Krafton Raises Target Price for 26 Stocks

'Kakao' Tops Downgrade Reports

More Downgrade than Upgrade Reports Reflect Market Slump

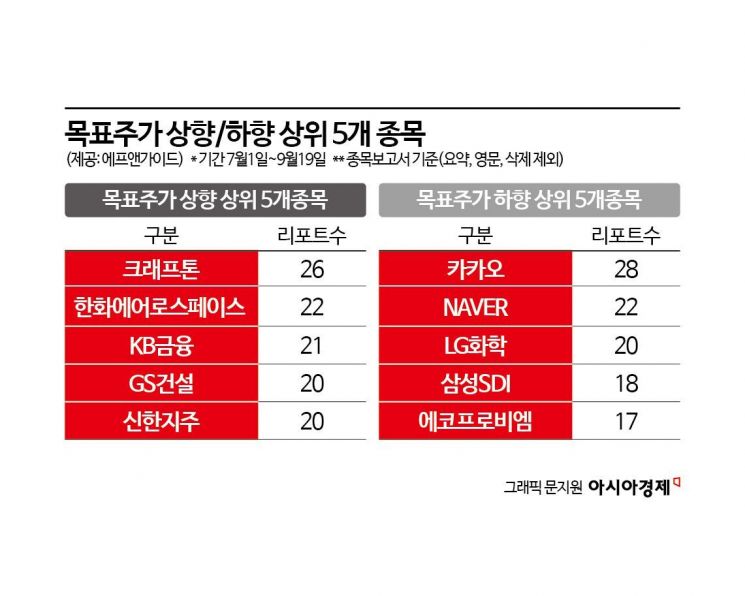

The listed company with the highest number of reports raising target prices was Krafton. Despite the semiconductor sector's sluggishness due to the sharp decline in U.S. tech stocks and the stock market weakness amid concerns over a U.S. economic recession, the prevailing outlook is that the stock price will rise, driven by expectations for third-quarter earnings and upcoming projects. Conversely, the company with the most downward target price reports in the second half of the year was Kakao.

According to FnGuide on the 23rd, from July 1 to September 19, Krafton was the stock with the most target price upgrade reports in the securities industry. A total of 26 securities firms raised their target prices. KB Securities raised Krafton's target price from 350,000 KRW to 400,000 KRW, and Bookook Securities adjusted it from 340,000 KRW to 450,000 KRW. Samsung Securities increased the target price from 350,000 KRW to 390,000 KRW. This is due to expectations for third and fourth-quarter earnings and the upcoming project, "Enjoy."

Lee Seonhwa, a researcher at KB Securities, analyzed, "Krafton is expected to record an earnings surprise exceeding the consensus operating profit of 245.2 billion KRW for the third and fourth quarters," adding, "The daily peak concurrent users on Steam remain around 690,000, and we have confirmed a recovery in daily sales of the Chinese game Peacekeeper Elite."

Following Krafton, Hanwha Aerospace ranked second with a total of 22 upgrade reports published. The stock price of Hanwha Aerospace, which was 120,000 KRW at the beginning of the year, closed at 290,000 KRW on August 28, the last trading day before the spin-off. The securities industry expects that after the spin-off, Hanwha Aerospace will maintain profitability and continue performance-driven growth.

Next were △ KB Financial Group (21 reports), △ GS Engineering & Construction (20 reports), and △ Shinhan Financial Group (20 reports) in order of the number of target price upgrade reports. The securities industry is pointing to KB Financial Group and Shinhan Financial Group as likely candidates for inclusion in the upcoming 'KRX Value-Up Index' to be announced this month. These are listed companies with healthy cash flow and active participation in the government's value-up program. The outlook for construction stocks, which experienced a decline in stock prices in the first half, is also positive. Securities firms recently raised GS Engineering & Construction's target prices collectively, expecting a recovery in the real estate market due to interest rate cuts and an increase in overseas orders.

The company with the most target price downgrade reports during this period was Kakao (28 reports), followed by NAVER (22 reports). Kakao's stock price fell nearly 40%, from 57,900 KRW at the beginning of the year to a closing price of 34,900 KRW on September 20. Shin Young Securities lowered the target price to 60,000 KRW, stating, "It is judged that it will take some time for new strategies to significantly turn around the company's overall performance, and considering that the value of non-core equity holdings is also unlikely to rebound."

Secondary battery-related stocks are expected to decline in price due to the slowdown in the electric vehicle market. Among the top five stocks with many target price downgrade reports were △ LG Chem (20 reports), △ Samsung SDI (18 reports), and △ EcoPro BM (17 reports). This is due to lowered profit and sales volume estimates as the electric vehicle market has yet to recover. The dominant opinion is that a meaningful rebound is unlikely in the second half of the year. Han Byunghwa, a researcher at Eugene Investment & Securities, said, "Considering the regrowth trend, the investment environment for battery-related stocks can improve," but added, "However, companies that are excessively overvalued compared to overseas peers will face stronger valuation scrutiny. High valuations cannot be blamed solely on market conditions."

Reflecting the sluggish market due to Black Monday when the KOSPI fell below 2,500 during trading hours, changes in U.S. monetary policy, semiconductor sector weakness following the sharp decline in U.S. tech stocks, and the U.S. presidential election, securities firms' stock price forecasts were pessimistic. While the number of target price downgrade reports for individual stocks increased significantly, the number of upgrade reports was only about one-quarter of the downgrade reports. From July to the 19th of this month, a total of 932 reports lowered target prices, while 204 reports raised them during the same period. The increase in reports lowering target prices is interpreted as a response to the continued weak trend, including the KOSPI falling below 2,600.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)