Public Tender Offer for 34 Million Common Shares

Tender Price 1,600 KRW... 34% Increase Over Average Closing Price

Stake to Rise from 2.3% to 19.8% if Successful

"Strengthening Responsible Management... Enhancing Business Competitiveness"

Kim Dong-sun, the third son of Kim Seung-yeon, chairman of Hanwha Group, and Vice President in charge of Future Vision at Hanwha Galleria, is set to launch a public tender offer for treasury shares worth 54.4 billion KRW. This move aims to strengthen responsible management as Hanwha Galleria has fallen into poor performance, turning around from an operating loss in the second quarter of this year. Hanwha is currently progressing succession work with the three brothers: Kim Dong-gwan, Vice Chairman of Hanwha Group; Kim Dong-won, President of Hanwha Life; and Vice President Kim Dong-sun, and this public tender offer is interpreted as part of that process.

According to the Financial Supervisory Service's electronic disclosure system (DART) on the 23rd, Vice President Kim announced that from today until July 11, he will conduct a public tender offer for 34 million common shares of Hanwha Galleria. The tender offer price is 1,600 KRW per common share. On the same day, Hanwha Galleria's stock price surged more than 15% immediately after the market opened, exceeding 1,500 KRW.

The tender offer price of 1,600 KRW is 22.8% higher than Hanwha Galleria's closing price of 1,303 KRW the previous day. Compared to the recent one-month average closing price of 1,190 KRW, it is about 34% higher. This represents the highest premium among public tender offers in the past three years, reflecting Vice President Kim's decisive decision, according to Hanwha Galleria.

Hanwha Galleria explained the purpose of this tender offer as "to strengthen responsible management together with the largest shareholder and related parties," adding, "to establish a swift and efficient decision-making system to enhance the business competitiveness of the target company and ultimately increase shareholder value."

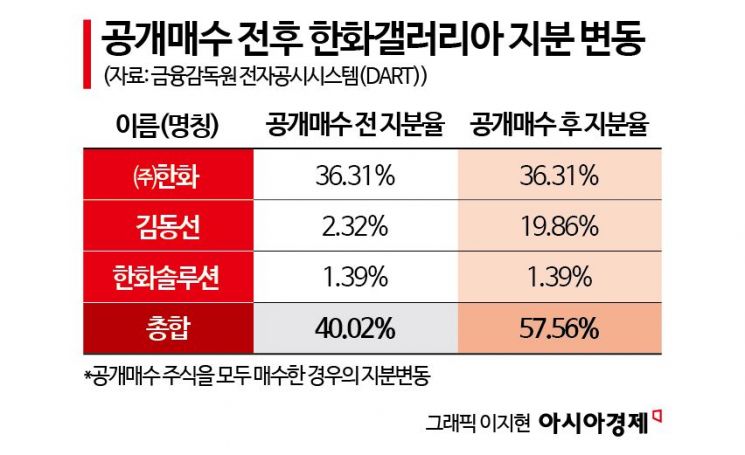

The planned tender offer volume of 34 million shares corresponds to 17.5% of Hanwha Galleria's total common shares. If the tender offer succeeds, Vice President Kim will hold a total of 19.86% of shares, including his existing 2.32% stake. Currently, the largest shareholder of Hanwha Galleria is Hanwha Corporation (36.31%), the second largest is Vice President Kim Dong-sun (2.32%), and the third largest is Hanwha Solutions (1.39%).

The combined shareholding of Hanwha, Vice President Kim Dong-sun, and Hanwha Solutions currently stands at 40.02%. If the tender offer is successfully completed, their total shareholding will increase to 57.56%.

Vice President Kim has accelerated treasury stock purchases since last year. From April last year to May this year, he purchased treasury shares a total of 137 times. After Hanwha Galleria was newly listed following a spin-off from Hanwha Solutions, he first bought 50,000 shares of Hanwha Galleria on April 12 last year and has been increasing his holdings since. Notably, in December last year (19 times), March (20 times), and April (21 times) this year, he purchased treasury shares every business day without fail.

The funds to be used for this tender offer amount to approximately 54.4 billion KRW, and Vice President Kim plans to inject personal funds for the tender offer. He borrowed the entire 54.4 billion KRW from Korea Securities Finance Corporation, pledging 1,260,892 shares of Hanwha Corporation stock he holds as collateral. As of June 30, Vice President Kim held 1,603,892 shares of Hanwha Corporation, meaning about 78.6% of his Hanwha shares were pledged as collateral. His shareholding ratio in Hanwha Corporation is 2.14%.

The tender offer will proceed by paying a certain premium to all shareholders and providing an equal opportunity to sell under the same conditions. Participation in the tender offer is decided by the shareholders. Hanwha Galleria expects the tender offer to lead to a long-term increase in stock price. If the tender offer succeeds, the shares of Hanwha Galleria circulating in the stock market will decrease from 60% to 42.5%, thereby increasing the value of individual shares.

Decisive action amid consecutive setbacks... "Strong will for growth"

FG Korea, the domestic operator of the American hamburger brand Five Guys, held a first anniversary event for its domestic launch on the 26th. The photo shows key officials including Kim Dong-seon, Vice President of Hanwha Galleria (fourth from the left), Kim Young-hoon, CEO of Hanwha Galleria (third from the left), and Oh Min-woo, CEO of FG Korea (sixth from the left), cutting the cake. Photo by Yonhap News

FG Korea, the domestic operator of the American hamburger brand Five Guys, held a first anniversary event for its domestic launch on the 26th. The photo shows key officials including Kim Dong-seon, Vice President of Hanwha Galleria (fourth from the left), Kim Young-hoon, CEO of Hanwha Galleria (third from the left), and Oh Min-woo, CEO of FG Korea (sixth from the left), cutting the cake. Photo by Yonhap News

Vice President Kim's public tender offer was influenced by the company's recent consecutive poor performances. Although new businesses such as Five Guys showed results, the department store division's sales declined due to prolonged consumer downturn, causing Hanwha Galleria to post a loss for the first time since its listing. Hanwha Galleria recorded an operating loss of 4.5 billion KRW on a consolidated basis in the second quarter of this year. During the same period, sales were 126.3 billion KRW, down 0.63% from the same period last year.

Hanwha Galleria explained that this tender offer is based on Vice President Kim's sense of responsibility and confidence in the company's corporate value and future vision. Earlier this month, Vice President Kim was promoted from head of the Strategy Headquarters to Vice President in charge of Future Vision, drawing the company's future blueprint.

Kim Young-hoon, CEO of Hanwha Galleria, said, "In this unprecedented crisis of turning to a loss, Vice President Kim has shown a strong will to grow the company further with shareholders by taking on heavier responsibility," adding, "The tender offer can send a positive signal for stock price and corporate value enhancement."

A Hanwha Galleria official said, "Taking this tender offer as an opportunity, we will continue to discover new growth engines in various fields along with enhancing the competitiveness of existing business sites to meet the increased corporate value."

Hanwha is progressing with third-generation succession work. The eldest son, Vice Chairman Kim Dong-gwan, is responsible for the group's core sectors such as defense industry, solar power, and petrochemicals. The second son, Kim Dong-won, President and Chief Global Officer (CGO) of Hanwha Life, is in charge of finance. Vice President Kim Dong-sun inherited the distribution and leisure sectors (Hanwha Hotels & Resorts), as well as robotics (Hanwha Robotics), including Hanwha Galleria, and this tender offer is interpreted as part of the share succession process.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.