Korea Housing Finance Corporation to Cover Up to 80-100% of Home Prices

Revision of 'Jeonse Fraud Special Act'... Expanded Support for Housing Stability

Korea Housing Finance Corporation (HF) announced on the 10th that, with the amendment of the “Special Act on Support for Jeonse Fraud Victims and Housing Stability (Jeonse Fraud Special Act),” victims of Jeonse fraud can now use the Bogeumjari Loan?a long-term, fixed-rate, amortized mortgage?using residential officetels as collateral.

Jeonse fraud victims refer to those recognized as victims under the Special Act and tenants defined in Article 2, Paragraph 4, Subparagraph (d).

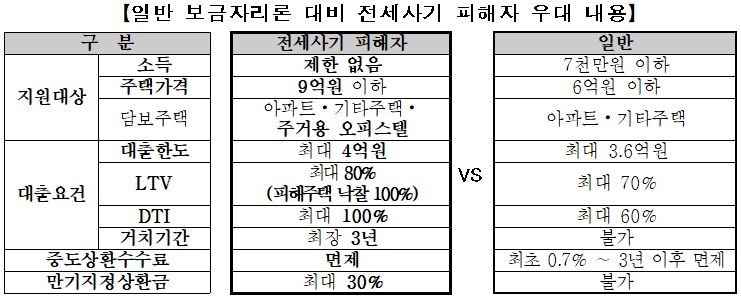

When a Jeonse fraud victim uses a residential officetel as collateral for a Bogeumjari Loan, the property price must be 900 million KRW or less. ▲ The maximum loan limit is 400 million KRW, and up to 80?100% of the property price can be borrowed. ▲ The interest rate currently ranges from a minimum of 2.95% (10 years) to 3.25% (50 years) per annum, offering more favorable terms than standard Bogeumjari Loans.

If the victim acquires the Jeonse fraud-affected property at auction, up to 100% of the auction price can be loaned within the court’s initial appraisal value. In other cases, up to 80% of the property price is available.

President Choi Junwoo stated, “Since the Bogeumjari Loan could only be used for residential properties, victims of Jeonse fraud could not use it with officetels, which are considered quasi-residential. However, we have improved the system to support those suffering from Jeonse fraud.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.