Ando-geol, Democratic Party Lawmaker

Total Tax Revenue from 2200 Trillion to 1916 Trillion Won over 5 Years of Rule

Points to Tax Cuts and Entrenched Low Growth as Causes

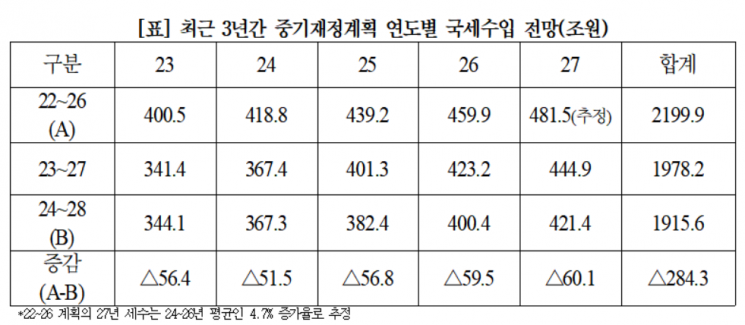

Analysis shows that a tax revenue base worth 57 trillion won annually has disappeared over the three years of the Yoon Suk-yeol administration. While the administration initially expected tax revenues of 2,200 trillion won over its five-year term, the forecast for the third year is only 1,916 trillion won.

According to the analysis of the "2024-28 National Fiscal Management Plan" released by Ahn Do-geol, a member of the Democratic Party of Korea, on the 19th, the tax revenue evaporating over the current administration’s five years amounts to 284 trillion won. Regarding the causes, indiscriminate tax cuts and the entrenchment of low growth have weakened the tax base, undermining the country’s fiscal foundation. Ahn pointed out these changes in tax revenue forecasts based on the last three years of the National Fiscal Management Plans submitted by the Ministry of Economy and Finance to the National Assembly.

Earlier, the Yoon Suk-yeol administration formulated the 2023 budget and the medium-term fiscal plan for 2022-26 immediately after taking office. At that time, the government expected tax revenue growth to be slightly higher than the nominal growth rate after 2024, projecting an average annual increase of 7.6% over the five-year term. Accordingly, the total tax revenue for the administration’s five years was estimated at 2,200 trillion won.

The government’s forecast proved overly optimistic. Last year, a record tax revenue shortfall of 5.64 trillion won occurred, forcing a major revision of the forecast within a year. Consequently, the 2023-27 medium-term plan announced last year stated that "from 2024 onward, the flow of national tax revenue will improve with economic recovery," expecting an average annual growth rate of 6.6% from 2024 to 2027. The five-year tax revenue forecast was reduced to 1,978 trillion won, 22.2 trillion won less than the previous estimate.

The situation worsened further. This year, with an expected tax revenue shortfall of around 2 trillion won, the forecast was further downgraded. According to the 2024-28 medium-term plan announced alongside this year’s budget, tax revenue is expected to "recover normally from next year and increase steadily at an average annual rate of 4.9%." Accordingly, the tax revenue forecast in this year’s medium-term plan is estimated at 1,916 trillion won over the Yoon administration’s five-year term, a further downward revision of 6.3 trillion won compared to last year’s forecast.

According to the government’s estimates, it is projected that tax revenue will return to the 400.4 trillion won level recorded in the last year of the previous administration, 2022, by 2026. Ahn said, "While the economy is growing, tax revenue has stagnated for four years," adding, "Normally, tax revenue should increase at least in line with the nominal growth rate, which is the normal fiscal and economic situation. However, under the current administration, while the real economy is expected to grow by nearly 20%, tax revenue is projected to stagnate for four years."

Regarding the causes of the decline in tax revenue, Ahn argued that the tax base has become seriously vulnerable due to a parade of large-scale tax cuts for the wealthy that have been continuously expanded over the past three years. He stated that tax law revisions under the current administration have reduced tax revenue by a simple total of 80 trillion won.

Ahn said, "The government has promoted tax cut policies claiming a virtuous cycle of growth and tax revenue, but in reality, low growth and tax revenue shortfalls have become entrenched."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.