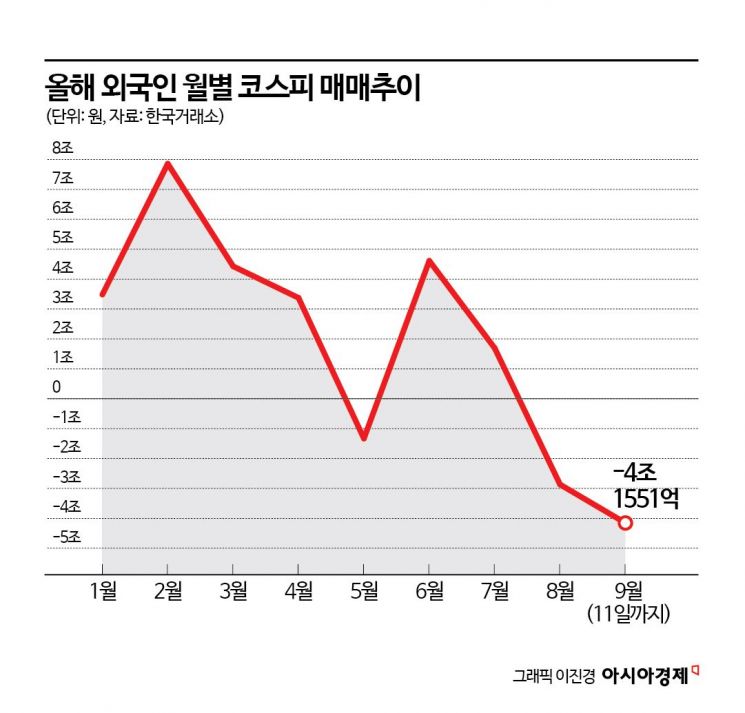

Foreigners Net Sold 4.1551 Trillion KRW on KOSPI This Month

Sell-off Continues for Two Consecutive Months Following Last Month

Foreign Selling Focused on Semiconductors... Samsung Electronics + SK Hynix Sold 4 Trillion KRW

Investor Sentiment Recovery Difficult Ahead of September FOMC and Other Events

Foreign selling pressure continues, leading to persistent sluggishness in the stock market. Foreign investors have already sold more than 4 trillion won in the KOSPI market this month, far surpassing last month's selling volume. With concerns about economic slowdown still unresolved and major events such as the U.S. Federal Open Market Committee (FOMC) meeting scheduled for next week, it is expected that foreign investors will not easily turn bullish.

According to the Korea Exchange on the 12th, foreign investors have net sold 4.1551 trillion won in the KOSPI market up to the previous day this month. This marks two consecutive months of selling pressure following last month. This is the first time this year that foreign investors have maintained a selling trend for two consecutive months. The selling volume this month has already exceeded the total selling volume for August, when foreign investors net sold 2.8682 trillion won.

The continued caution among foreign investors is interpreted as a risk-averse response to the U.S.-originated economic slowdown concerns that surfaced last month. Joon-ki Cho, a researcher at SK Securities, said, "The main selling entity in the domestic stock market this month has been foreign investors," adding, "From August through the 10th of this month, foreign investors have net sold 5.9 trillion won in KOSPI spot and 1.1 trillion won in futures, reflecting an environment where foreign demand for the domestic stock market, which moves in tandem with global risk appetite, is still difficult to return."

The supply-demand gap caused by foreign investors has led to weak stock prices. The KOSPI broke below the 2700 level at the end of last month and has since fallen below the 2600 level this month. On the 9th and the previous day, the index even fell below the 2500 level intraday, putting the 2500 level at risk. Dong-gil Noh, a researcher at Shinhan Investment Corp., said, "Foreign net selling has accumulated to 6 trillion won over the past 40 trading days, and this pace of foreign net selling is the fastest since early last year."

In particular, foreign selling has been concentrated in semiconductors. Foreign investors have net sold Samsung Electronics by 3.4659 trillion won this month, making it the most sold stock, followed by SK Hynix with a net sale of 626.8 billion won. The combined net selling volume of these two stocks exceeds 4 trillion won. As foreign selling pressure has concentrated, Samsung Electronics has fallen for seven consecutive days, dropping below 65,000 won. It hit a 52-week low of 64,200 won intraday on the previous day. Foreign investors have maintained selling pressure in the KOSPI market for seven consecutive days recently, during which both the KOSPI and Samsung Electronics showed weakness. The concentrated foreign selling of Samsung Electronics has led to its price decline, and the poor performance of the leading stock Samsung Electronics has become a cycle that drags down the KOSPI.

With the domestic stock market closed next week due to Chuseok and the September FOMC meeting scheduled, it seems difficult to expect immediate changes in foreign demand. Researcher Cho said, "The likelihood of money flowing back in increases only after the noise clears." Seok-hwan Kim, a researcher at Mirae Asset Securities, explained, "Foreign net buying in the domestic stock market remains weak," adding, "Considering that the fundamental investment sentiment toward the market situation is not optimistic, maintaining a conservative stance is advisable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)