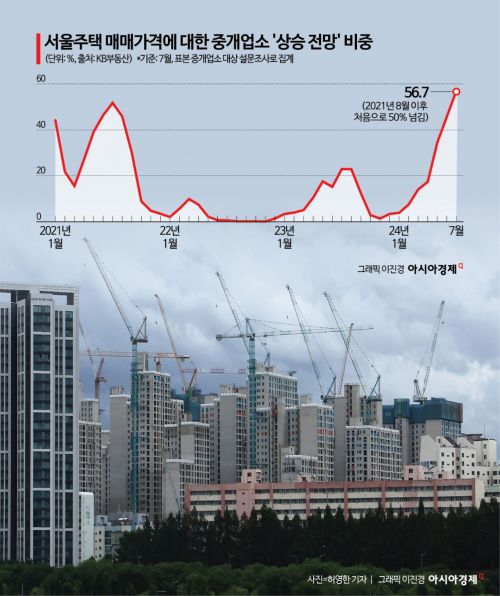

56.7% Expect 'Increase' as of July

Over Half for the First Time in 35 Months

"Feeling Recovery in Buying Sentiment on Site"

KB Sales Price Forecast Index Up 13.3P in One Month

Buyers' Dominance Index Also Rises 20.9P

Impact of Increased Transactions and Rising House Prices

More than 50% of real estate agents who directly experience the Seoul real estate market on the ground predicted that "Seoul housing prices will rise further." It has been over three years since the proportion of those expecting housing price increases exceeded half, the last time being August 2021 when Seoul apartment sale prices soared to an all-time high.

Real Estate Agencies' 'Rise' Outlook Returns to 2021 Levels

According to monthly time series data released by KB Real Estate on the 2nd, 56.7% of real estate agencies in Seoul expected housing sale prices to rise as of July. The usual figure was 39.9%, and those expecting a decline accounted for only 3.3%.

KB Real Estate conducts monthly surveys of about 6,000 real estate agencies nationwide, asking whether local prices will rise or fall. The aggregated result is the Sale Price Expectation Index. In July, Seoul's Sale Price Expectation Index was 127.2, up 13.3 points from the previous month. This index had recorded 106.5 in September 2023 and had consistently stayed below the baseline of 100 until recently, surpassing 100 for three consecutive months. An index above 100 indicates a majority expect prices to rise, while below 100 indicates a majority expect prices to fall.

Looking at detailed survey responses, the expectation of price increases clearly rose in July within the past three months. In May and June, when the Sale Price Expectation Index exceeded 100, those forecasting a 'rise' were 17.4% and 34.5%, respectively. The proportion expecting a rise to exceed half occurred for the first time in 35 months since August 2021.

In 2021, the longest period of ultra-low interest rates (base rate 0.5%) coincided with the government increasing mortgage loan limits for low-income and actual demand buyers in the second half of the year, leading to a sharp increase in apartment sales by so-called Yeongkkeul (borrowing to the limit) buyers. Subsequently, the Bank of Korea raised the base rate ten times by 3 percentage points, dampening buying sentiment and causing housing prices to plummet. This year, concerns over supply shortages and rising jeonse (long-term deposit lease) prices have pushed real estate prices up again.

The increase in real estate agencies expecting price rises suggests that buying sentiment is reviving on the ground. A representative from a real estate office in Gangbuk-gu said, "Although it doesn't match Gangnam or Mayongsung (Mapo-gu, Yongsan-gu, Seongdong-gu), inquiries have increased compared to the difficult period when we had to close the office," adding, "Urgent sale properties with reduced prices are almost sold out."

July Sees Highest Sales Volume... Apartments Recover 90% of Previous Peak

The photo shows a real estate agency in a densely populated apartment complex in Seoul. Photo by Hyunmin Kim kimhyun81@

The photo shows a real estate agency in a densely populated apartment complex in Seoul. Photo by Hyunmin Kim kimhyun81@

The KB Buyer Dominance Index, which indicates buying sentiment in Seoul, was 68 in July, up 20.9 points from the previous month. The Buyer Dominance Index means that a value above 100 indicates more buyers, while below 100 indicates more sellers. Although it did not reach the baseline, it was the highest since November 2021 (66.9). Seoul's Buyer Dominance Index hovered around the 20-30 range from October last year to May this year.

Actual apartment sales volume in Seoul is also increasing. According to the Seoul Real Estate Information Plaza, the sales volume in July was 8,728 transactions, the highest in four years since 11,170 transactions in July 2020.

The increase in transaction volume is attributed to buyers in their 40s. According to the Korea Real Estate Agency's buyer transaction volume by age group, the proportion of buyers in their 40s purchasing Seoul apartments in July was 33.2%, surpassing those in their 30s (31.5%). This is the first time in 1 year and 11 months since August 2022 that the 40s' purchase proportion exceeded that of the 30s. Typically, buyers in their 40s are considered more cautious about housing prices and interest rate fluctuations compared to those in their 30s, as they have less access to low-interest policy funds such as newborn loans or first-time homebuyer funds. However, as Seoul apartment prices approach previous peak prices and the upward trend continues, they have joined the buying ranks.

As transaction volume increases, housing prices have also risen to about 90% of the all-time high on average. Real Estate R114 analyzed Seoul apartment sale prices up to the 19th of last month and reported that prices have recovered to about 90% of the previous highest prices for the same complexes and sizes since 2021.

Seocho-gu and Yongsan-gu nearly reached 99% of their previous peak prices on average, and Gangnam-gu rose to about 97%. Yeokyunghee, head of the Big Data Research Institute at Real Estate R114, analyzed, "With market interest rates falling and the abolition of comprehensive real estate tax on single-home owners being promoted, demand to switch to a well-located single property has surged," adding, "As transactions increase mainly in quasi-prime areas, the pace of price recovery has accelerated."

Mixed Variables for Price Rise and Fall... "Need to Monitor Trends After Chuseok"

With the unstoppable rise in housing prices, policy and financial authorities have repeatedly applied brakes, which may cause a short-term slowdown in transaction volume. However, there are also mixed downward variables such as base rate cuts. Experts point out that since the main moving season for housing is September to October, the fall season, it is necessary to closely monitor trends after the Chuseok holiday.

Song Seunghyun, CEO of Urban and Economy, said, "Even if buying demand temporarily decreases due to stricter loan conditions, transaction volume can recover if the base rate is lowered," adding, "Housing prices are also likely to rise moderately rather than sharply."

There is also a forecast that buying sentiment will be hard to dampen for the time being. Yoon Jihae, senior researcher at Real Estate R114, said, "People who wanted to buy a house do not easily give up even if loans are not approved. They will look for properties in the same neighborhood with lower prices or cheaper options in nearby neighborhoods," adding, "The psychology that loans might become stricter in the future can also influence buying."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)