Stock Price Rises 28% from Low Point

Touching 400,000 Won This Month, Attempting to Stabilize Above 400,000 Won

Foreign and Institutional Buying Driving Stock Price Increase

Performance Improvement Expected from Q3

Amid concerns over the electric vehicle chasm (temporary demand stagnation) causing a slow recovery in secondary battery stocks, LG Energy Solution has recently stood out by maintaining a strong upward trend. As securities firms' outlooks on LG Energy Solution gradually improve, the stock price recovery is expected to continue.

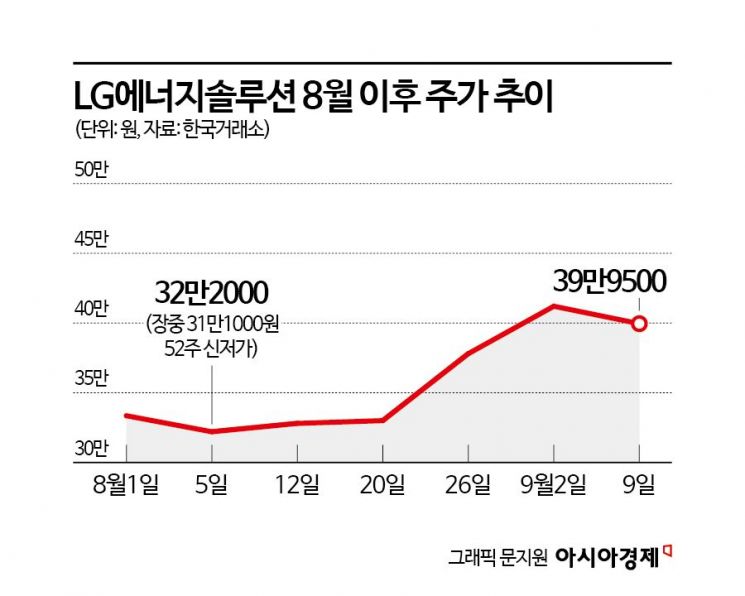

According to the Korea Exchange on the 10th, LG Energy Solution closed at 399,500 KRW, up 1.14% from the previous day. LG Energy Solution, which had fallen to the low 310,000 KRW range and recorded a 52-week low during last month's crash, has been attempting to stabilize above the 400,000 KRW mark this month. This represents an increase of over 28% compared to the lowest price.

Foreign investors and institutions are both buying LG Energy Solution shares, driving the stock price up. Since the beginning of this month until the day before, foreign investors have net purchased LG Energy Solution shares worth 86 billion KRW, making it their largest purchase. Institutions have also net bought 97.1 billion KRW, ranking second only to KODEX 200 Futures Inverse 2X.

The continuous inflow of buying from major investors is interpreted as reflecting expectations for LG Energy Solution's improved earnings. Kang Dong-jin, a researcher at Hyundai Motor Securities, said, "From the third quarter earnings this year, the negative lagging effect (time lag in fuel input) will be completed, and with stricter regulations and the effect of German subsidies, European sales are expected to gradually recover, leading to profitability improvement." He added, "Fourth quarter earnings are expected to continue improving due to the 2025 European regulatory tightening effect, Tesla's new cylindrical battery, and the recovery of General Motors (GM) sales."

Anna Lee, a researcher at Yuanta Securities, analyzed, "In the secondary battery sector, the upcoming third quarter earnings will be an important point for investment strategy. Companies expected to show earnings improvement in the third quarter compared to the previous quarter are LG Energy Solution for cells and POSCO Future M for materials." She added, "LG Energy Solution is expected to see an expansion in the Advanced Manufacturing Production Tax Credit (AMPC) scale due to increased operating rates for major U.S. customers."

As customers complete inventory adjustments, LG Energy Solution is forecasted to be the fastest among major cell manufacturers to see a sales rebound. Jeong Yong-jin, a researcher at Shinhan Investment Corp., said, "After the second quarter earnings announcement, LG Energy Solution recorded a 28% increase from the bottom, reflecting the early anticipation of negative factors and the bottoming out of demand." He continued, "Inventory adjustments by LG Energy Solution's major customers are sequentially ending, so a sales rebound at the earliest timing among large cell manufacturers is expected." He added, "Considering the tariffs on Chinese electric vehicles starting in November and the tightening of carbon dioxide regulations in 2025, cautious expectations for order expansion are also possible."

The securities industry's outlook on LG Energy Solution is also rising. Shinhan Investment Corp. raised LG Energy Solution's target price by 12% to 480,000 KRW, while Hyundai Motor Securities increased it from 450,000 KRW to 560,000 KRW. Researcher Kang explained, "The target price was set by applying a 20% premium to the average 2026 enterprise value to cash flow (EV/EBITDA) multiple of major Chinese battery companies." He added, "With recent GM sales expansion, the U.S. market share is increasing, providing sufficient grounds for the premium."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.