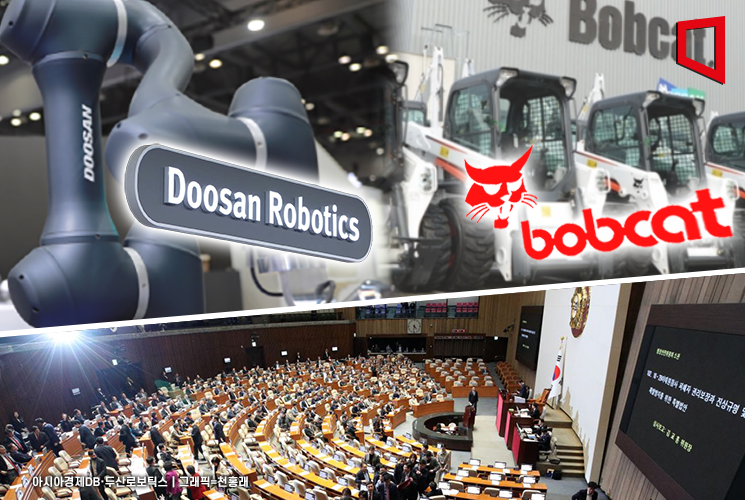

The international credit rating agency S&P Global Ratings (hereinafter S&P) maintained Doosan Bobcat's designation as 'Credit Watch Negative' despite the withdrawal of the merger between Doosan Bobcat and Doosan Robotics.

On the 4th (local time), S&P stated in a report, "Although the Doosan Group's governance restructuring plan has been revised, we do not consider it sufficient to remove Doosan Bobcat from 'Credit Watch'."

S&P pointed out that Doosan Robotics may require a substantial amount of investment to secure growth momentum, and if Bobcat provides financial support for this, it could still pose a burden on Bobcat's credit rating.

However, S&P positively evaluated that concerns over the expansion of Bobcat's financial burden have disappeared due to the withdrawal of the merger plan between Bobcat and Robotics, and that minority shareholders have been protected.

S&P stated that if the exercise amount of the stock purchase rights by Doosan Enerbility shareholders does not exceed the limit of 600 billion KRW, they will review factors such as ▲ potential changes in Bobcat's financial policy ▲ credit ratings of Robotics and Doosan ▲ possibility of negative intervention by the parent company in Bobcat to decide whether to remove the watch status.

However, they noted that the exercise period for the stock purchase rights, scheduled from September 25 to October 15, may be postponed to November due to the amendment procedure of the securities registration statement, and the limit on the stock purchase payment may also be subject to revision.

Earlier in July, S&P designated Doosan Bobcat's long-term issuer credit rating and bond rating of 'BB+' as 'Credit Watch Negative,' stating that if Doosan Bobcat becomes an unlisted subsidiary of Doosan Robotics, the possibility of group-level management intervention would increase, potentially increasing Bobcat's financial burden.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.