Scheduled to Unveil Alo Flagship Store in Second Half

Lululemon Ranked 3rd with 100 Billion KRW Sales Last Year

Interest Grows Over Potential Shift in Jeximix-Andar-Lululemon Dynamics

Athleisure leading brand Andar is unveiling its first flagship space, 'Life Positive Studio,' on the 22nd in Sogyeok-dong, Jongno-gu, Seoul.

Athleisure leading brand Andar is unveiling its first flagship space, 'Life Positive Studio,' on the 22nd in Sogyeok-dong, Jongno-gu, Seoul.The Life Positive Studio features the 'Tea Life Lounge' on the basement and first floors, where premium tea can be enjoyed. On the second floor, there is the Andar store and a self-photo studio. Especially on the third floor, the Yoga & Lecture Room offers programs related to lifestyle that can make daily life healthier, including yoga and pilates, with a panoramic view of Samcheong-dong through large windows. Photo by Kang Jin-hyung aymsdream@

As the Korean launch of Alo Yoga, favored by domestic and international celebrities such as Hailey Bieber, Kendall Jenner, and BLACKPINK's Jisoo, approaches, attention is focused on whether it will cause a seismic shift in the domestic athleisure market.

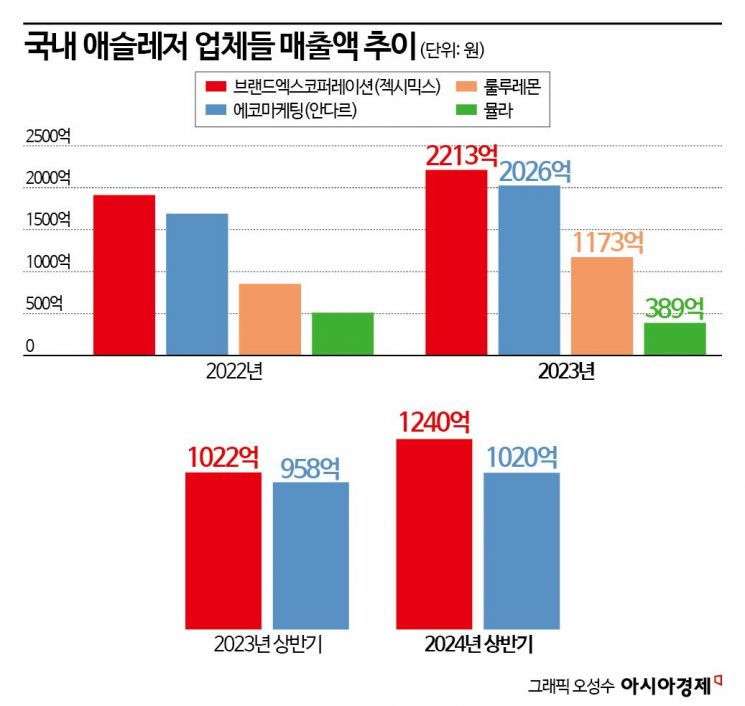

According to the fashion industry on the 27th, the domestic athleisure market's sales last year were led by Jeximix and Andar, followed by Lululemon and Mula in terms of market share. Jeximix and Andar ranked first and second with sales in the 200 billion KRW range, while the American brand Lululemon firmly held third place with 117.3 billion KRW in sales. Back in 2020, Mula, Korea's first athleisure brand, had sales surpassing Lululemon, but from 2021 onwards, Lululemon overtook Mula, achieving sales in the 100 billion KRW range.

Alo Yoga plans to open its first flagship store in Korea this year in the second half, located next to the Herm?s store on Dosan-daero, Gangnam-gu, Seoul. The Korean entry of Alo Yoga became a foregone conclusion after news broke last month about the establishment of its Korean corporation. Instead of entrusting distribution rights to a domestic conglomerate, it plans to enter the Korean market directly. In the rapidly growing domestic athleisure market, it was judged that direct entry would increase profit scale more than just receiving commissions.

Alo Yoga is a yoga wear brand that started in the United States in 2007. It offers premium products so much so that it is called the Chanel or Herm?s of yoga wear. Tops are priced above 100,000 KRW per piece, and bottoms range from 100,000 to 200,000 KRW. In addition to yoga wear, it also offers various sportswear and exercise products.

The domestic industry expects Alo Yoga's arrival to impact the market share in the athleisure market. Attention is especially focused on whether Alo Yoga will block the advance of Lululemon, which offers premium products. Lululemon saw a 38% surge in sales last year, showing the highest growth rate among athleisure companies. The Canadian brand Lululemon entered Korea by opening a flagship store in Cheongdam-dong, Gangnam-gu, Seoul in 2016. It was the first to enter the Asian region but initially operated conservatively. However, from 2021, it expanded the number of stores to 21 (including outlets and street stores) and aggressively expanded its online channels.

However, since Alo Yoga is expected to overlap with Lululemon's consumer base due to its premium price range, a blow is inevitable. In fact, in the U.S., Alo has recently gained great popularity among people in their 20s and 30s, directly impacting Lululemon. Actor Lee Seo-jin recently explained the trend on his YouTube channel, saying, "In the U.S., it's Alo rather than Lululemon." Comparing the two brands, Lululemon is said to provide comfort as if you are not wearing anything, while Alo offers various styles, fits, and high-quality sophisticated designs. There is a sense that Lululemon's popularity, centered in North America, has declined, with its stock price on the Nasdaq dropping 46% since the beginning of the year.

The top two domestic athleisure companies, Andar and Jeximix, do not see Alo Yoga's arrival as an immediate major threat. They believe the consumer groups differ because their prices are about half as expensive. Furthermore, by expanding their product lines beyond yoga wear to include men's products, tennis, golf wear, underwear, and business casual in the domestic market, it is expected that the departure of yoga wear consumers will not affect their performance.

In fact, Jeximix recorded a sales growth rate of over 23% in the domestic market in the second quarter, with golf brand sales soaring by 143%. A fashion industry insider explained, "Consumers who have experienced athleisure through Jeximix and Andar are likely to have price resistance to Alo and Lululemon," adding, "Also, they see a difference from foreign brands in that they emphasize shaping power and well realize fits for Asians."

It is also positively evaluated that both brands are diversifying their sales into overseas markets. Andar is expanding into Japan and Singapore, while Jeximix is focusing on market expansion centered on China.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)