FSS Publishes Precautions on Insurance Contract Termination and Revival Due to Unpaid Premiums

An office worker, Mr. Kim, was paying his insurance premiums via automatic bank account transfer but failed to pay the premium on the due date due to insufficient balance. Even after receiving a notice of non-payment and a demand letter from the insurance company, he did not pay the premium, resulting in the termination of his contract. Later, he was diagnosed with cancer and filed a claim for insurance benefits, but the payment was denied.

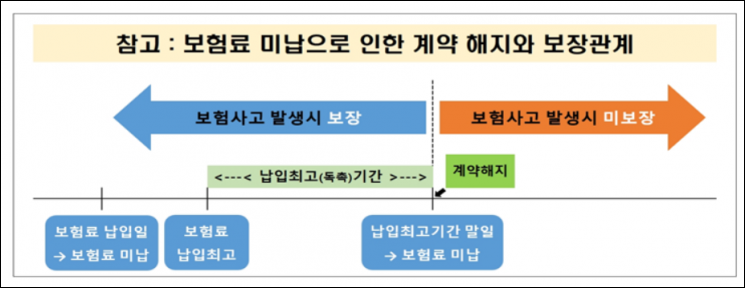

The Financial Supervisory Service disclosed consumer precautions regarding the termination and reinstatement of insurance contracts due to non-payment of premiums on the 10th. Recently, cases of insurance contracts being terminated due to non-payment of premiums caused by insufficient balance in automatic transfer accounts and credit card replacement issuance have been continuously occurring. If an insurance contract is terminated due to non-payment of premiums, there is a risk of disadvantages such as limited coverage for insurance incidents occurring after the contract termination.

Mr. Lee was paying his insurance premiums via automatic credit card billing but lost his card and later received a replacement card. However, he did not inform the insurance company of the updated card information, resulting in non-payment of premiums. Even after receiving a notice of non-payment and a demand letter, he did not pay the premiums, and the contract was terminated. After the contract termination, he underwent surgery due to an injury and filed a claim for insurance benefits, but the payment was denied.

There is also a way to reinstate an insurance contract terminated due to non-payment of premiums. If the contract was terminated due to non-payment but the surrender value was not received, the insured can pay the overdue premiums and interest within a certain period (2 or 3 years depending on the policy terms) from the termination date and request the restoration of the original insurance contract’s validity. In this case, coverage is provided under the same conditions as the original insurance contract. However, the obligation to disclose information before the contract must be fulfilled again when applying for reinstatement. Even if the contract is reinstated, insurance incidents occurring between the termination and reinstatement are not covered.

If paying premiums is burdensome, the contract can be maintained by utilizing automatic loan payment of premiums or premium reduction. Automatic loan payment is a system where a loan is taken within the surrender value range to pay premiums when premiums are overdue due to non-payment. It must be applied for before the expiration of the demand period, and interest must be paid on the loaned premiums. If the total amount of the loaned premiums and interest exceeds the surrender value, automatic loan payment will be suspended, and premiums may become overdue.

Premium reduction is a system that simultaneously reduces insurance benefits and premiums by changing the contract details while maintaining the existing insurance contract. When applying for premium reduction, the reduced portion is treated as a terminated insurance contract, and the insurance company pays the surrender value.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)