Ministry of Economy and Finance Releases '2023 Public Enterprise Management Performance Evaluation Report'

LH Received Overall Grade C

But Financial Ratings, Crucial for Project Execution, All D Grades

Worsened Compared to Last Year

Examining the Korea Land and Housing Corporation (LH)'s management performance evaluation for last year reveals that it received a D grade (inadequate) in the financial sector. The rating dropped further compared to previous years amid worsening performance and financial soundness. Additionally, signs of budget waste were detected. Last year marked the period when LH President Lee Han-jun officially began management activities after taking office in November 2022. In the comprehensive evaluation of public enterprise management performance, including the financial sector, LH barely escaped the D (inadequate) grade after four years, achieving a C grade.

According to the ‘2023 Public Enterprise Management Performance Evaluation Report’ released by the Ministry of Economy and Finance on the 20th, LH received a D+ grade in all areas of financial budget management, financial management planning, and fiscal soundness planning. This report breaks down the public enterprise management performance evaluation, which was disclosed in June, into detailed categories. Notably, LH’s financial sector evaluation worsened from a B grade in 2022 to a D+ grade last year.

Sales, Operating Profit, and Profitability All Plummeted

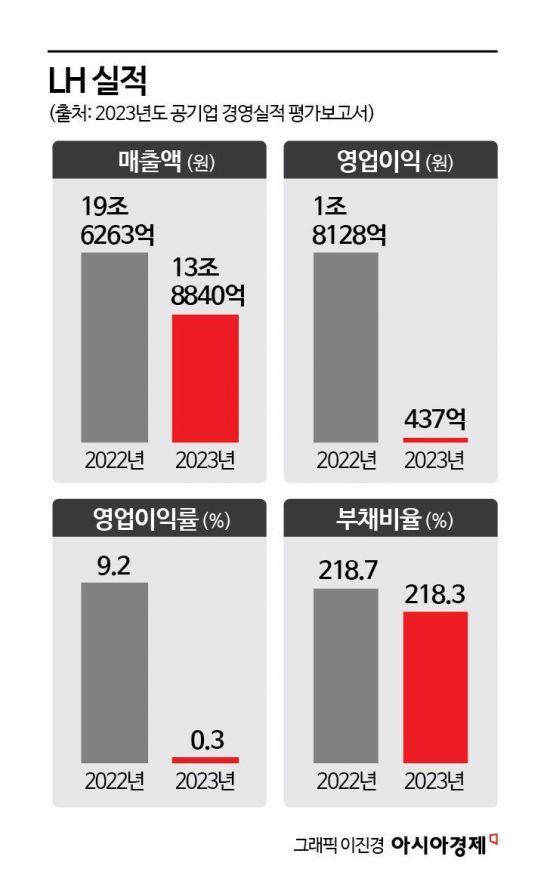

The primary reason cited for LH’s D grade is the simultaneous deterioration of its management performance last year. The report stated, "Sales, operating profit, and profitability have been continuously declining sharply, and although the debt ratio slightly decreased, it remains at a high level," adding, "This situation is expected to persist for the time being."

LH’s sales dropped significantly from KRW 19.6263 trillion in 2022 to KRW 13.884 trillion last year. Operating profit also plunged from KRW 1.8128 trillion in 2022 to KRW 43.7 billion last year. Particularly, the operating profit margin fell from 9.2% in 2022 to 0.3% last year, failing to exceed 1%. The debt ratio last year (218.3%) slightly decreased compared to the previous year (218.7%) but remained at a risky level. The report emphasized, "Since LH’s estimated debt ratio for 2027 is 208.2%, measures to maintain financial soundness must be sought."

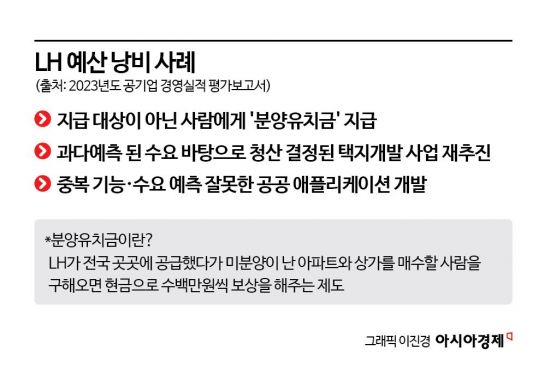

Instances of budget waste by LH were also confirmed. The report stated, "LH received a caution from the Board of Audit and Inspection for ‘relaunching land development projects that had been liquidated based on overestimated demand’ and ‘paying pre-sale inducement fees to ineligible recipients in violation of agreements.’" The pre-sale inducement fee is a system where LH compensates people with several million won in cash if they find buyers for unsold apartments and commercial spaces supplied nationwide. The Board of Audit and Inspection pointed out that LH misused this system, causing budget waste issues.

Public applications (apps) created by LH, such as LH Chungyak Plus, LH Smart Home, and My Home, were also identified as major culprits of budget waste. The report criticized, "Many applications have low utilization compared to the budget invested, failing to fulfill their original purpose and violating the principle of efficient budget execution," and urged, "The accuracy of demand surveys should be improved, and redundant app development should be avoided."

Asset Sales Delayed... Large Errors in Performance Forecasts

Asset sales, such as office buildings and company housing, fell far short of targets, resulting in a D+ grade for the fiscal soundness plan. Initially, LH set the asset sales target at KRW 5.1 billion last year. Later, it raised the target to KRW 245 billion by adding sales amounts from regional heating and cooling businesses, including the Daejeon Southwest Combined Heat and Power Plant and the Asan Baebang Tangjeong Complex Thermal Power Plant.

Regarding this, the report stated, "Subsequent failures in selling district energy facilities and the impossibility of recovering equity stakes resulted in sales performance amounting to only KRW 3 billion," emphasizing, "The effectiveness of the fiscal soundness plan must be enhanced."

LH also failed to accurately forecast its own performance, receiving a D+ grade for its mid- to long-term financial management plan. LH initially set a net profit target of KRW 2.2566 trillion last year but drastically lowered it to KRW 103.9 billion after reflecting the construction market downturn and other sales declines. However, the actual net profit achieved was KRW 515.8 billion. The report questioned the reliability of LH’s management plans.

The report noted, "LH’s sales volatility is high due to the time lag between selling inventory assets and recognizing them as sales. However, despite the net profit revision occurring within the same year, the discrepancy was significant," stressing, "The reliability of financial management plans needs to be improved."

As LH’s performance hit bottom, productivity also declined. Labor productivity, measured by value added per employee, fell 15% compared to the previous year. The report explained, "Although LH reduced its workforce by 475 employees, the real estate market downturn caused delays in land payment collections and a decrease in rental housing pre-sale conversions, leading to a decline in operating profit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.