KPMG '2024 2nd Quarter VC Investment Trend Report'

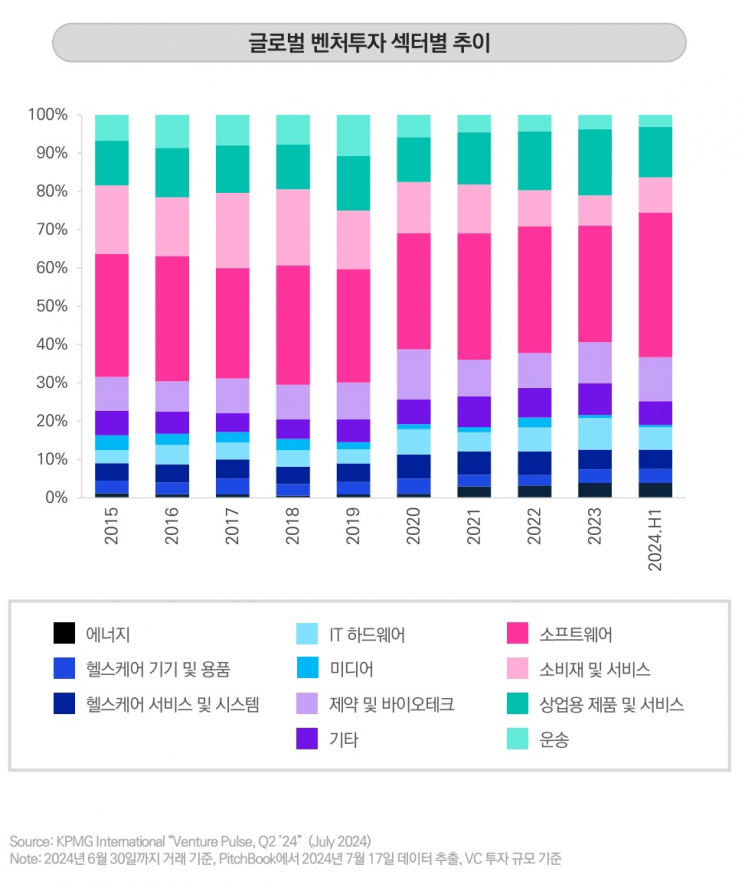

Active investment in artificial intelligence (AI) has led to a 25% increase in global venture investment in the second quarter of this year compared to the previous quarter. The AI sector remains a promising field due to active investments and interest from tech giants such as Microsoft, Nvidia, and Google. Additionally, interest in ▲energy ▲cleantech ▲defense industry and cybersecurity has also increased.

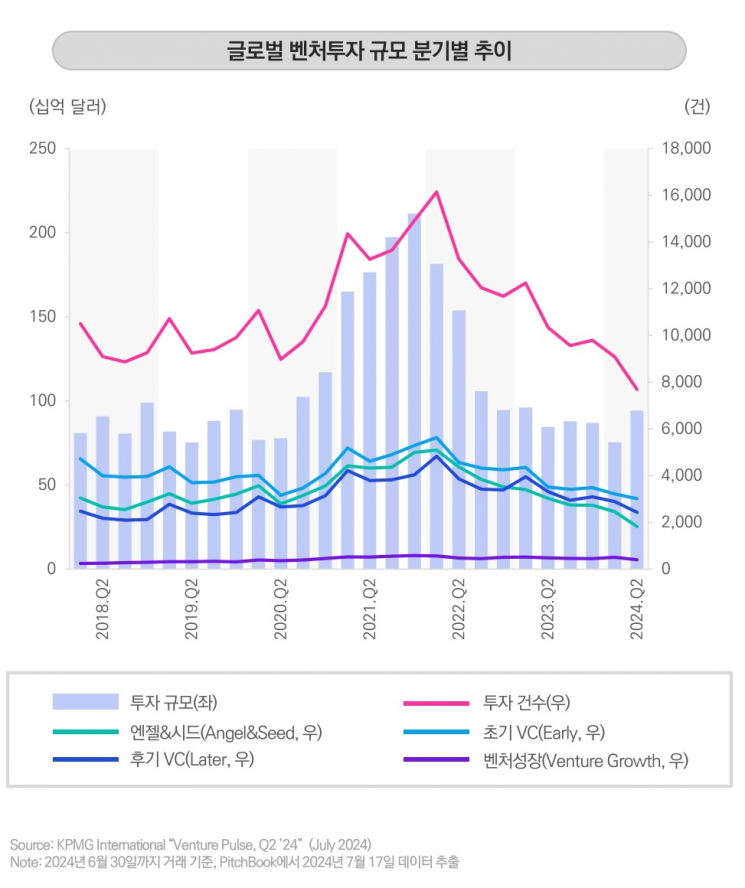

According to the “Q2 2024 VC Investment Trends” report published on the 9th by global accounting and consulting firm KPMG, global venture capital (VC) investment in the second quarter reached $94.3 billion (approximately 126 trillion KRW), the highest in five quarters, driven by U.S.-originated mega deals exceeding $1 billion (about 1 trillion KRW). The number of deals decreased by 15% from the previous quarter to 7,691.

The VC exit market remained sluggish due to reduced liquidity and increased stock market volatility. In the first half of the year, the global venture investment exit market recorded $75.6 billion (approximately 101 trillion KRW) across 1,212 deals.

Mega deals stood out in global venture investments in Q2. Nine companies secured mega deals, more than doubling from the previous quarter. CoreWeave, which operates and leases data centers with Nvidia’s AI semiconductors, raised $8.6 billion, while Elon Musk’s AI startup xAI successfully attracted $6 billion in investment.

By region, the Americas recorded $58.3 billion in investments across 3,472 deals in Q2. The United States led overall investment with six mega deals. Canada ($1.3 billion), Brazil ($820 million), and Mexico ($260 million) also showed rebounds compared to the previous quarter.

Europe saw an increase in investment scale to $17.8 billion across 1,869 deals compared to the previous quarter. The UK’s autonomous driving startup Wayve raised $1 billion, and France’s AI language model developer Mistral AI secured $650 million in funding. Alternative energy and cleantech also attracted capital, including $380 million for UK-based liquefied air energy storage technology company Highview Power and $170 million for Estonian fuel cell leader Elcogen.

The Asia-Pacific region completed $17.4 billion in investments across 2,155 deals. While China’s VC investment sharply declined from $13.5 billion in Q1 to $6.9 billion in Q2, Japan recorded an increase to $1.2 billion in VC investment, supported by government startup promotion strategies and technological capabilities. India attracted $4 billion, marking about a 38% increase in VC investment compared to Q1.

Jung Do-young, partner at Samjong KPMG Startup Support Center, stated, “Investment in the AI industry will focus not only on upstream but also on downstream areas related to the application and deployment of AI solutions. As the need to respond to climate change grows, alternative energy and cleantech will also gain attention. Despite market uncertainties, some investors are expanding capital supply, which may increase mergers and acquisitions (M&A) of venture companies facing funding difficulties and mega deals exceeding $100 million.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.