After Draft Release, Business Community Reacts "Lacks Practicality"

Accounting Standards Board Urges Mandatory Enforcement Through Jasi Act Revision

US Presidential Election a Wildcard... Roadmap Development to Accelerate Post-Election

The government will hold a meeting with executives from major domestic companies such as Samsung and LG to discuss the 'Sustainability (ESG) Disclosure System.' This is to gather opinions from the companies responsible for implementation regarding the draft and timeline previously announced by the government ahead of the mandatory sustainability disclosure. The government is expected to begin full-scale preparation of the sustainability disclosure roadmap starting in November, after the conclusion of the U.S. presidential election, which is expected to bring significant changes to energy and climate policies.

According to the financial investment industry on the 11th, the Financial Services Commission will hold a meeting with ESG (Environmental, Social, Governance) officers from major domestic conglomerates, including the top 10 groups such as Samsung and LG, after the Chuseok holiday. Chaired by Vice Chairman Kim So-young, the meeting was originally planned for the 11th but was postponed once due to Kim's schedule. The exact date of the meeting has not yet been decided.

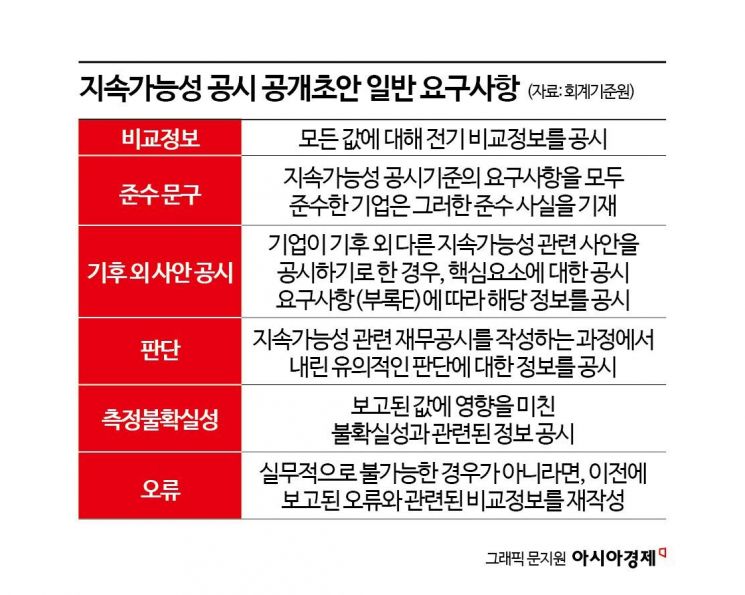

Earlier, the Financial Services Commission announced that it would finalize the domestic ESG disclosure standards by the end of this year and postpone the mandatory implementation to after 2026, considering the schedules of major countries. The core of ESG disclosure is to mandate the disclosure of related information and industry indicators so that domestic companies' ESG activities and efforts can be evaluated. Companies must disclose information on climate-related risks and opportunities expected to impact their outlook. The Korea Sustainability Standards Board (KSSB) under the Korean Accounting Standards Board released a draft of these disclosure standards last April.

Since the draft was released, the business community has consistently called for revisions and cautious implementation of the system. The Korea Employers Federation submitted a statement on the 28th of last month demanding significant revisions, stating that the draft "lacks practicality." In particular, the Federation clearly stated that the disclosure of 'Scope 3' carbon emissions, which includes all indirect emissions within the supply chain and is one of the major issues, should be excluded from the roadmap. Additionally, the business community hopes that ESG disclosures will be part of the Korea Exchange disclosures rather than the Financial Supervisory Service disclosures, which have stricter regulations.

On the other hand, the Accounting Standards Board, which drafted the proposal, insists that ESG disclosure must be mandated through amendments to the Capital Markets Act. Lee Han-sang, Chairman of the Accounting Standards Board, emphasized, "We must promptly mandate sustainability disclosure through amendments to the Capital Markets Act and present an implementation roadmap. Legal burden mitigation and implementation support measures are also necessary."

The Accounting Standards Board argues that ESG disclosure should be designated as a legal disclosure because if it becomes a mandatory disclosure item in the Financial Supervisory Service's financial statements, the law can include exemption provisions and grace periods. Legal disclosure refers to mandatory disclosures based on relevant laws such as the Capital Markets Act. Regarding the parts that the business community requests to be revised, such as excluding Scope 3 carbon emissions disclosure, the Board drew a line, stating that these do not conform to international standards. A representative of the Accounting Standards Board said, "Among the opinions received by August 31, 17 global investment institutions, including the Norwegian Government Pension Fund (NBIM) and the Dutch pension fund (APG), submitted their views. They demanded that the disclosure level should align with the ISS standards, a foreign advisory institution, rather than easing it considering corporate acceptance."

The financial authorities plan to prepare the roadmap by thoroughly reviewing opinions from the business community, academia, and related agencies. However, the timing for finalizing the roadmap's direction is expected to be after the U.S. presidential election. There are concerns that if former President Trump, known as a 'climate troublemaker,' returns to office, an anti-ESG wave could sweep globally. This could render the ESG disclosures that companies have painstakingly prepared useless.

A financial investment industry official said, "Looking at the U.S. election strategies, such as abandoning mandatory electric vehicles and easing fossil fuel regulations, the perspectives of Europe and the U.S. on ESG are completely different. After the election, once the direction of U.S. energy and climate policy becomes clear, the financial authorities are expected to refer to this and set the roadmap direction accordingly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.