Despite the first interest rate cut in 4 years this month,

Wall Street forecasts S&P 500 index to rise 1% by year-end

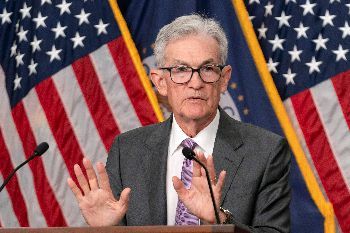

Despite expectations that the U.S. central bank, the Federal Reserve (Fed), will cut interest rates for the first time in four years since 2020 this month, pessimism about the stock market is spreading on Wall Street.

The S&P 500 index and the Nasdaq index plunged 4.25% and 5.77%, respectively, last week as recession fears reignited. The S&P 500 recorded its largest weekly decline since March last year, while the Nasdaq experienced its biggest weekly drop since January 2022. Although there were several negative factors such as September bearish sentiment and AI bubble concerns, the biggest cause of the increased downward pressure on the stock market was the renewed recession fears triggered by cooling employment data.

Accordingly, investors are eagerly awaiting the Federal Open Market Committee (FOMC) meeting on the 18th (local time), where the Fed is expected to decide on an interest rate cut for the first time in four years since March 2020. This is because the shift in the Fed's monetary policy cycle from tightening to easing is expected to bring an "everything rally" across all risk assets including stocks.

However, Wall Street still views it as uncertain whether the rate cut will be a catalyst for a stock market rebound. The average year-end revised forecast for the S&P 500 index by 20 strategists tracked by Bloomberg predicts a rise of only 1% from the current level to 5500.

Bank of America (BoA) and Morgan Stanley set their year-end targets at 5400, while Barclays and BMO suggested 5600. The most pessimistic forecast came from Stifel Nicolaus at 5000, and the most optimistic from Evercore ISI at 6000.

In this regard, Bloomberg emphasized, "Since a rate cut is a response to economic slowdown, it does not guarantee a stock market rebound." It also noted, "If accompanied by a more pessimistic assessment of the economy, it could become a catalyst for further selling."

The fact that the U.S. presidential election is less than two months away also adds to market anxiety. The hedge fund industry tends to sell U.S. stocks ahead of the election to prepare for high volatility, and after the election, the fortunes of industries and companies vary depending on who wins. Frederic Carrier, head of investment strategy at the Royal Bank of Canada (RBC), said, "As uncertainty over the U.S. presidential election results grows, market sentiment is expected to become more fragile through the end of the year."

Jens Forenbach, head of public markets at the UK-based Man Group, analyzed, "U.S. market valuations are somewhat inflated and a hard landing is not priced in. Therefore, negative surprises in the future could trigger a strong market reaction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.