Orders from the Middle East including Saudi Arabia increased, but US orders sharply declined

Major projects such as NEOM and Ukraine reconstruction face difficulties

From the beginning of this year until August, the cumulative overseas construction orders secured by domestic construction companies fell below 20 billion dollars. Achieving the government's annual target of 40 billion dollars, as well as maintaining the 30 billion dollar order volume secured for four consecutive years, has become challenging. Last year, there was a special boom in local factory establishment by Korean companies due to the U.S. Inflation Reduction Act (IRA), but even that has ceased, and various factors such as changes in overseas clients' decisions are exacerbating difficulties in securing orders.

According to the Overseas Construction Association on the 12th, the cumulative overseas construction orders from January to August this year amounted to 17.95673 billion dollars, which is only 81.9% compared to the same period last year (21.93243 billion dollars). Compared to the same period in previous years, this is the smallest scale since 2021, when about 16.2 billion dollars were secured.

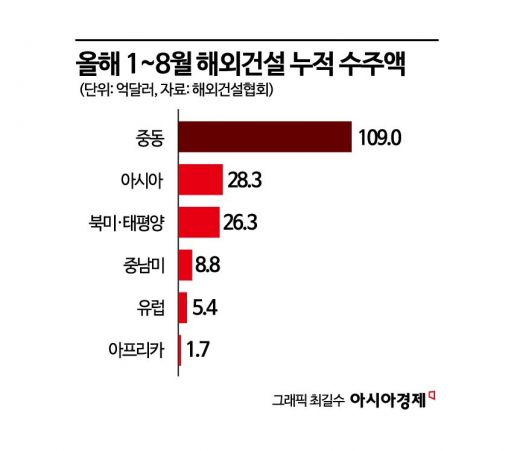

By region, the Middle East accounted for the largest share with cumulative orders of 10.89747 billion dollars (60.7%). Asia followed with 2.83472 billion dollars (15.8%), North America and the Pacific with 2.62805 billion dollars (14.6%), Latin America with 882.94 million dollars (4.9%), Europe with 543.65 million dollars (3.1%), and Africa with 169.95 million dollars (0.9%).

The cumulative orders in the Middle East increased by more than 3 billion dollars compared to last year, thanks to strong performances in Saudi Arabia (6.22626 billion dollars → 8.55173 billion dollars) and Qatar (41.34 million dollars → 1.25475 billion dollars). On the other hand, the North America and Pacific region saw a sharp decline from 7.34118 billion dollars to 2.62805 billion dollars during the same period. The cumulative orders in the U.S. were 2.58888 billion dollars, which is about one-third of last year's 7.14389 billion dollars, directly impacting this decrease.

Last year, in response to the U.S. IRA, major Korean conglomerates established electric vehicle and battery production lines locally. At that time, construction subsidiaries of each company took charge of the projects, which were counted as overseas construction orders. Samsung C&T secured the semiconductor plant of Samsung Electronics in Texas (4.7 billion dollars), and Hyundai Engineering won the L-JV project (1.2 billion dollars) and S-JV project (1.75 billion dollars) for the battery joint venture plants of Hyundai Motor Group in Georgia.

It is difficult to predict whether the 30 billion dollar order volume, maintained for four consecutive years since 2020, can be secured again. The government's annual order target for this year is 40 billion dollars. Overseas construction orders are sluggish, and there are cases of project failures. Recently, the Paraguayan government converted the 'Asuncion Light Rail Project,' worth over 500 million dollars, into an open tender. Initially, a private contract was being discussed with the Korea Overseas Infrastructure & Urban Development Corporation (KIND), but they changed their mind. Also, 'Team Korea,' consisting of Korea Hydro & Nuclear Power and others, was selected as the preferred negotiator for the construction of two new nuclear power plants in the Czech Republic, but actual orders are expected to be finalized only next year.

Most overseas construction projects, which were expected to secure orders worth trillions of won, are facing difficulties in progress. The Saudi NEOM project is seeing a reduction in the scale of 'The Line' (an eco-friendly residential and commercial city) due to financial issues. The Ukraine reconstruction project remains in its initial stages as the war with Russia has continued for over two and a half years.

The government has judged that "whether the order target will be achieved must be observed until the end of the year." Since the 10th, the Ministry of Land, Infrastructure and Transport has been hosting the '2024 Global Infrastructure Cooperation Conference (GICC),' inviting ministers, vice ministers, and CEOs from 50 institutions across 30 countries. Through special sessions focusing on construction finance, investment development projects (PPP), railroads, and Africa, they are exploring cooperation plans with various countries. Recently, they strengthened their efforts by appointing former First Vice Minister of Land, Transport and Maritime Affairs Han Man-hee as the head of the Overseas Construction Association. After the Chuseok holiday, President Yoon Seok-yeol will visit the Czech Republic with an economic delegation composed of heads of major groups to expand cooperation in the nuclear power sector.

A Ministry of Land, Infrastructure and Transport official said, "We are actively progressing with railroad projects in Tanzania and Panama, and based on new town projects underway in Vietnam by the Korea Land and Housing Corporation (LH), we are actively promoting PPP capabilities to pioneer markets. We also plan to actively pursue orders in the EPCF form, which adds finance to the existing Engineering, Procurement, and Construction (EPC) model."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.