Appreciation Expressed for National Tax Service's Automatic Application of Earned Income Tax Credit

At the end of last month, a couple sent a 'thank you letter' to Kang Minsu, the Commissioner of the National Tax Service. Living on about 300,000 won per month in welfare benefits with his wife, they repeatedly expressed their gratitude, saying they recently received the Earned Income Tax Credit thanks to the National Tax Service's 'automatic application' system.

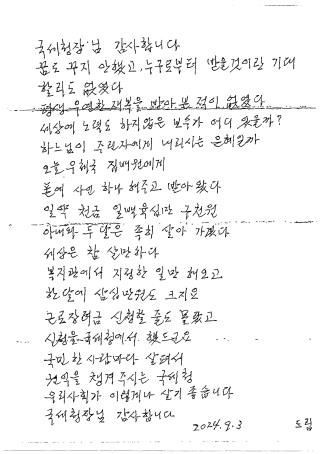

'Yonhap News' on the 15th revealed the contents of the handwritten letter recently sent to Commissioner Kang. The letter writer, Mr. A, said, "I never even dreamed of it, nor did I expect to receive anything from anyone. I have never experienced any unexpected fortune in my life," and began with, "Commissioner of the National Tax Service, thank you."

He described the Earned Income Tax Credit as a "windfall," saying, "1,609,000 won, enough for my wife and me to live for at least two months." He added, "The world is truly livable. I didn't even know how to apply for the credit, but the National Tax Service applied on my behalf."

He continued, "The National Tax Service looks after each citizen and protects their rights," bowing deeply again, saying, "Our society is so good to live in." According to the National Tax Service, the number of automatic applicants for the Earned Income Tax Credit in September (based on semi-annual applications) was 450,000, more than four times the previous year's 110,000.

The automatic application system requires the applicant's consent only once, after which applications are completed without any further procedures from the following year. It targets seniors aged 60 and over and persons with severe disabilities who meet income and asset criteria but may have difficulty applying due to physical limitations or old age. The system was introduced last year to minimize cases where eligible individuals fail to apply.

This year, among the total 748,000 automatic application consents (regular and semi-annual applications), 685,000 were seniors aged 65 and over, and 63,000 were persons with severe disabilities.

Meanwhile, applications for the Earned Income Tax Credit for earned income in the first half of the year are accepted until the 19th of this month. Applications for last year's annual income credit can be submitted as 'late applications' until December 2nd.

The Earned Income Tax Credit can be applied for if the couple's combined income last year was less than 22 million won for single-person households, less than 32 million won for single-earner households, and less than 38 million won for dual-earner households. The total assets of all household members must be less than 240 million won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.