KRX Stock Index Rises 16% After 5-Day Plunge

Outperforms KOSPI Growth Rate in Same Period

Samsung Securities Hits Record High, Major Brokerage Stocks Continue Recent Rally

Strong Earnings, Valuation Upside Momentum, and Interest Rate Cut Expectations Combined

Securities stocks have recently shown strong performance. It is interpreted that the stock prices are being pushed up as favorable earnings, valuation upgrades, and expectations of interest rate cuts coincide.

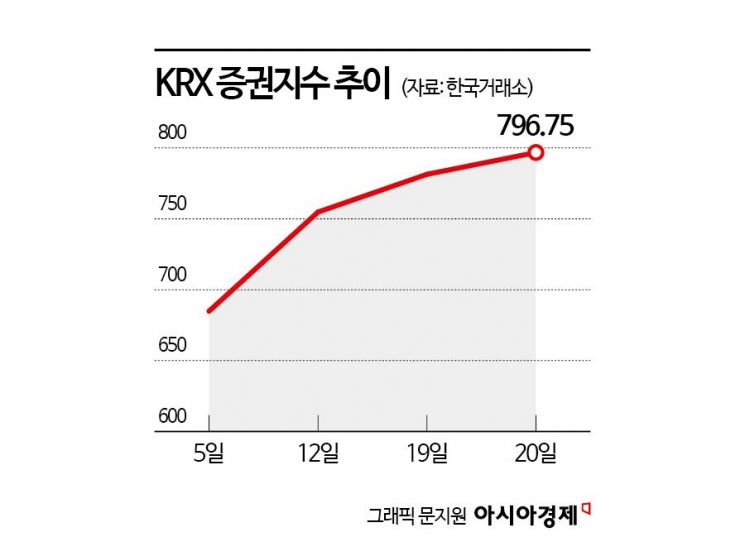

According to the Korea Exchange on the 21st, the KRX Securities Index has risen 16.34% since the crash on the 5th. During the same period, the KOSPI increased by 10.45%.

Major securities stocks have continued their upward march recently. Samsung Securities reached 47,800 KRW yesterday, marking a 52-week high. It has maintained an upward trend for the past four consecutive days. Except for one day since the 5th, it has risen every day. Kiwoom Securities has risen for six consecutive trading days. The stock price, which had dropped to the 110,000 KRW range after the plunge on the 5th, has climbed back to the 138,000 KRW range. NH Investment & Securities rose for five consecutive days, and Mirae Asset Securities also maintained an upward trend for four consecutive days.

Yoon Yudong, a researcher at NH Investment & Securities, said, "Although market volatility has increased recently, securities stocks are relatively resilient," adding, "This is because, amid the resolution of real estate project financing (PF) issues, there are earnings improvements and valuation upgrade momentum."

First, favorable earnings are supporting the stock prices. Samsung Securities posted a net profit of 257.9 billion KRW in the second quarter of this year, a 70.2% increase compared to the same period last year. Kiwoom Securities recorded 232.1 billion KRW, up 74%, and Mirae Asset Securities recorded 201.2 billion KRW, up 42.8%. NH Investment & Securities increased by 8% to 197.2 billion KRW.

Following the second-quarter earnings announcements, securities firms have actively engaged in shareholder returns such as share buybacks, which also influenced the stock price strength due to valuation upgrade expectations. Kiwoom Securities announced on the 14th that it would newly acquire 350,000 treasury shares to enhance shareholder value. Accordingly, it plans to acquire 350,000 shares on the market by November 15 and cancel them along with the 700,000 treasury shares it already holds by March next year.

Earlier, Mirae Asset Securities also announced on the 7th that it would proceed with share buybacks and cancellations. It plans to complete the purchase of 10 million common shares on the market within three months by November 7 and cancel the 10 million shares after completing the new treasury share acquisition.

Park Hyejin, a researcher at Daishin Securities, said, "As more securities firms are participating in valuation upgrade programs, there are many factors that can strengthen the sector index itself," adding, "Considering that valuation upgrades are part of the measures to resolve the Korea discount, the government's intention to elevate the Korean stock investment environment to global standards is naturally a favorable event for securities stocks."

Expectations of interest rate cuts are also positive for securities stocks. Jeong Taejun, a researcher at Mirae Asset Securities, said, "The longer high interest rates persist, the greater the concerns about the economy will become, which is already reflected in the decline of market interest rates," adding, "Since market interest rates tend to move ahead of the base rate, securities firms can enjoy improvements in bond valuation gains and losses even before the base rate is cut. The strong trading and product profits of securities firms in the second-quarter earnings also stem from this." He added, "If the base rate continues to be cut in the future, market interest rates will fall further, which will work favorably for securities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)