LS Securities forecasted on the 19th that the upcoming additional interest rate cuts by the U.S. within this year will be implemented consecutively as baby cuts.

Woo Hye-young, a researcher at LS Securities, stated, "If there is no sharp increase in the unemployment rate, the basic scenario is to present consecutive cuts in baby steps."

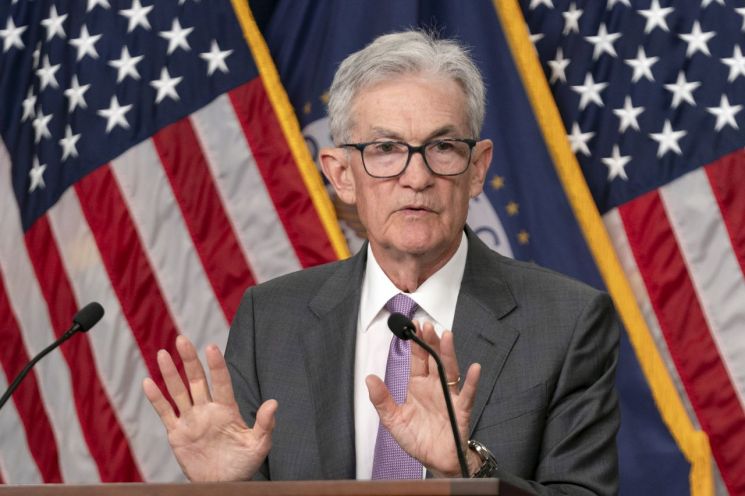

In the early hours of the day, the Federal Open Market Committee (FOMC) meeting in September lowered the policy rate by 50 basis points to 4.75%?5.00%. Notable points in the statement were ① the deletion of the existing forward guidance following the rate cut decision, and ② a downward revision of employment assessments with a stronger emphasis on employment goals compared to July.

Researcher Woo explained, "The federal funds rate outlook was lowered from 5.1% to 4.4% in 2024, from 4.1% to 3.4% in 2025, and from 3.1% to 2.9% in 2026," adding, "Except for this big cut, the remaining meetings suggest an additional 50 basis points cut."

Woo said, "If it is a big step cut, one more cut is expected; if it is a baby step cut, two additional cuts are anticipated," and diagnosed, "Since the inflation outlook has been lowered, the key factor determining the magnitude and speed of future additional cuts is ultimately the pace of the unemployment rate increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)