Expected Shift from Limited to Active Government Intervention within 5 Years

Preferred Asset Classes Are Emerging Market Stocks and Bonds

Basic, Bearish, and Bullish Scenarios Presented Based on Inflation Outlook

There is a forecast that moderate but stable economic growth will continue, driven by advancements in artificial intelligence (AI).

According to the 5-year outlook report titled "2025-2029 Expected Returns: Atlas Lifted," recently released by Robeco Asset Management, the United States' per capita GDP is expected to grow at an average annual rate of 1.75%. Other developed countries, including those in Europe, are also expected to catch up with the U.S., enabling balanced global growth. However, the report added a caveat that the likelihood of this forecast being realized is 50%.

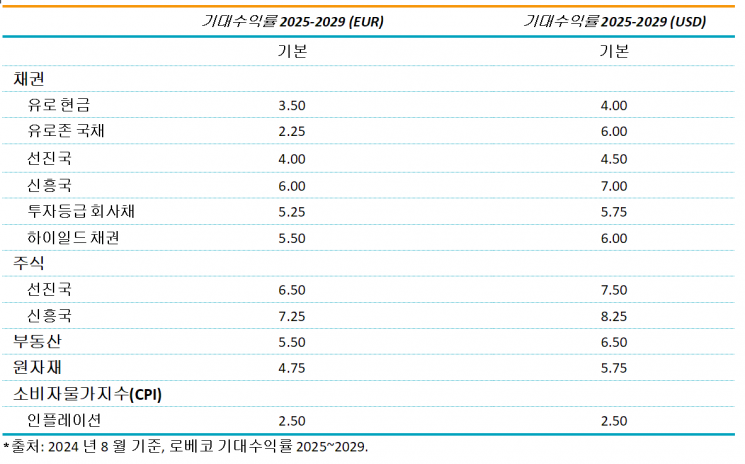

It predicted that capital allocation will become more efficient, increasing investment opportunities, and forecasted that inflation will average around 2.5%, alongside a prediction that central banks may underestimate the neutral interest rate. It reiterated that as capital allocation becomes more efficient, investment opportunities will increase, and inflation is expected to remain at an average of 2.5%.

The report also disclosed a bearish scenario with a 30% probability. It anticipated that high fiscal deficits in the U.S. and a restructuring of the global power structure will lead to persistent inflation and stagflation in the U.S. Inflation is expected to remain high continuously, threatening overall economic stability. It pointed out that while the fight against inflation may initially seem victorious, economic stability will face serious threats similar to periods in history when inflation was high.

The probability of a bullish scenario was analyzed at 20%. It expected rapid AI adoption to boost productivity, with an annual growth rate reaching 2.25%. Real GDP growth is projected to approach 3%, while inflation is predicted to remain around 2%. With improved geopolitical stability and capital deepening, central banks are expected to maintain neutral interest rates, creating a favorable investment environment.

Robeco explained that the 5-year report contains an in-depth analysis of current global economic trends along with forecasts on how government intervention, stakeholder capitalism, and innovation will reshape the global economic landscape.

Peter van der Welle, Robeco Multi-Asset Solutions Strategist, explained, "Our 5-year outlook assumes that capital owners are increasingly considering not only shareholder profits but also stakeholder well-being." He added, "The free market economy is less efficient than before and the era of extreme individualism is over. Today’s investors balance profitability with social impact."

Laurens Swinkels, Head of Quantitative Strategy for Sustainable Multi-Asset Solutions, emphasized, "In distorted markets with stronger government intervention, a research-driven approach is crucial to generate alpha. This report highlights the necessity of strategic investment in a changing investment environment."

The report also presented three scenarios for U.S. dollar-based investors. Under the base scenario, assuming a rise in risk-free rates, risk premiums are expected to decline across most asset classes. Emerging market equities are expected to deliver the highest returns, with an average annual return of 8.25%, developed market equities at 7.5%, and emerging market bonds at 7%.

In the credit sector, investment-grade corporate bonds are expected to yield 5.75% over the next five years. High-yield bonds are predicted to rise to 6%. Under the base scenario, real estate is expected to achieve an average annual return of 6.5%, and commodities 5.75%.

In the bearish scenario, inflation and instability are diagnosed to negatively impact high-risk investment returns. In the bullish scenario, AI-driven productivity improvements could enable emerging market bonds and commodities to achieve above-average returns.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)