Next Month, Capital Region Stress DSR Interest Rate Strengthened from 0.38% to 1.2%

Effect is Neutral

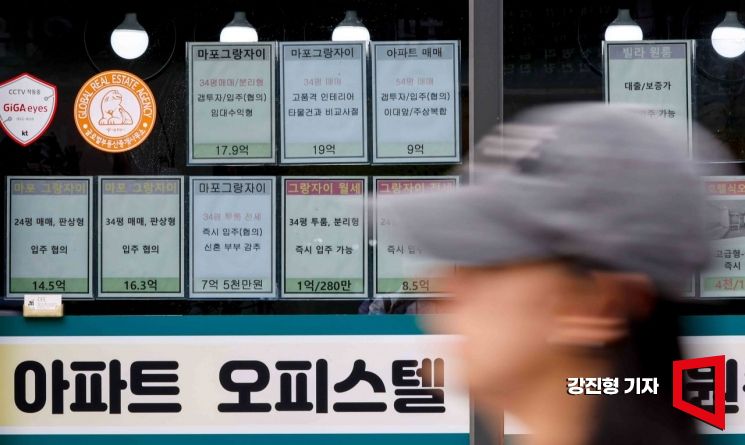

According to the KB Real Estate Weekly KB Apartment Market Trend report, last week Seoul apartment sale prices surged by 0.22% in just one week, with apartment sale and jeonse prices listed on May 5th in Mapo-gu, Seoul. Photo by Jinhyung Kang aymsdream@

According to the KB Real Estate Weekly KB Apartment Market Trend report, last week Seoul apartment sale prices surged by 0.22% in just one week, with apartment sale and jeonse prices listed on May 5th in Mapo-gu, Seoul. Photo by Jinhyung Kang aymsdream@

As of July, the volume of apartment sales transactions in Seoul has increased to over 8,000 cases, and these transaction movements are spreading beyond Seoul to major metropolitan areas such as new towns and Gyeonggi·Incheon.

According to the 'Weekly Apartment Market Report for the Metropolitan Area in the Fourth Week of August' released by Real Estate R114 on the 24th, as the transaction volume continues to rise, rapidly selling off bargain properties priced below market value, the recovery trend toward past peak prices is expected to continue throughout the second half of the year across Seoul and the metropolitan area.

Seoul apartment sale prices have been rising for 11 consecutive weeks, increasing by 0.02% this week. Reconstruction apartments rose by 0.03%, up from 0.01% the previous week, while general apartments increased by 0.01%. New towns rose by 0.02%, and Gyeonggi·Incheon increased by 0.01%.

In Seoul, the upward trend that started in the Gangnam area last week is spreading to non-Gangnam areas. By individual regions, Dongdaemun (0.09%), Jungnang (0.07%), Dongjak (0.05%), Yangcheon (0.03%), Mapo (0.03%), and Gangseo (0.03%) showed the highest rate of change.

In new towns, the rise was notable in second-phase new towns located in the southeastern Gyeonggi area, such as Gwanggyo (0.08%), Dongtan (0.06%), and Bundang (0.01%). Gyeonggi and Incheon saw increases in Hwaseong (0.10%), Suwon (0.07%), Anyang (0.02%), and Incheon (0.01%).

The jeonse (long-term lease) market has been on an upward trend for over a year since July last year, with Seoul rising by 0.02%, the same as the previous week. New towns increased by 0.01%, and Gyeonggi·Incheon rose by 0.02%, showing a relatively higher increase in the Gyeonggi·Incheon area.

In individual areas of Seoul, the upward trend was prominent in Dongdaemun (0.10%), Songpa (0.06%), Yangcheon (0.05%), Eunpyeong (0.04%), Mapo (0.04%), and Dongjak (0.04%).

In individual new town areas, Gwanggyo (0.06%), Dongtan (0.06%), and Bundang (0.01%) rose, while the rest remained flat (0.00%). Gyeonggi and Incheon were led by increases in Hwaseong (0.14%), Suwon (0.14%), Pyeongtaek (0.08%), and Ansan (0.07%).

Among individual complexes, jeonse prices rose as real demand concentrated on relatively recently occupied large-scale new complexes (with more than 1,000 households).

As household debt centered on mortgage loans has increased sharply, the government will strengthen loan regulations by applying the second phase of stress DSR differentially in the metropolitan area starting next month. Accordingly, from September, stress interest rates of 1.2% for the metropolitan area and 0.75% for non-metropolitan areas will be applied.

The stress DSR system imposes an additional interest rate (stress interest rate) when calculating the DSR for borrowers using variable interest rate loans, reducing the loan limit. The stress interest rate is revised twice a year and is currently set at 1.5%.

A Real Estate R114 official said, "However, the effect of introducing this system is expected to cause both a decrease and an increase in demand in the market simultaneously," adding, "While some demand will drop due to reduced loan limits, there is still about a year left until the full 100% application of the third phase of the stress interest rate (expected 1.5%~1.7% in January 2025), so demand aiming to make decisions in advance will also join simultaneously."

He continued, "The issue of differential introduction of stress DSR by region is considered somewhat neutral in the housing market until the full 100% application of the stress interest rate," and "especially as loan regulations tighten, there may be a growing tendency to leverage jeonse deposits through private financing rather than using banks, so it is necessary to carefully examine the side effects of the system's introduction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.