Stock Market Weakness Amid Favorable Price Trends for Value-Up Related Stocks

DB Financial Investment Surges Over 20% Following Value-Up Disclosure

High Dividend Stocks Also Show Strong Prices on Shareholder Return Expectations

As the stock market continues to show sluggish trends, value-up related stocks are emerging as defensive stocks against the market downturn. Stocks reflecting plans to enhance corporate value or expectations of expanded shareholder return policies, as well as high-dividend stocks, are performing well amid the market weakness.

According to the Korea Exchange on the 9th, the KOSPI closed at 2,544.28 on the 6th, down 31.22 points (1.21%) from the previous day, marking four consecutive days of decline. Amid the overall market weakness, value-up related stocks gained momentum and stood out.

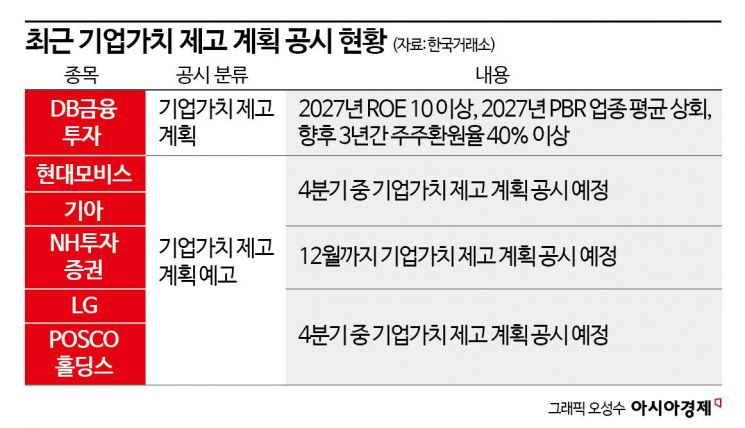

DB Financial Investment surged more than 20%. DB Financial Investment rose 21.40% to close at 5,900 KRW. During the session, it reached 6,280 KRW, hitting a 52-week high. The sharp rise in DB Financial Investment is attributed to the announcement of its corporate value enhancement plan. On the 5th, DB Financial Investment disclosed its corporate value enhancement plan, which includes goals such as ▲achieving a return on equity (ROE) of over 10% by 2027 ▲exceeding the industry average price-to-book ratio (PBR) by 2027 ▲maintaining a shareholder return ratio of over 40% for the next three years. Notably, the 40% shareholder return ratio significantly exceeds DB Financial Investment’s recent five-year average of 27.6% and is higher than that of other securities firms that previously announced value-up plans. The company also stated, "We believe the current PBR is excessively undervalued, and we aim to restore it to above the securities industry average PBR," adding, "If a revaluation of the securities industry as a whole occurs, achieving a PBR of 1 is also possible."

Hyundai Mobis, which announced plans to enhance corporate value in the fourth quarter, also rose for two consecutive days. Hyundai Mobis announced on the 4th that it plans to establish a corporate value enhancement plan and disclose it during the fourth quarter.

KT&G continued its upward trend for four consecutive days, likely due to positive market evaluations of its shareholder return policy. Younghoon Joo, a researcher at NH Investment & Securities, said, "KT&G is currently conducting a buyback of 3.61 million shares, which is sufficient to act as a corporate value defense factor amid increased market volatility," adding, "Although it is currently regarded as having one of the best shareholder return policies in Korea, the announcement of a new corporate value enhancement plan in the second half of the year warrants attention and expectations." NH Investment & Securities raised KT&G’s target price from 120,000 KRW to 130,000 KRW.

Telecommunication stocks, reflecting value-up expectations as high-dividend stocks, have recently emerged as representative defensive stocks in the market and are showing strength. SK Telecom has risen for four consecutive days, repeatedly hitting 52-week highs. On the 6th, SK Telecom closed at 57,800 KRW, up 1.05%. During the session, it reached 58,800 KRW, marking a 52-week high.

KT also showed recent strength, with its stock price rising from the 38,000 KRW range at the end of last month to the 41,000 KRW range. Junseop Kim, a researcher at KB Securities, explained, "KT’s investment points lie in stable earnings growth through business efficiency improvements driven by artificial intelligence (AI) applications, high growth in AI-related businesses such as data centers and cloud, and expectations for the announcement of a value-up program," adding, "In particular, the potential inflow of shareholder returns from next year’s real estate subsidiary’s sales profits is attracting attention as it aligns with value-up expectations."

Since August, the number of companies announcing corporate value enhancement plans has been increasing, which is expected to strengthen the value-up momentum. Since August, there have been 24 announcements or notices of corporate value enhancement plans. This figure nearly doubles the 13 announcements made from late May to late July, when such disclosures first began. Inseong Bang, a researcher at Eugene Investment & Securities, said, "The recent spread of corporate value enhancement plan announcements from the financial sector to non-financial sectors is positive news for shareholders," adding, "From a mid- to long-term perspective, attention is needed for companies actively proposing shareholder returns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.