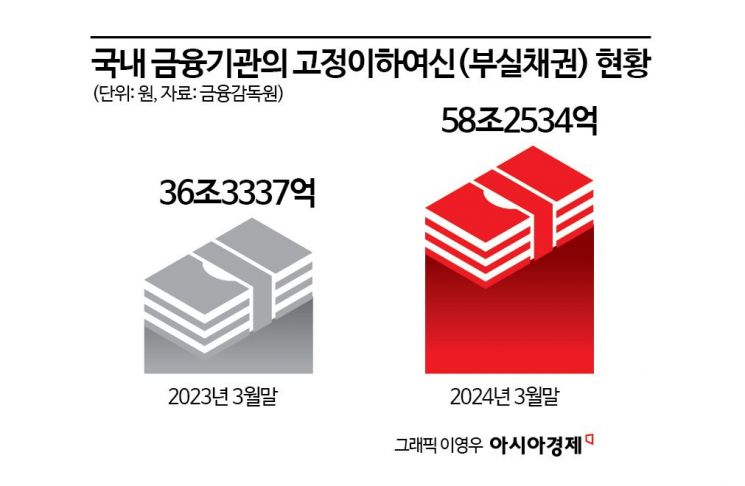

58.2 Trillion Won in Non-Performing Loans Over 3 Months Past Due

Explosive Increase in Secondary Financial Sectors Including Securities, Insurance, and Savings Banks

The amount of non-performing loans (NPLs) in the domestic financial sector, including banks, securities, and insurance, has surged nearly 60 trillion won in just one year.

According to key financial statistics from the Financial Supervisory Service on the 10th, as of the end of March 2024, the total amount of non-performing loans (NPLs) in domestic financial institutions stood at 58.2534 trillion won, an increase of about 22 trillion won (60.3%) compared to one year ago (36.3337 trillion won). This includes 13.6 trillion won in banks, 38.7803 trillion won in small and medium financial institutions, 4.372 trillion won in securities companies, and 1.5011 trillion won in insurance companies.

Among the increases in non-performing loans over the past year, mutual finance showed the largest growth. The NPLs of agricultural, fishery, and forestry cooperatives rose from 8.2194 trillion won at the end of March last year to 15.3469 trillion won at the end of March this year, an increase of 7.1275 trillion won (86.7%). Including credit unions (2.4577 trillion won), the increase exceeded 9 trillion won. Savings banks’ NPLs increased from 5.7906 trillion won at the end of March last year to 10.4562 trillion won at the end of March this year, up 4.6656 trillion won (80.6%).

The highest growth rate was seen in insurance companies, followed by securities firms. Insurance companies’ NPLs rose from 593.1 billion won last year to 1.5011 trillion won this year, an increase of 908 billion won (153%). Securities firms’ NPLs increased from 2.3115 trillion won last year to 4.372 trillion won this year, up 2.0605 trillion won (89.1%).

Banks’ NPLs increased from 10.6 trillion won last year to 13.6 trillion won this year, a rise of 3 trillion won (28.3%).

Non-performing loans overdue for more than 3 months approach 60 trillion won... Higher growth rates in securities and insurance than banks

Non-performing loans (NPLs), or fixed overdue loans, refer to loans overdue for more than three months that are difficult to recover. Financial institutions classify and separately manage these NPLs, and when the likelihood of recovery is deemed very low, they are considered written-off assets. Subsequently, they are either removed from the books entirely (write-off) or sold at a discount to asset securitization companies (sale).

The significant expansion of bad loans in the financial sector is understood to be due to the slow pace of economic recovery, the exposure of hidden bad debts masked by COVID-19 loan repayment deferrals, and the overlapping of real estate project financing (PF) defaults.

The reason why the increase in non-performing loans in the secondary financial sector?such as securities firms, insurance companies, and savings banks?is more noticeable than in banks is due to the surge in PF defaults caused by the downturn in the real estate market and prolonged high interest rates.

Kim Pil-gyu, Senior Research Fellow at the Capital Market Research Institute, said, "The main reason for the larger increase in NPLs in securities firms and insurance companies compared to commercial banks appears to be the real estate PF defaults. PF issues continue to be a problem. Based on past cases, recovery takes some time, and the future responses of construction companies, financial firms, and the government are crucial." He added, "If sales rates and construction progress proceed properly, a soft landing seems possible, but the current situation remains uncertain."

With the real estate market unlikely to recover easily, the bad debts may spread to the financial companies that lent money, causing a negative chain reaction. Since higher NPL ratios increase loan loss provisions, this is expected to adversely affect financial firms’ earnings this year.

In addition to officially reported figures, hidden bad debts that have not surfaced are also a concern. Global accounting firm Samjong KPMG recently estimated the domestic real estate PF risk exposure at around 200 trillion won in its report titled "Key Issues and Outlook on Real Estate PF." Samjong KPMG pointed out, "The main causes of the real estate PF problem are high interest rates and high inflation leading to a downturn in the real estate market. Since developers, construction companies, secondary financial institutions, and trust companies are all entangled in PF, the risk could spread like a domino effect."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)