Interest Rate Cut → Expected Reduction in Financing Costs

Market Nervous About US Presidential Election "Focus on REITs Defending Against Decline"

Recession Concerns Persist... Need to Confirm Characteristics of Investment Targets

As interest rate cuts begin, REITs (Real Estate Investment Trusts) are gaining attention amid expectations of reduced financing costs. The defensive characteristics of REITs and their high dividend yields are also cited as attractive investment points in the volatile market ahead of the US presidential election. However, securities firms advise that since concerns about an economic recession still linger in the market, it is necessary to understand the characteristics of individual investment properties.

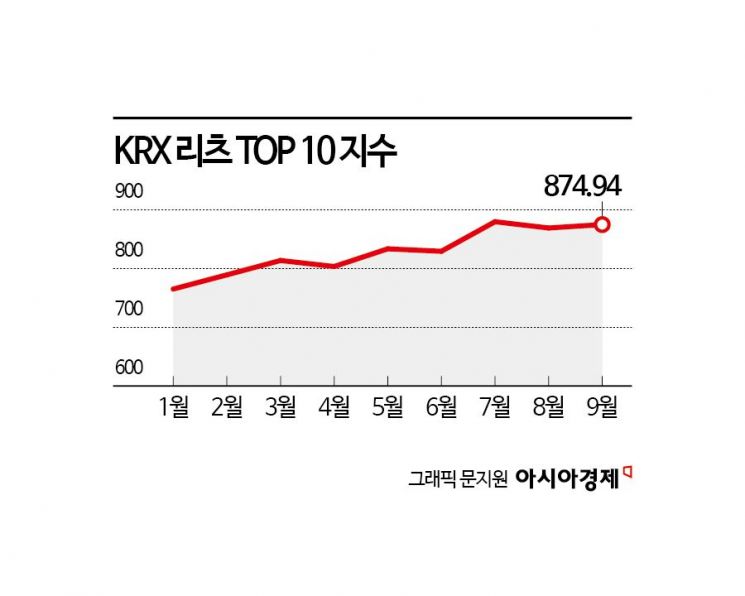

According to the Korea Exchange on the 23rd, the KRX REITs TOP10 Index recorded 874.94 based on the previous trading day's closing price, rising 6.75% over the past three months. This performance significantly outpaces the KOSPI (-7.31%) during the same period. Among individual stocks, Aegis Value REIT, SK REIT, and ESR Kendall Square REIT have reached 52-week highs since the beginning of this month.

The strength of REITs has become more prominent recently as the US Federal Reserve (Fed) has implemented a 'big cut' (a 0.5 percentage point reduction in the base interest rate). Currently, seven listed REITs, including Shinhan Alpha REIT, Aegis Residence REIT, and Hanwha REIT, are pursuing paid-in capital increases totaling over 1 trillion won. Interest rate cuts can act as a long-term positive factor by reducing costs through refinancing or enabling external growth.

Researcher Park Sera of Shin Young Securities said, "Recently, domestic listed REITs have been actively expanding their scale through asset acquisitions," adding, "Attention should be paid to the benefits of lower financing costs due to interest rate cuts and the relative attractiveness of stable rental income."

Researcher Lee Kyungja of Samsung Securities also noted, "Last month, Lotte REIT succeeded in lowering the interest rate on secured bonds for Lotte Department Store Gangnam to 3.4%. This is a drastic reduction in financing costs," and predicted, "For large REITs with high credit ratings, the effects of interest rate cuts will appear faster and more significantly."

The defensive nature of REITs as a response to market volatility is also highlighted as an investment point. Researcher Kang Jinhyuk of Shinhan Investment Corp. explained, "Top market capitalization REIT stocks enjoyed profits during this year's stock market upswing and showed excellent price defense during downturns," adding, "With uncertainties such as the US presidential election remaining, it is effective to maintain interest in REITs for the time being."

However, there is an analysis that yield disparities within REITs may widen now that full-scale interest rate cuts have begun. A securities firm official said, "In fact, the best time to invest in REITs is during the interest rate freeze period when concerns about rising financing costs are resolved and expectations for future rate cuts peak, that is, at the end of the tightening cycle," advising, "Considering that concerns about an economic recession remain as we enter the interest rate cut phase, it is advisable to narrow investment choices to properties with low economic sensitivity and steady demand or stocks with stable dividends."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.