recurring pattern where capital inflows to emerging markets increased after U.S. rate cuts, leading to a recovery in import demand.

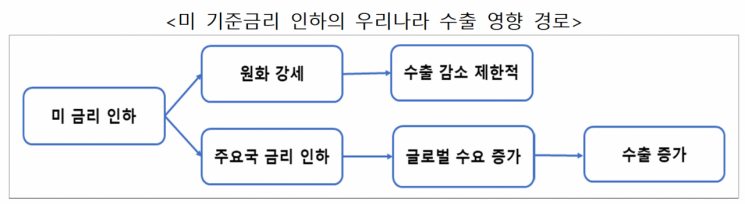

It was also forecasted that the negative impact of the Korean won's appreciation, caused by the U.S. rate cut, on exports would be limited. Global investment banks expect that even after the recent rate cut announcement, the value of the U.S. dollar will weaken by only 2.3% in the third quarter of next year compared to the fourth quarter of this year. The won-dollar exchange rate is expected to decline gradually, falling below 1,300 won per dollar only after the second half of next year.

Additionally, the report assessed that since a rate hike in Japan and a strengthening of the yen are anticipated, the negative impact on South Korean exports through exchange rate channels will also be limited.

Impact Path of US Interest Rate Cut on South Korea's Exports

Impact Path of US Interest Rate Cut on South Korea's Exports [Image Source=Korea International Trade Association]

Jo Eui-yoon, Senior Researcher at the Korea International Trade Association, stated, "This U.S. rate cut is positive in that it marks a gradual normalization of interest rates, ending the high-interest-rate era." However, he emphasized, "In the fourth quarter, including the remaining Federal Open Market Committee (FOMC) schedule, geopolitical risk factors such as the Russia-Ukraine war and Middle East risks remain, so it is necessary to carefully monitor changes in the export environment of key markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)