Doosan Bobcat M&A Push Halted

Expected 1 Trillion Won Capacity for Nuclear Power Investment

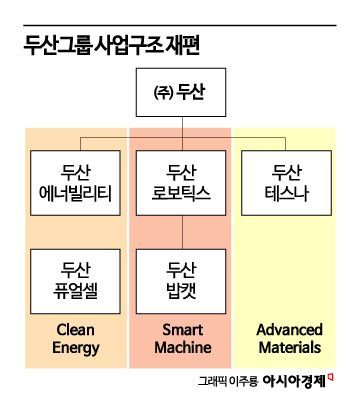

The merger between Doosan Robotics and the small heavy equipment company Doosan Bobcat was withdrawn, leaving Doosan Group's planned business restructuring only half accomplished. As the overall business blueprint of Doosan Group was disrupted, the acquisition and merger (M&A) efforts of Doosan Bobcat, now a subsidiary, in artificial intelligence (AI) and unmanned technology companies have been stalled. Doosan decided to reconsider the merger from scratch while continuing to explore synergy creation plans for these companies.

According to Doosan Group on the 30th, Doosan Bobcat and Doosan Robotics each issued shareholder letters under the name of their CEOs on the 29th, stating, "Even if the direction of business restructuring is expected to be positive, it is difficult to proceed without sufficient support from shareholders and the market," and "We will review the business restructuring again depending on future regulatory improvements."

A company official explained regarding the 'business restructuring review,' "Nothing has been decided yet on whether to proceed with the integration of Robotics and Bobcat." Essentially, they decided to reconsider the possibility of the merger from the beginning. Previously, both companies held board meetings and resolved to cancel the comprehensive stock exchange agreement.

With the merger falling through, Doosan Bobcat's plans to acquire smart machine companies specializing in AI and motion control have also been disrupted. Remaining as a subsidiary limits the scope of its business activities. Under the Fair Trade Act, a subsidiary must acquire 100% of the shares of the company to be acquired.

An industry insider said, "As Doosan Bobcat remains a subsidiary, it has become difficult to pursue M&A at a time when investment in unmanned and automated sectors is necessary," adding, "Doosan Robotics also needed investment to expand its market, but with the merger canceled, it is difficult to expect financial support from Doosan Bobcat." Doosan Robotics had planned to jointly enter the autonomous driving robot and autonomous unmanned forklift markets, which exceed 10 trillion won in market size, through integration with Doosan Bobcat to create new business opportunities, but this plan has also inevitably been disrupted.

Earlier, after Doosan disclosed its business restructuring plan, it faced strong opposition from financial authorities and political circles. This was because the merger ratio of 1 to 0.63 between Doosan Bobcat, which generates operating profits of around 1 trillion won, and the deficit company Doosan Robotics, was seen as undervaluing Doosan Bobcat's corporate value. After the restructuring, Doosan Co., Ltd., which holds 14% of Doosan Bobcat's shares, would increase its stake to 42% in the merged entity, leading to criticism of favoritism toward the major shareholder. The financial authorities pressured Doosan by requesting corrections to the merger plan twice, on the 24th and 26th of last month.

However, Doosan Group has not abandoned the first phase of restructuring, which involves splitting Doosan Bobcat from Doosan Enerbility. This is because securing investment capacity for the nuclear power business is urgent. By splitting Doosan Bobcat, Doosan Enerbility can reduce its borrowings by 700 billion won, improving its financial indicators. If it later disposes of non-operating assets such as shares in Doosan Cubex and D20 Capital, it can secure 500 billion won in cash, creating a total new investment capacity of 1 trillion won.

The company is considering additional orders from several countries including the Czech Republic, Poland, the United Arab Emirates (UAE), and Saudi Arabia, and expects multiple nuclear power plant orders domestically as well. Small Modular Reactors (SMRs) are also planning large-scale facility expansions due to rapidly increasing demand for AI and data center power supply. An industry insider in the nuclear power sector said, "With the phase-out of nuclear power, facilities have become outdated," adding, "The 700 billion won debt burden is significant for Doosan Enerbility to handle the Czech nuclear power plant order."

Due to the change in the restructuring plan on this day, the deadline for submitting the amended report, originally set for the 29th, was missed. Consequently, the shareholders' meetings of Doosan Enerbility and Doosan Robotics, scheduled for the 25th of next month, have also been postponed. Since the Financial Supervisory Service pointed out insufficient grounds for the valuation of the newly established division's earnings, there is speculation in the industry about possible changes to the stock exchange ratio between the newly established Doosan Enerbility entity and Doosan Robotics. A Doosan Enerbility official said regarding this, "We will thoroughly review the Financial Supervisory Service's correction requests."

The limit on the right to request stock purchase is also a variable. Doosan Enerbility has set the limit for stock purchase requests at 600 billion won. Even a single exercise of this right by the National Pension Service would far exceed this amount.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)