Only Nekaoman Subject to Regulation... Google and Apple May Be Excluded

Burden of Proving Illegality on Companies... Concerns Over Business Restrictions

The government has withdrawn its plan to pre-designate giant platforms as 'dominant operators' and regulate them accordingly. Instead, it will presume after the fact whether a platform that has committed unfair practices qualifies as a dominant operator and hold it responsible for proving illegality. Although this is a step back from criticism that pre-regulation was excessive, the industry is opposing it, saying it is no different from pre-regulation. This is because major domestic platforms presumed to be dominant operators will face restrictions on business activities similar to pre-regulation.

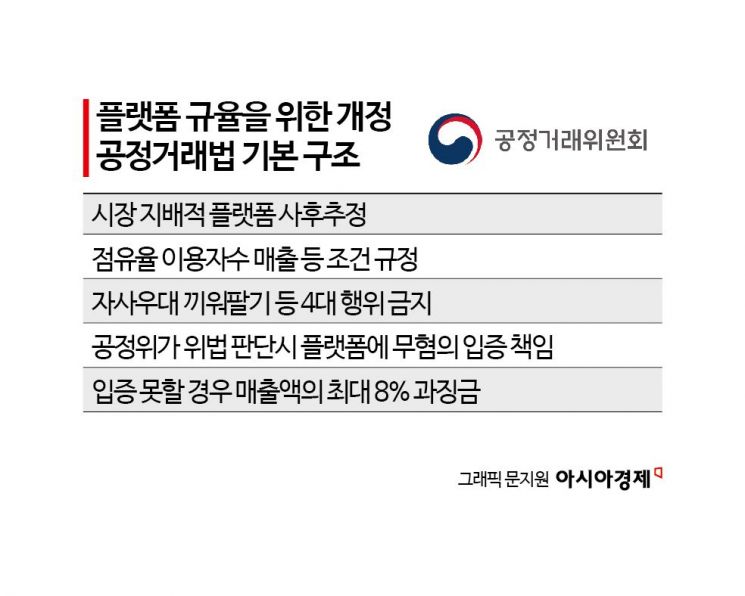

On the 9th, the Fair Trade Commission (FTC) announced the 'Platform Fair Competition Promotion Plan.' Instead of enacting a platform law after nine months, it decided to regulate platforms by amending existing laws.

According to the plan, the FTC will presume after the fact whether a platform is a dominant operator if any of the four major anti-competitive acts (self-preferencing, tying sales, multi-homing restrictions, and most-favored-nation demands) occur in six sectors: brokerage, search, video, social networking services (SNS), advertising, and others. A company is considered a dominant operator if it has a market share of 60% or more with over 10 million users, or if three or fewer companies have a combined market share of 85% or more with over 20 million users. However, if the direct or indirect sales generated in the domestic market are less than 4 trillion KRW, the company is exempt from regulation. If a dominant operator commits an illegal act, a fine of 8% of the related sales will be imposed.

The industry expects that Naver and Kakao will be classified as dominant operators. Considering market share and user numbers, Google and Apple could also fall within the scope, but domestic sales calculations are a variable. Ultimately, since only large domestic platforms clearly fall under regulation, the industry views this as not significantly different from pre-regulation. A representative from a platform company said, "Besides portal search, commerce and video services can also be considered search. Given the nature of platforms that combine all functions, it is uncertain which criteria will apply, so even post-presumption will restrict business activities like pre-regulation."

Shifting the burden of proving illegality to the operators is also controversial. The burden of proof generally lies with regulatory agencies, and transferring it to operators is criticized as violating the constitutional principle of presumption of innocence. An industry insider said, "Requiring operators to prove lack of intent effectively means most acts will be considered illegal," adding, "To eliminate uncertainty, companies will have no choice but to invest in internal staff or law firms and conduct business cautiously under regulatory scrutiny."

Concerns about reverse discrimination against foreign platforms remain. Google is estimated to have generated over 10 trillion KRW in domestic sales, but Google Korea’s disclosed revenue last year was only 365.3 billion KRW. This is because domestic sales are attributed to overseas entities such as Singapore, resulting in underreporting. According to this standard, companies with annual sales under 4 trillion KRW are exempt from regulation. Chinese e-commerce platforms rapidly growing in the domestic market, such as AliExpress and Temu, are also likely to be excluded. An industry representative said, "This regulation opens the door only for foreign platforms and will only restrict the growth of domestic large platforms and startups aiming to become the next Neka (Naver-Kakao)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.