South Korea's Electric Vehicle Market Shrinks More Than Global Trend

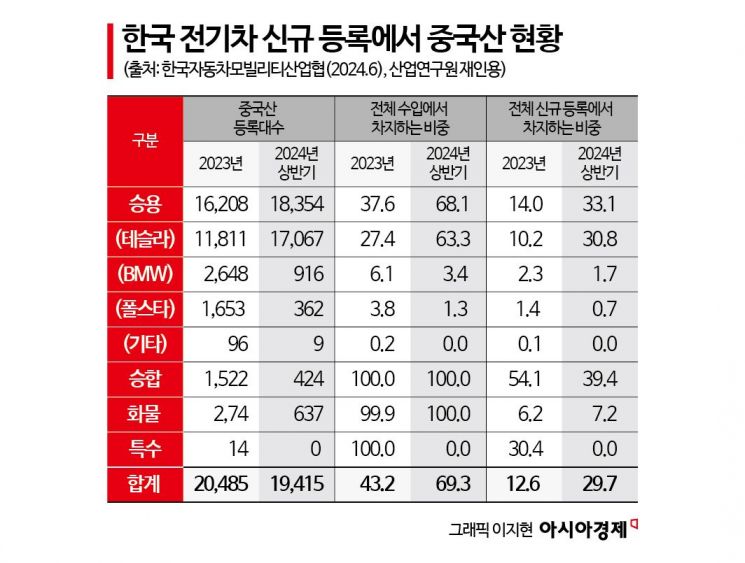

Electric Vehicles Produced in China Account for 33.1% of Domestic Market

Subsidies Alone Not Enough... Companies Must Strive to Lower Prices

Despite the recent slowdown in the growth of electric vehicle (EV) sales, known as the chasm (Chasm: temporary growth stagnation), Chinese electric vehicles and batteries are rapidly capturing the global market. The offensive of Chinese-made electric vehicles is strong not only globally but also in the Korean market. There are calls for Korean electric vehicle and battery companies to seek new changes.

Senior Researcher Cho Cheol of the Korea Institute for Industrial Economics & Trade (KIET) stated in the report "Key Issues and Implications of the Electric Vehicle and Battery Industry," released on the 10th, that "To respond to the slowdown in sales growth and the rise of China, the domestic automobile and battery industries need to continuously address various technologies, improve cost competitiveness and differentiation, and adjust or moderate battery investments and plans based on optimistic forecasts."

From 2020 to 2022, global electric vehicle sales increased explosively, but growth somewhat slowed last year, and in the first half of this year, battery electric vehicle sales in major countries grew by only 10.6%. In Korea, battery electric vehicle sales barely increased last year and decreased by 15.3% in the first half of this year. On the other hand, plug-in hybrid vehicles and hybrid vehicles increased by 51% and 33.3% respectively last year, and also grew by 58.7% and 17.1% in the first half of this year. Battery demand increased by 38.6% last year and by 22.3% in the first half of this year, showing a slowdown in growth.

Battery electric vehicle (BEV) sales had been mostly optimistic, but recently, as countries relax environmental regulations and safety issues such as fires become cost factors, the possibility of sales being lower than previous forecasts is increasing.

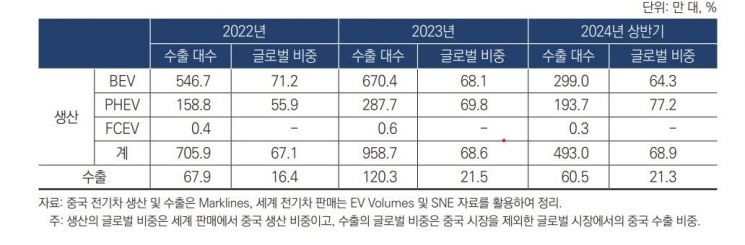

Meanwhile, according to KIET's analysis, the production share of Chinese-made electric vehicles (including plug-in hybrids) in the global market has exceeded 68%. The export share increased from 16.4% in 2022 to 21.5% in 2023, and 21.3% in the first half of 2024, showing an upward trend.

Number of Electric Vehicles Produced and Exported in China and Their Global Share. Source=Korea Institute for Industrial Economics and Trade

Number of Electric Vehicles Produced and Exported in China and Their Global Share. Source=Korea Institute for Industrial Economics and Trade

Although the share of Chinese electric vehicles is small in the U.S. market, which already imposes high tariffs, the share of Chinese-made vehicles (based on BEV) in the European market exceeded 18% in the first half of this year and is rapidly increasing. In Thailand, 84.2% of total electric vehicle sales last year were Chinese brands.

In Korea, sales of Chinese brands have not yet occurred. However, with the full-scale sale of Chinese-made Tesla vehicles, the share of electric vehicles produced in China rose sharply from 14% last year to 33.1% this year. Globally, many Chinese brands rank high in electric vehicle sales, and Chinese BYD has overtaken Tesla to hold the absolute number one position.

Price competitiveness plays a crucial role in the rapid market share increase of Chinese-made and Chinese brand electric vehicles. According to data from JATO, a UK-based industrial analysis firm, the average price of Chinese brands in major countries' electric vehicle markets was only half that of other brands. The price competitiveness of Chinese-made and Chinese brand electric vehicles stems from the well-developed parts supply chain within China. A representative example is batteries and related materials. More than 70% of the world's battery production capacity is concentrated in China. In particular, Chinese companies hold an absolute advantage in the low-cost lithium iron phosphate (LFP) cathode batteries.

On the other hand, Korea's battery electric vehicle market is shrinking more sharply than the global market. The report pointed out that this is undesirable for the domestic automobile industry as well. Electric vehicle sales should be conducted at a level that aligns with global automotive industry trends. High electric vehicle prices cannot be resolved by subsidies alone, and the report suggests that efforts by companies to reduce prices, along with regulations to encourage sales expansion, are necessary.

Although the U.S. and European markets defend against the penetration of Chinese electric vehicles through tariff barriers, in domestic and emerging markets, the price competitiveness of domestic electric vehicles is significantly lagging. The report stated, "To secure price competitiveness, innovation in production methods and supply chain efficiency are necessary, and thorough analysis to understand the sources of China's price competitiveness must precede. We must pursue our own differentiation in various aspects such as autonomous driving, smart features, and design."

Furthermore, the report said, "the battery industry also faces the immediate task of responding to LFP, which forms the basis of China's price competitiveness," and added, "In the global trend to exclude China from the battery supply chain, it is possible to consider forming a new supply chain led by our companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.