US Effectively Cuts Interest Rates in September... "Expecting Capital Gains"

Bio Stocks Benefiting from Rate Cut Also '↑'

U.S. Treasury-related exchange-traded funds (ETFs) have recently recorded high returns. This appears to be due to investors' attention focusing as the U.S. has effectively formalized an interest rate cut in September.

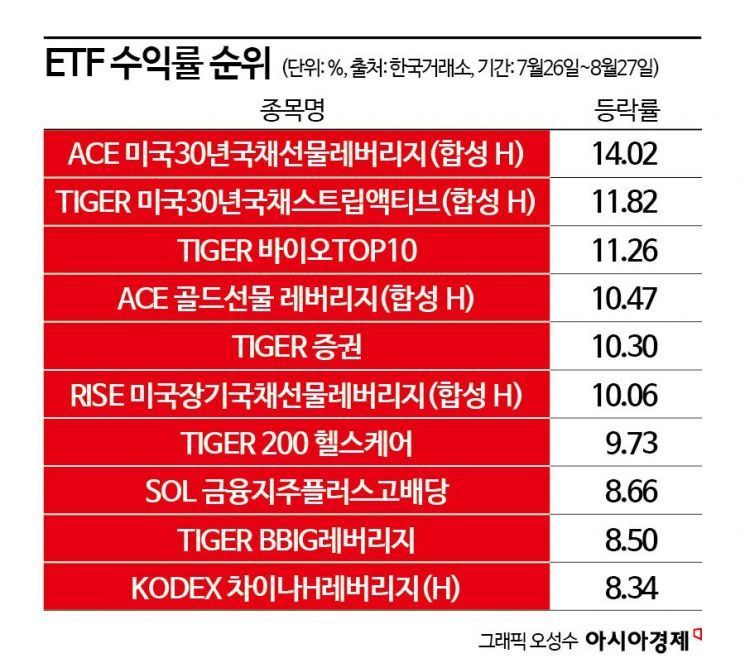

According to the Korea Exchange on the 28th, the top-performing ETF listed domestically from August 26 to September 27 was ACE U.S. 30-Year Treasury Futures Leverage (Synthetic H), which rose 14.02%. Additionally, TIGER U.S. 30-Year Treasury Strip Active (Synthetic H) and RISE U.S. Long-Term Treasury Futures Leverage (Synthetic H) also increased by 11.82% and 10.06%, respectively, showing high returns for U.S. Treasury-related ETFs.

These returns are interpreted as reflecting the fact that the U.S. interest rate cut next month has been effectively formalized. Jerome Powell, Chair of the U.S. Federal Reserve (Fed), signaled a rate cut during his keynote speech at the Economic Policy Symposium held in Jackson Hole, Wyoming, on the 23rd (local time), stating that "the time has come to adjust monetary policy."

If the rate cut proceeds, Treasury-related ETFs can expect capital gains from bonds. Also, some products pay monthly dividends, attracting investor funds. In fact, the market capitalization of ACE U.S. 30-Year Treasury Futures Leverage (Synthetic H) increased from KRW 81.855 billion on August 26 to KRW 85.07 billion on September 27, and TIGER U.S. 30-Year Treasury Strip Active (Synthetic H) rose from KRW 468.2 billion to KRW 555.1 billion.

Along with this, ETFs related to the bio sector, considered beneficiaries of the rate cut, also showed high returns. In the bio sector, the funding environment improves when interest rates are cut. Furthermore, the recent approval of Yuhan Corporation’s non-small cell lung cancer treatment, Reklaza, by the U.S. Food and Drug Administration (FDA) also had an impact. As a result, TIGER Bio TOP10 recorded a return of 11.26%, and TIGER 200 Healthcare rose 9.73%.

On the other hand, ETFs that had recorded high returns in the domestic stock market for some time, such as those related to semiconductors, artificial intelligence (AI), and cosmetics, posted poor performance. TIGER Semiconductor TOP10 Leverage fell 21.16%. Additionally, TIGER 200 IT Leverage dropped 13.99%, TIGER China Electric Vehicle Leverage (Synthetic) declined 13.37%, HANARO Semiconductor Core Process Leading Stocks and KODEX AI Power Core Facilities also fell by approximately 13.16% and 12.49%, respectively. VITA MZ Consumer Active and TIGER Cosmetics also decreased by 10.96% and 10.83%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)