Samba Hits 52-Week High at 1.01 Million Won

Samjeon Touches 52-Week Low at 66,000 Won

Pharmaceutical and Bio Stocks Rally, Semiconductor Stocks Show Weakness

The fortunes of Samsung Electronics and Samsung Biologics are diverging. While Samsung Biologics is thriving, hitting a 52-week high during the trading session, Samsung Electronics' stock price has fallen to a 52-week low, showing a contrasting trend. The differing fortunes of these two stocks reflect the market leadership flow, with pharmaceutical and bio stocks showing strength amid the recent market correction phase, while semiconductor stocks, which have given back most of their previous gains, are experiencing the largest adjustments.

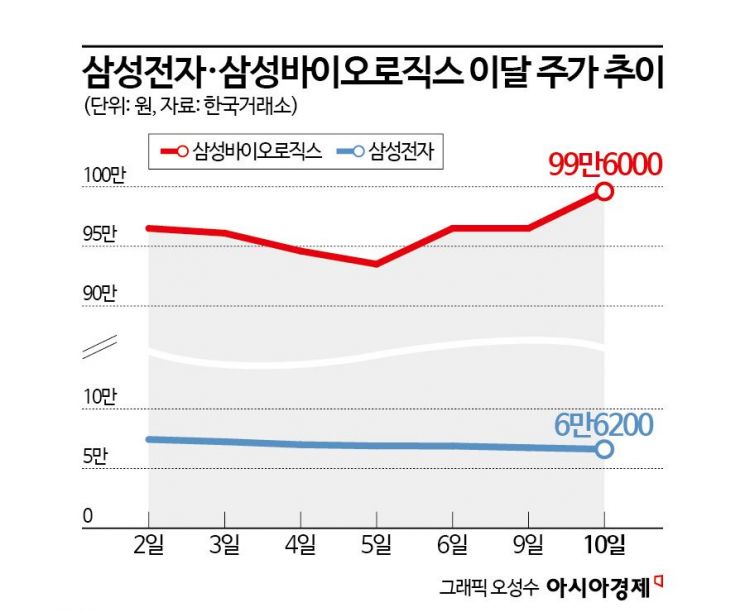

According to the Korea Exchange on the 11th, Samsung Biologics rose to 1.01 million won during the previous trading session, setting a new 52-week high. Samsung Biologics, which had signaled reclaiming its status as a blue-chip stock by surpassing 1 million won intraday at the end of last month, showed some weakness after touching the 1 million won mark but has recently resumed its upward trend, attempting to stabilize above the 1 million won level. The stock price, which had fallen to the 930,000 won range on the 5th, has climbed back up to around 990,000 won.

The strong performance of Samsung Biologics' stock price is interpreted as reflecting expectations of a positive spillover effect for domestic Contract Development and Manufacturing Organizations (CDMOs) like Samsung Biologics, following the U.S. House of Representatives' passage of the 'Biosecurity Act' aimed at curbing Chinese bio companies, as well as anticipated increases in the utilization rate of its 4th plant in the second half of the year and continued earnings growth.

On the 9th (local time), the U.S. House of Representatives passed the Biosecurity Act with 306 votes in favor and 81 against. The bill will become law once it passes the Senate and is signed by the President. Introduced earlier this year, the bill designates leading Chinese bio companies as entities of concern to U.S. national security and prohibits transactions between these companies and U.S. federal agencies. If enacted, Chinese companies named in the bill, such as Beijing Genomics Institute (BGI·Huada) and its subsidiary Huada Zizhao (MGI), as well as Wuxi AppTec, will be barred from doing business with U.S. administrative agencies or companies supported by the U.S. government. Additionally, Wuxi Biologics, considered one of the global 'Big 4' CDMOs, is also subject to sanctions, which is expected to benefit domestic CDMO companies classified as U.S. allies. Seogeunhee, a researcher at Samsung Securities, stated, "As the likelihood of the Biosecurity Act passing increases, distancing from CMO and CDMO companies like Wuxi Biologics and Wuxi AppTec will intensify. Companies currently contracted with Chinese firms will need to find new production partners to replace the Chinese supply chain, increasing demand for new CDMO companies that can substitute for Wuxi AppTec, which holds a high market share in both CMO and CDMO businesses." She added, "If the Biosecurity Act passes, Samsung Biologics' CMO and CDMO businesses will benefit in the mid to long term." Samsung Securities recently raised Samsung Biologics' target stock price from 1 million won to 1.1 million won, anticipating an earlier full operation of the 5th plant currently under construction due to large-scale order acquisitions and the impact of the Biosecurity Act.

On the other hand, Samsung Electronics continued its six-day losing streak, hitting a 52-week low. The stock fell to 66,000 won intraday, matching the 52-week low recorded on October 6 last year. Samsung Electronics closed at 66,200 won, down 1.93% that day. The sustained selling pressure from foreign investors, coupled with securities firms lowering their earnings and stock price forecasts for Samsung Electronics, has significantly dampened investor sentiment. Meritz Securities lowered Samsung Electronics' target price from 108,000 won to 95,000 won, reflecting downward revisions in earnings estimates. Hyundai Motor Securities cut its target from 110,000 won to 104,000 won, KB Securities from 130,000 won to 95,000 won, and Hanwha Investment & Securities from 110,000 won to 100,000 won. Dongwon Kim, a researcher at KB Securities, said, "Due to weak smartphone and PC sales in the third quarter, inventory levels at memory module manufacturers have increased to 12-16 weeks, leading to expectations that memory shipments and price increases in the second half will fall short of initial forecasts." He added, "Samsung Electronics' third-quarter operating profit is estimated at 9.7 trillion won, below the consensus estimate of 13.7 trillion won."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.