Korean Industrial Activity Trends Sluggish for 3 Consecutive Months

IBs "Growth Potential Weakening, Base Interest Rate Should Be Lowered"

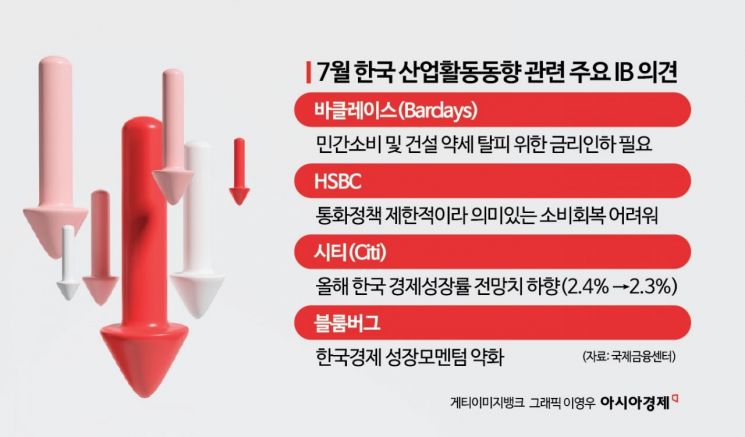

As South Korea's industrial activity showed sluggishness for three consecutive months, major investment banks (IBs) warned of weakening growth potential. They also recommended a cut in the base interest rate to overcome the persistent domestic demand slump.

According to the International Finance Center on the 2nd, as Korea's industrial activity recently contracted, some IBs suggested the need for a base interest rate cut to revive domestic demand. Some have also downgraded their economic growth forecasts for this year due to weakened growth potential.

July Total Industrial Production -0.4%, Declining for Three Consecutive Months

According to Statistics Korea, total industrial production in South Korea decreased by 0.4% in July compared to the previous month, marking a decline for three consecutive months following May (-0.8%) and June (-0.1%). Total industrial production is an indicator that quantifies production activities across all industries and is useful for understanding short-term domestic economic trends.

In July, the production of the manufacturing sector, which includes Korea's key industries, fell by 3.6% month-on-month, pulling down the overall indicator. This was the largest decline in 19 months since December 2022 (-3.7%). Looking at detailed items, production sharply decreased in semiconductors (-8.0%), automobiles (-14.4%), and electronic components (-11.8%).

Citibank stated that considering the July total industrial production results, it lowered its forecast for the third quarter GDP growth rate from the previous 0.6% to 0.4%, a 0.2 percentage point cut. The full-year GDP growth forecast was also lowered by 0.1 percentage points from 2.4% to 2.3%.

The Bank of Korea (BOK) had previously projected the country's third quarter and full-year growth rates at 0.5% and 2.4%, respectively, last month. Citibank took a more conservative view of the Korean economy than the BOK. Bloomberg evaluated, "The larger-than-expected decline in July's manufacturing production indicates a weakening growth momentum in the Korean economy."

Need for Base Interest Rate Cut to Revive Sluggish Domestic Demand

Barclays raised the necessity of cutting the base interest rate to stimulate sluggish domestic demand. In July, South Korea's retail sales decreased by 1.9% month-on-month, with sales of durable goods (-1.6%), semi-durable goods (-2.3%), and non-durable goods (-2.1%) all declining. Construction investment also fell by 1.7% compared to the previous month.

Barclays stated, "We expect the manufacturing sector's recovery, led by semiconductor production and exports, to continue for the time being," but also argued, "The persistent weakness in private consumption and construction sectors suggests the need for an interest rate cut to stimulate domestic demand." HSBC diagnosed, "Meaningful recovery in private consumption will be somewhat difficult under restrictive monetary policy."

Citibank assessed, "In the case of private consumption, downward pressure from real estate project financing (PF) restructuring, weakening income growth, and reduced excess savings outweighs the upward pressure from slowing inflation and rising housing prices."

However, there were also opinions that the July manufacturing production weakness might be a temporary phenomenon caused by external factors, and that the possibility of further economic contraction is not high as the service sector shows improvement. Barclays said, "The production weakness in Korea's export-driven industries such as semiconductors and automobiles may be temporary," adding, "Disruptions in shipping caused by summer vacations and typhoons may have had an impact."

Shinhan Investment Corp. analyzed, "The semiconductor production slump in July should consider the base effect from the sharp rebound in June, and the automobile production decline is largely due to temporary factors."

Jinkyung Lee, an economist at Shinhan Investment Corp., emphasized, "The July industrial activity trend showed an overall economic slowdown," but added, "As service sector production rebounded, the possibility of further economic contraction is limited." Kyuho Choi, an economist at Hanwha Investment & Securities, also explained, "Although the economy slowed last month, it is not seen as a trend reversal. It is difficult to say the manufacturing cycle has turned down, and consumption is likely to rebound moderately."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.