Paid Membership for 'Baemin Club' on the 11th

Decisive Battle with Coupang Eats

The battle between the top two delivery apps in the market, Baedal Minjok (Baemin) and Coupang Eats, which competed with a 'free delivery' subscription model, will be decided this month. The turning point is the monetization of Baemin's subscription service 'Baemin Club,' which had been operated as a free trial until now. Baemin, which launched this service in May to respond to Coupang Eats' free delivery service for Wow members, saw an increase of 1 million users during the four-month free trial period. Whether this momentum can continue is expected to be determined after the implementation of the paid service. However, the fact that the free delivery services of both companies, while increasing users, have also sparked backlash from restaurant owners, making it a 'double-edged sword,' could be a variable.

On the 10th, Baemin announced that it had completed preparations for the monetization of Baemin Club and would officially start the service from the 11th. Baemin Club is a subscription product that includes free delivery, discounts on B Mart grocery shopping service, brand discount coupons, movie viewing, and fuel discount coupons, with a monthly fee of 3,990 KRW. Baemin has been making every effort to attract pre-subscribers by discounting this to 1,990 KRW and offering benefits such as free usage for a certain period.

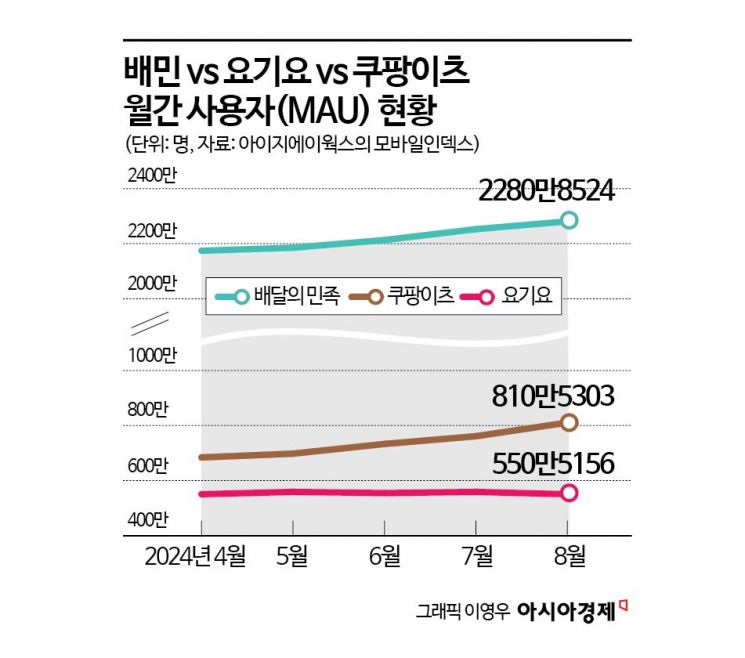

The strategy of eliminating delivery fees, which had been a hurdle for food delivery orders, proved effective in the market. According to Mobile Index by data company IGAWorks, last month, the number of users (MAU) for Baemin, Coupang Eats, and Yogiyo were 22.81 million, 8.1 million, and 5.5 million respectively. Looking at Coupang Eats, the number increased by 1.85 million compared to March when the free delivery service was launched. Baemin also showed a declining trend until April this year but switched to an increasing trend from May when it launched the subscription service in response to Coupang Eats' free delivery. Compared to then, Baemin's users increased by nearly 1 million last month.

The outline of the competition between the two companies, both enjoying the effects of the free delivery subscription strategy, will become clear after the monetization of Baemin Club on the 11th. Baemin's advantage is that free delivery is possible not only for restaurants where Baemin riders deliver food but also for cases where delivery is done through separate delivery personnel from the store. Baemin has about 320,000 restaurants listed, so it is expected to secure the largest number of free delivery restaurants. However, the requirement to go through a separate registration process and register a payment method is disadvantageous compared to Coupang Eats, which already has subscribers. Considering that Yogiyo secured 500,000 subscribers within two months after launching its subscription service 'Yogipass' and market share, the industry expects Baemin to comfortably secure more than 2 million subscribers. The key question is whether Baemin can curb Coupang Eats' steep rise. A Baemin official said, "Consumer preference for free delivery is high, and we are providing benefits such as free usage tickets and coupons for pre-registration, so the response is good," adding, "The number of subscribers is steadily increasing."

The possibility of the third-ranked Yogiyo's advancement is a variable. Yogiyo has expanded its subscribers by partnering with Naver, Shinhan Card, Toss, and others, providing free delivery benefits to each company's members. Yogiyo explained that the number of new subscribers increased by 150,000 within a week of partnering with Naver Plus Membership, showing the effectiveness.

The industry is also closely watching how the backlash from restaurant owners against the free delivery competition will affect the market. A representative example is the Korean Franchise Industry Association launching the 'Franchise Delivery App Crisis Countermeasures Committee' and deciding to report the delivery apps' commission hikes to the Fair Trade Commission. They claim that delivery apps are shifting the costs related to free delivery competition onto restaurant owners. An industry insider said, "The delivery ecosystem operates with the intertwined interests of consumers, restaurant owners, and riders," adding, "Competition is necessary, but at the same time, ways to coexist with the ecosystem's stakeholders must be found."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)