Among the Top 5 Insurance Companies, Meritz Fire & Marine Shows the Lowest Satisfaction

Known as the "second health insurance," indemnity medical insurance (hereinafter referred to as indemnity insurance) showed relatively low consumer satisfaction specifically regarding premium levels. Additionally, among the five major insurance companies, Meritz Fire & Marine Insurance scored lower in overall satisfaction across various categories.

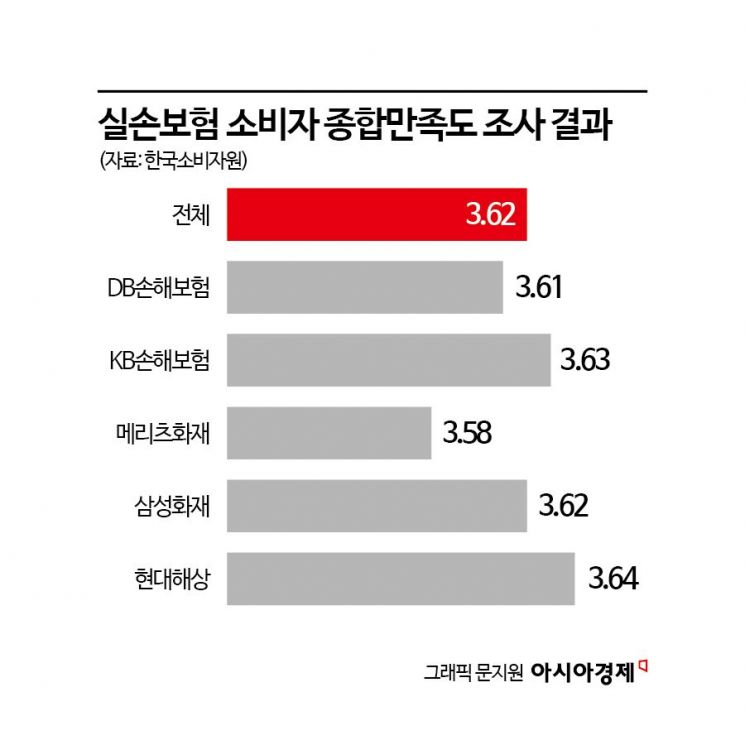

According to the Korea Consumer Agency on the 21st, a survey of 1,500 consumers who had indemnity insurance and received insurance payouts within the past year revealed that the average satisfaction score for the five major insurers was 3.62 out of 5. Satisfaction scores by insurer ranged from 3.58 to 3.64, with differences between companies falling within the margin of error. Among the three major categories, the "service product" category, which evaluates core service aspects, scored 3.93, while the comprehensive satisfaction category, "overall satisfaction," scored relatively high at 3.68.

Analyzing satisfaction by factors within the three major categories, in the service quality category, the "customer response" factor?assessing appropriateness and promptness in handling customer inquiries and problem resolution?scored the highest at 3.81. Conversely, the "response environment" factor, which evaluates visual communication elements such as website and application design and product information materials, scored the lowest at 3.59.

In the service product category, the "premium payment" factor, which assesses the diversity and convenience of premium payment methods, and the "insurance payout" factor, which evaluates the promptness and simplicity of claim payments, both scored the highest at 4.11. On the other hand, the "premium level" factor, which assesses the appropriateness of premiums compared to other companies and relative to quality, scored the lowest at 3.55.

Within the service experience category, the "positive emotion" factor scored 3.07, lower than the "negative emotion" factor at 3.92. Notably, the experience level of the positive emotion element "feeling happy" was the lowest at 2.96, below average.

A detailed look at this evaluation reveals the strengths and weaknesses of insurers’ indemnity insurance, which is noteworthy for consumers considering purchasing indemnity insurance. Hyundai Marine & Fire Insurance had the highest average satisfaction score at 3.64, followed by KB Insurance (3.63), Samsung Fire & Marine Insurance (3.62), DB Insurance (3.61), and Meritz Fire & Marine Insurance (3.58).

Meanwhile, 37.5% (562 people) of surveyed consumers reported having insurance payouts they could claim after hospital treatment but chose to forgo them. The main reason for giving up was that the amount of insurance money receivable was small, accounting for 80.1% (450 people), followed by "too bothersome or busy" at 35.9% (202 people), and "uncertainty about coverage eligibility" at 13.9% (78 people).

Additionally, 19.5% (293 people) of consumers reported experiencing dissatisfaction or damage while using indemnity insurance. Among types of dissatisfaction or damage, "underpayment of insurance claims" was the most common at 34.1%, followed by "excessive renewal premiums" at 27.0%, and "delays in insurance payouts" at 25.9%.

A representative from the Korea Consumer Agency stated, "We will continue to produce comparative information in popular and newly interested service areas to help consumers make rational choices, and provide tailored information to assist service providers in improving their services."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.