As of the end of March, accounting for 7.27% of total investment

Increase in defaults has slowed but the upward trend continues

FSS warns "Concerns over expanding risk of investment asset deterioration"

It has been revealed that there has been a default in overseas real estate worth 2.5 trillion KRW invested by financial companies. Financial authorities plan to continuously encourage the enhancement of loss absorption capacity as the scale of defaults has been steadily decreasing since the third quarter of last year, but the upward trend continues.

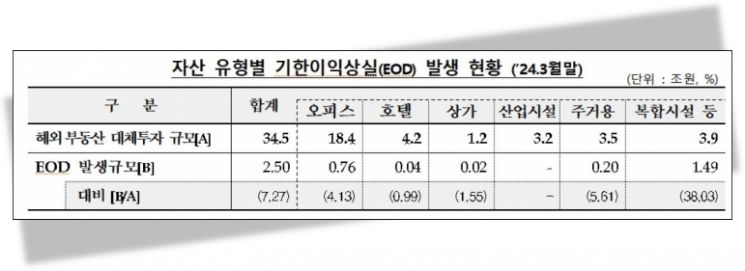

According to the Financial Supervisory Service on the 19th, as of the end of March, among overseas real estate investments worth 34.5 trillion KRW by financial companies, 2.5 trillion KRW experienced events of default (EOD). This corresponds to 7.27% of the total invested real estate.

The increase in defaults amounted to 90 billion KRW. Default assets increased by 980 billion KRW in the third quarter of last year and by 100 billion KRW in the fourth quarter. By asset type, the scale of EOD occurrences in mixed-use facilities and others accounted for 38.03% of the total (3.9 trillion KRW), reaching 1.49 trillion KRW. This was followed by residential at 5.61% and office at 4.13%.

The balance of alternative investments in overseas real estate by the financial sector was 57 trillion KRW as of the end of March, down 600 billion KRW from the previous quarter. This is about 0.8% of the total financial sector assets (6,985.5 trillion KRW). By sector, insurance held 31.3 trillion KRW (55.0%), banks 12 trillion KRW (21.0%), and securities 7.8 trillion KRW (13.8%), with mutual finance, credit finance, and savings banks following.

By region, North America accounted for the largest share at 36.1 trillion KRW (63.4%), followed by Europe at 10.2 trillion KRW (17.8%), Asia at 3.9 trillion KRW (6.9%), and other and multiple regions at 6.7 trillion KRW (11.8%). By maturity, investment assets worth 6.8 trillion KRW will mature by the end of this year, and assets worth 18.2 trillion KRW and 13.7 trillion KRW will mature by the end of 2026 and 2028, respectively.

Park Gwi-wook, a team leader at the Financial Supervisory Service, stated, "Due to the continued high interest rates and delayed improvement in overseas real estate markets such as the US and Europe, the amount of alternative investments in overseas real estate decreased compared to the previous quarter," but added, "Uncertainty in the office market remains high due to factors such as remote work, raising concerns about the possibility of increased EOD occurrences and deterioration of investment assets."

Accordingly, the Financial Supervisory Service plans to continuously monitor the handling status of sites with unusual trends to induce appropriate loss recognition and enhance loss absorption capacity of financial companies. Team leader Park said, "We will promote inspection and improvement of overall work processes to ensure thorough risk management, internal control, and sound investment practices by financial companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)