DL Chemical, DL Construction, Lotte Chemical, Lotte Construction, etc.

Utilize Promissory Notes and Corporate Purchase-Only Cards for Short-Term Fundraising

Delay Payment of Purchase Amounts to Alleviate Working Capital Burden

Petrochemical and construction companies are securing short-term liquidity by utilizing accounts receivable as funding becomes difficult due to deteriorating performance and insolvency. Recently, DL Chemical, DL Construction, Lotte Chemical, and Lotte Construction have eased their working capital burdens by leveraging accounts receivable.

According to the investment banking (IB) industry on the 20th, DL Chemical raised 53 billion KRW through promissory note securitization. They issued a one-month promissory note by postponing the payment of raw material purchase costs (accounts payable) to Yeochun NCC. An SPC received the promissory note on behalf of Yeochun NCC and issued short-term asset-backed securities using it as the underlying asset (a type of collateral). The SPC used the funds from issuing the asset-backed securities to pay Yeochun NCC for the purchased goods. When DL Chemical repays the promissory note to the SPC, the investors in the asset-backed securities share the payment. This securitization was underwritten by Woori Investment & Securities.

Through accounts receivable securitization, DL Chemical was able to postpone the payment of purchase costs until the promissory note maturity. Yeochun NCC receives payment directly from the SPC without delaying the payment for supplied goods, reducing its working capital burden. Investors in the asset-backed securities effectively invest in the one-month promissory note issued by DL Chemical. A representative from the underwriter explained, "This securitization method was used not because DL Chemical lacked liquidity, but to adjust the timing of accounts payable settlement."

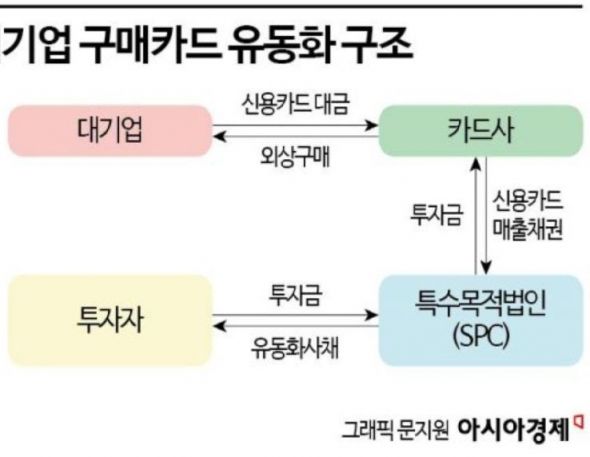

Securitization of accounts receivable using corporate purchase cards is also being actively implemented. Corporate purchase cards are used by companies to pay for goods within an agreed credit limit with credit card companies. The credit card companies issue asset-backed securities using the receivables from the companies as the underlying assets to secure funds. Recently, Hyundai Engineering, DL Construction, Hanwha Impact, Lotte Chemical, and Lotte Construction have secured liquidity through this method.

Hyundai Engineering issued purchase card-backed securities worth 150 billion KRW with Korea Investment & Securities as the lead underwriter. This method involves issuing asset-backed securities based on the credit card agreement with Hyundai Card. DL Construction raised 23 billion KRW underwritten by Bookook Securities, Hanwha Impact raised 12.2 billion KRW underwritten by KB Securities, and Hansol Paper raised 17 billion KRW underwritten by DB Financial Investment using the same method. Lotte Chemical is also reported to have recently raised around 100 billion KRW through purchase cards.

In June, Lotte Construction extended the maturity of asset-backed securities issued with a three-month maturity using purchase cards by an additional three months. They had secured 100 billion KRW in liquidity in June underwritten by Bookook Securities. After signing a card agreement with Hyundai Card, Hyundai Card issued asset-backed securities using the card payment receivables that Lotte Construction will repay as the underlying assets.

An IB industry official explained, "Corporate purchase card securitization is usually used by companies to postpone payment and alleviate short-term liquidity burdens," adding, "While it is effective for securing short-term funds, many cases involve continuously extending the maturity upon card payment due dates." The official also noted, "Recently, companies mainly in the petrochemical and construction sectors have been using this as a liquidity securing measure due to worsening performance and financial conditions making long-term funding difficult."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.