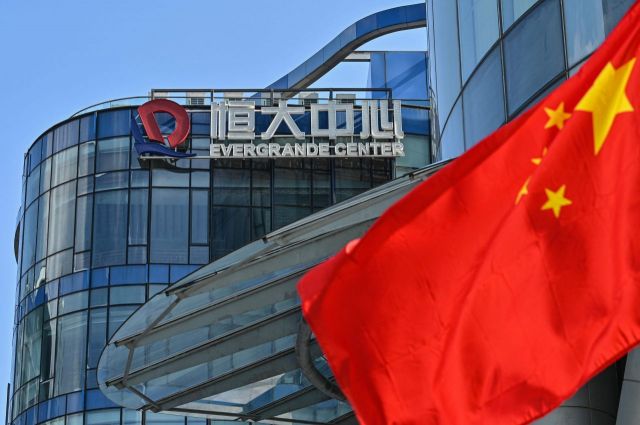

China Securities Regulatory Commission: "Hengda Fraud Concealment, Aided by Complicity"

China has imposed a six-month business suspension and a fine exceeding 80 billion won on the mainland China office of PricewaterhouseCoopers (PwC), the global accounting and consulting firm that audited Evergrande, a domestic real estate developer that went bankrupt in 2021.

According to Bloomberg and other sources, on the 13th, China's Ministry of Finance announced in a statement that it ordered a six-month business suspension for PwC's China entity, 'PwC Zhongtian LLP,' and imposed a fine of 116 million yuan (approximately 21.7 billion won). The Chinese financial regulatory authorities also stated in a separate announcement that they confiscated 27.7 million yuan (about 5.2 billion won) of PwC Zhongtian's Evergrande-related revenue and imposed a fine of 297 million yuan (about 55.6 billion won). Bloomberg reported, "Combining the fines and confiscated funds amounts to 441 million yuan (about 82.5 billion won)," adding that "China has imposed a record fine on PwC."

The China Securities Regulatory Commission (CSRC) pointed out that PwC Zhongtian helped conceal and even tacitly approved Evergrande's fraud while auditing the company's annual performance in 2019 and 2020. It stated, "PwC seriously undermined the law and good faith and damaged the interests of investors." Additionally, it announced the revocation of the license of PwC Zhongtian's Guangzhou branch, which audited Evergrande's inflated financial reports from 2018 to 2020.

Chinese authorities have been investigating PwC's role in Evergrande's accounting practices following the Securities Regulatory Commission's imposition of a fine worth about 700 billion won on Evergrande for fraud allegations in March. At that time, the Securities Regulatory Commission fined Evergrande 4.175 billion yuan (approximately 780 billion won) for false statements in its 2019 and 2020 annual reports.

PwC, one of the world's Big Four accounting firms, was responsible for auditing Evergrande not only at the time of its 2009 listing but also during the real estate boom when Evergrande expanded its business using leverage. However, PwC explained that it ceased auditing in January last year and did not receive important information related to Evergrande's consolidated financial statements for the 2021 fiscal year.

Evergrande defaulted in December 2021 after failing to repay offshore debt, and the Hong Kong court ordered liquidation of Evergrande, a symbol of China's real estate crisis, in January. Evergrande's debt is estimated to exceed 300 billion dollars (about 399 trillion won), making it the largest among global real estate developers.

PwC is also under investigation by Hong Kong authorities separately from mainland China.

Bloomberg reported, "Since Chinese authorities launched investigations, more than 30 listed Chinese real estate developers have severed ties with PwC since March," adding, "These companies paid PwC over 800 million yuan (approximately 149.7 billion won) in audit fees last year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)