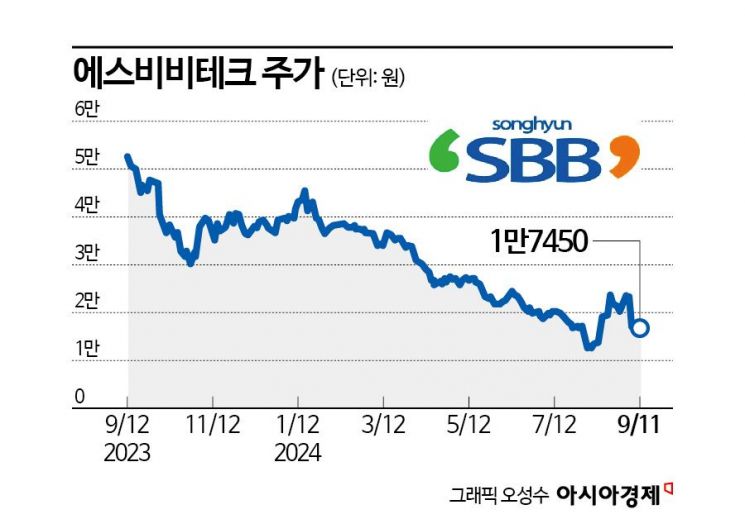

Stock Price Fell 67% in the Past Year

Poor Performance Compared to Initial Forecast at Listing

The stock price of SBV Tech, a developer of precision gear reducers, has been steadily declining over the past year. Despite continuing large-scale expansions in preparation for the advent of the robot era, the operating rate has fallen, resulting in ongoing losses.

According to the financial investment industry on the 12th, SBV Tech's stock price has dropped 67% over the past year. Considering that the KOSDAQ index fell 21% during the same period, the market-relative return is -46 percentage points (P).

SBV Tech is a company that develops precision gear reducers and robo bearings. It mainly supplies products to domestic defense contractors. A gear reducer is a mechanical device that reduces high-speed rotational input to the motor by a certain ratio, enabling torque increase and high-precision rotational control. Among various types of gear reducers, harmonic type gear reducers and cyclo type (RV) gear reducers are used in robots and precision machinery. Robo bearings are one of the essential components of vacuum robot drive units applied in semiconductor manufacturing processes.

Since listing on the KOSDAQ market in October 2022, SBV Tech has continued investing to expand production capacity. Funds raised through the initial public offering (IPO) and the third tranche of convertible bonds (CB) issued in May last year have been used as facility capital.

As of the end of last year, the production capacity of gear reducers was 50,000 units per year. The company aims to have facilities capable of producing 200,000 to 250,000 units annually by the end of next year. To respond to the increasing demand for robots, an additional new factory has been secured.

Separately from expansion investments, sales have been on a declining trend. Sales revenue decreased from 7.5 billion KRW in 2022 to 5.1 billion KRW in 2023. In the first half of this year, sales recorded 2.8 billion KRW, slightly increasing compared to the first half of last year. The operating rate of gear reducers in the first half was only 7.2%. As of the end of the first half, gear reducer sales amounted to just 1 billion KRW. The order backlog stands at 4.6 billion KRW.

When SBV Tech went public, the public offering price was calculated based on the assumption that net profit for this year would reach 7.1 billion KRW. According to the investment prospectus for listing, sales were estimated at 23.2 billion KRW in 2023 and 43 billion KRW in 2024. Operating profit of 9.8 billion KRW and net profit of 7.1 billion KRW were expected for this year.

The gap between the forecast and actual performance appears to have recently affected the stock price. Although large-scale expansion investments are underway, the pace of order growth has been slower than expected. However, sales are expected to increase along with the growth of the robot industry.

Related industries expect that demand for domestically produced precision gear reducers will also increase with the growth of the robot industry. Jeong Dong-ho, a researcher at Mirae Asset Securities, said, "Precision control is the key to enhancing technological competitiveness as robots become more advanced," adding, "The government has set a goal to increase the self-reliance rate of core intelligent robot component technologies to 80% by 2030."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)