Plan to Raise 22.9 Billion KRW Through Rights Offering

Continued Deficit Due to Poor Performance in Existing Business Units

Funds Raised to Be Invested in Secondary Battery Equipment

HiSonic has embarked on a large-scale fundraising effort to advance its secondary battery business. Losses have continued due to sluggish performance in its existing core businesses of camera module parts production and corporate purchasing agency (MRO). In a situation where profitability must be improved through new business ventures, the company has no choice but to put all its efforts into securing funds.

According to the Financial Supervisory Service's electronic disclosure system on the 13th, HiSonic will issue 9.4 million new shares by allocating 0.597 new shares for every one existing share. The planned issue price is 2,440 KRW per share, raising a total of 22.9 billion KRW.

HiSonic will recruit investors through a general public offering for any unsubscribed shares following the subscription by existing shareholders. If the target funds are not raised even after the general public offering, SangSangin Securities and SK Securities will underwrite the remaining shares. The underwriting fee is 20% of the balance underwritten. Because the fee rate is relatively high, the capital increase must be completed during the general public offering stage.

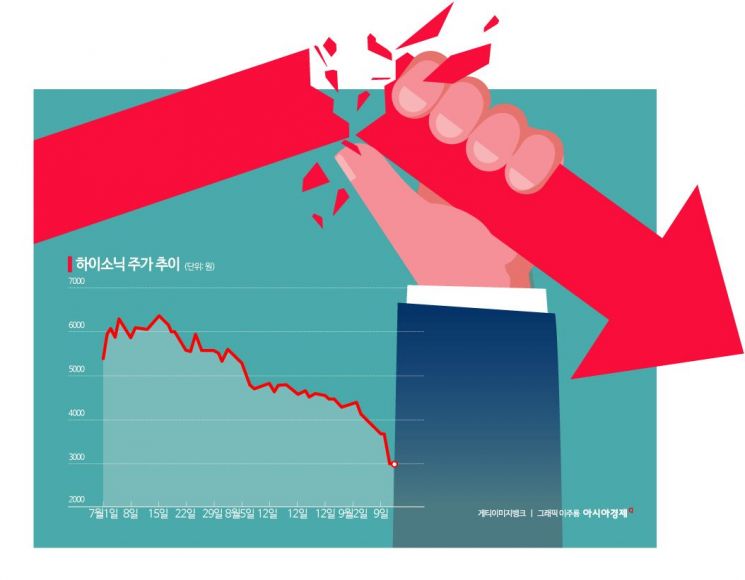

The issue price will be finalized on December 2, and the higher the current stock price compared to the issue price, the greater the likelihood of success. The gap between the current stock price and the planned issue price is 22%. Since the stock price has been declining after reaching the year's high on January 2, there is a possibility that the fundraising scale will decrease. After the board of directors resolved the capital increase, the stock price plunged and hit the year's lowest. The continued losses appear to have affected the stock price as well. The company recorded a net loss of 11.3 billion KRW last year, and the net loss narrowed to 1 billion KRW in the first half of this year.

HiSonic plans to inform investors that a rights offering is inevitable to ensure the success of the paid-in capital increase. A company official explained, "The fundraising is for investment in production facilities necessary for the secondary battery parts business, which is both a new growth engine and a core business," adding, "Once the production infrastructure is established, the expansion of the secondary battery business will gain momentum."

Out of the funds raised through the capital increase, 17.5 billion KRW will be used for investment related to secondary battery production facilities. The company aims to establish secondary battery parts production facilities in Tennessee, USA. HiSonic established an electric vehicle (EV) cell business division in July last year. It supplied samples to secondary battery manufacturer Company A and expected to sign a main contract by the end of this year.

Full-scale sales are expected to begin in July next year. The company passed Company A's quality inspection in April and signed a memorandum of understanding (MOU) in June. It is expected to supply parts for prismatic energy storage systems (ESS) used in secondary batteries. HiSonic explained that considering the supply schedule for the project won by Company A, the possibility of not signing the main contract is low. If the contract fails, Company A will have to endure schedule delays.

HiSonic's largest shareholder is HS Holdings, holding a 26.53% stake. It will acquire 30% of the 2.49 million shares allocated in the paid-in capital increase. The company plans to secure funds for the new shares acquisition through the sale of subscription rights certificates and borrowing from the parent company.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.