Presidential Office: "Emphasis on Structural Reform over Base Number Reform"

Differential Application of Insurance Premium Rates by Generation and Establishment of Fiscal Stabilization Measures

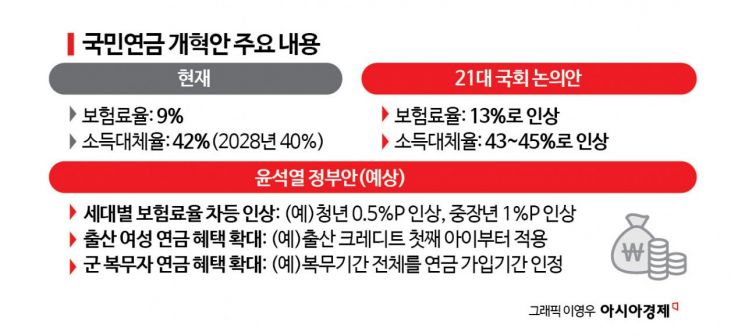

President Yoon Suk-yeol will personally announce a national pension reform plan this week during a scheduled government briefing, focusing on "differentiated contribution rates by generation" and the "introduction of fiscal stabilization mechanisms." As a measure to enhance fairness in pension benefits and alleviate the younger generation's anxiety over fund depletion, the contribution rates for middle-aged individuals nearing pension eligibility will be set higher than those for younger generations. Given the high social concern over the sustainability of the national pension, the plan also proposes the introduction of an automatic stabilization mechanism that can flexibly adjust contributions and benefits based on key macroeconomic indicators such as inflation and economic growth rates.

On the 26th, a senior official from the Presidential Office told Asia Economy, "The core of this reform plan is to apply differentiated contribution rates by generation to improve intergenerational equity and to introduce a fiscal stabilization mechanism based on key macroeconomic indicators to ensure the pension's sustainability." Considering South Korea's demographic structure, the plan's distinction lies in fundamentally reforming the system itself, as previous discussions focused mainly on parametric reforms, which are insufficient to solve pension issues. The Presidential Office's stance is that reforms should focus on the sustainability of the national pension rather than merely adjusting contribution rates and income replacement rates.

In particular, the reform plan centers on proactively preparing for fund depletion by introducing an automatic stabilization mechanism. Under the current system, pension payments increase with inflation, causing benefit amounts to rise. Going forward, the plan aims to establish a mechanism that can flexibly adjust contributions and benefits not only based on inflation but also on South Korea's economic growth rate, demographic structure, birth rate, and life expectancy, thereby delaying the fund depletion timeline. By considering economic growth rates and life expectancy, the fund's trajectory can be projected, allowing for subtle adjustments in advance to prevent sudden deterioration or decline in the fund's total amount. The government reform plan is expected to delay the anticipated national pension fund depletion from 2055 by more than 30 years.

The differentiated contribution rates will also be structured so that middle-aged individuals reach a 13-15% contribution rate increase over 10 years, while younger generations reach the increase over 20 years, taking intergenerational equity into account. To mitigate opposition to the contribution rate increase among middle-aged groups, the government plans to raise the basic pension. A Presidential Office official stated, "The increase in the basic pension is a separate issue from the national pension reform," adding, "President Yoon is considering raising the current basic pension, which is in the 300,000 won range, to 400,000 won during his term to alleviate elderly poverty." The government is also positively reviewing the introduction of a "childbirth credit," which adds 12 months to the contribution period for each child starting from the first child, and a "military service credit" that extends the national pension contribution period by the length of a man's military service.

Experts: "Low Practical Feasibility"... Social Acceptance Is Key

Experts have pointed out that while the direction of the upcoming government pension reform plan may be appropriate, its practical feasibility is low. Professor Choi Young-jun of Yonsei University's Department of Public Administration said, "Applying differentiated contribution rates by generation is unprecedented worldwide and practically impossible," adding, "The proportion of self-employed individuals who must bear their full contributions increases from their 50s, and it is excessive to require them to pay more just because their pension eligibility age is approaching." He further explained, "This approach could cause intergenerational conflict," and "Instead of differentiated contributions, young people could be sufficiently supported in other areas such as university tuition." Professor Choi also expressed concern about the automatic stabilization mechanism, saying, "Currently, the average national pension benefit is only about 900,000 won, and if an automatic stabilization mechanism is introduced, the livelihood of the elderly could become even more difficult."

Oh Geon-ho, Policy Committee Chair of the Welfare State We Make, said, "Since there are issues with equity in contributions and benefits by age group in the current national pension plan, the differentiated contribution rate by generation is worth considering to improve this," but emphasized, "However, since some middle-aged individuals also find it difficult to bear high contribution rates, complementary measures for the self-employed and women with career interruptions must be implemented simultaneously." Oh added, "Regarding the automatic stabilization mechanism, in Western countries where sustainable pension systems are already established, systems that automatically reflect demographic and economic variables can operate, but in South Korea, due to significant fiscal imbalances, its introduction could lead to abrupt benefit cuts or high contribution increases, making social acceptance difficult."

Meanwhile, it is reported that President Yoon and the leadership of the People Power Party plan to hold a dinner meeting on the 30th. Ahead of the September regular National Assembly session, President Yoon and the ruling party leadership are expected to discuss major issues and exchange views on the government's four key reforms?pension, healthcare, education, and labor?as well as measures to address low birth rates.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.