Hyundai Motor and GM Join Hands for Comprehensive Cooperation

Electrification and Software Boost Competitiveness in Korea, China, and Japan

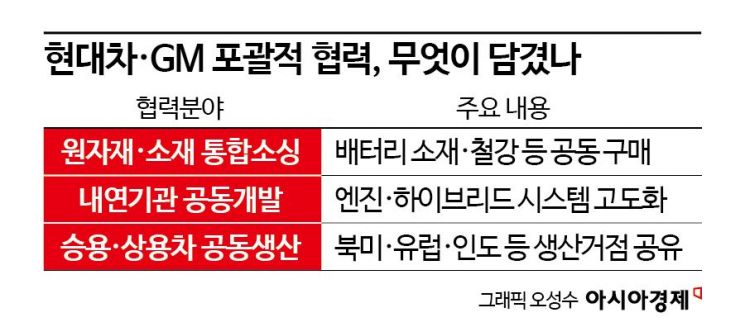

Hyundai Motor Company and General Motors (GM) have pledged comprehensive cooperation to jointly develop and produce electric and hydrogen technologies. In particular, the hydrogen sector is still in its early stages with a small market, requiring collaboration among major companies. It is difficult to create a new market with the capabilities of just one or two companies alone.

When it comes to hydrogen technology-based mobility, Hyundai Motor and Toyota are considered the leaders. Hyundai was the first in the world to mass-produce hydrogen fuel cell system-applied vehicles such as the large truck Xcient, the sports utility vehicle (SUV) Tucson, and the Nexo. Toyota first introduced the hydrogen fuel cell vehicle Mirai in 2014. The current model on sale is the second generation.

A Hyundai hydrogen fuel cell vehicle Tucson FCEV is refueling at a hydrogen charging station in California, USA.

A Hyundai hydrogen fuel cell vehicle Tucson FCEV is refueling at a hydrogen charging station in California, USA. [Photo by Yonhap News, Reuters]

Hydrogen fuel cells, which store energy generated from hydrogen chemical reactions and use it as driving power, have also been developed by other automakers in the past. GM, for example, introduced the Electro Van, a multipurpose vehicle using hydrogen fuel cells, in 1966. In the 2000s, they released SUV and pickup truck models such as the Chevrolet Equinox (2007) and Chevrolet Colorado (ZH2).

However, there is a significant difference between small-scale pilot production or prototypes and establishing a mass production system aimed at commercial sales. Not only are Hyundai and Toyota joining hands, but it seems that another alliance is forming around these two companies. Recently, Toyota and BMW agreed to jointly develop hydrogen fuel cell vehicles targeting 2028.

Hyundai is also reportedly discussing fuel cell system cooperation plans with various other automakers besides GM. Some domestic car manufacturers have indirectly or directly expressed their willingness to collaborate with Hyundai on fuel cell systems. Operating a factory and research facilities in Guangzhou, China, under a branded fuel cell system is also a move that considers supplying the directly developed fuel cell systems to other automakers.

An industry insider said, "For products applying new technologies to establish themselves, the market must be rapidly expanded to achieve economies of scale, but hydrogen vehicles are just taking their first steps. Joint development and production could lower costs and bring the availability date forward."

In the electrification sector centered on battery electric vehicles, manufacturers from Asia, including China, South Korea, and Japan, are generally regarded as leading. Batteries are considered a key component that determines vehicle performance, and Chinese companies have a solid supply chain from raw material procurement to final products.

Major companies such as Ningde Times (CATL) and BYD have secured raw material supply chains by acquiring stakes in overseas mines or establishing joint ventures. Additionally, the Chinese government has early on promoted electric vehicle adoption, increasing battery demand. Relatively lenient environmental regulations have also allowed steady accumulation of smelting and processing technologies.

Lithium-ion batteries, widely used in electric vehicles and energy storage systems (ESS), were originally a market created and grown by Japanese companies. While small batteries used in home appliances and portable electronics were initially dominant, larger batteries are now more commonly used in automobiles. Tesla, which contributed to growing the electric vehicle market, also refined battery technology together with Panasonic.

CATL exhibition hall set up at Automechanika, a parts exhibition held in Frankfurt, Germany. Vehicle batteries are on display.

CATL exhibition hall set up at Automechanika, a parts exhibition held in Frankfurt, Germany. Vehicle batteries are on display. [Photo by Yonhap News, Xinhua News Agency]

In South Korea, battery cell companies such as LG Energy Solution, Samsung SDI, and SK On are established players. Hyundai has cooperated with these battery companies since producing hybrid vehicles and pilot electric vehicles in the past. The three Korean battery companies have contracts with most global automakers and supply products. According to data from market research firm SNE Research, the top 10 companies by electric vehicle battery usage share over 90%, all of which are Korean, Chinese, or Japanese companies.

If Europe was the first to create internal combustion engine vehicles, the United States led mass production and popularization in the 20th century. As the automotive industry's competitiveness is now measured by electronics, electrification, and software technologies, the balance of power appears to be shifting toward Asian automakers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.